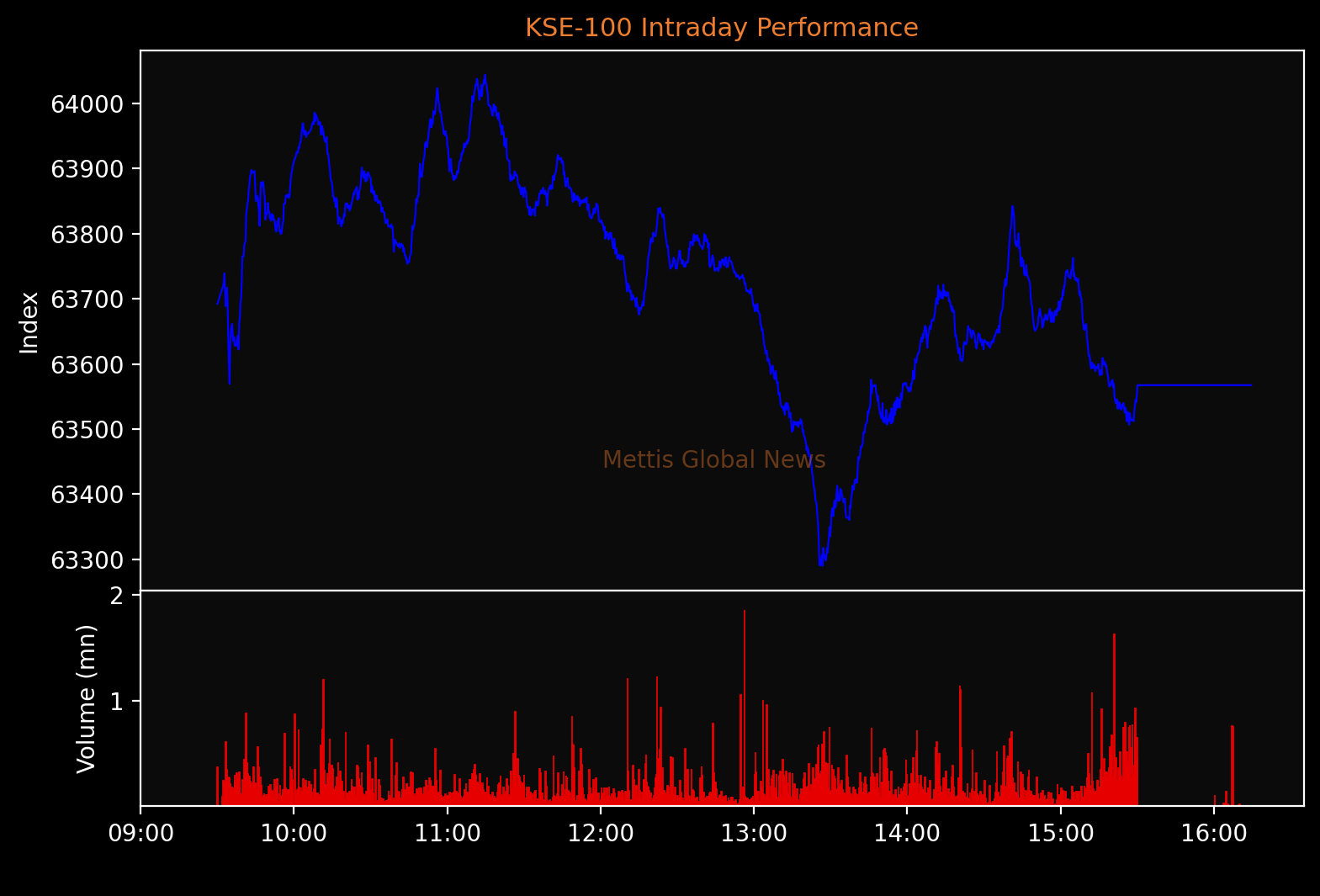

January 17, 2024 (MLN): The benchmark KSE-100 index closed Wednesday's trading session at 63,567.34 showing a decrease of 170.13 points or 0.27%.

Positive economic data as well as the recent approval of the International Monetary Fund of second loan tranche failed to uplift the stock market, as it continued to remain subdued in today's session.

The country recorded a significant current account surplus of $387 million in December, after five consecutive months of deficits.

Moreover, the cash-strapped nation attracted substantial foreign investments worth $243m in December, a 56% increase from the previous month and the highest level in a year.

These are key data indicators for Pakistan, which is struggling with external funding gaps.

To note, Pakistan has total external financing requirements of around $24.6bn in FY24, while the foreign exchange reserves stand at $8.15bn.

In today's session, the index traded in a range of 753.69 points showing an intraday high of 64,043.87 (+306.41) and a low of 63,290.18 (-447.28) points.

The total volume of the KSE-100 index was 249.257 million shares.

Of the 100 index companies 29 closed up, 64 closed down, 4 were unchanged, while 3 remained untraded.

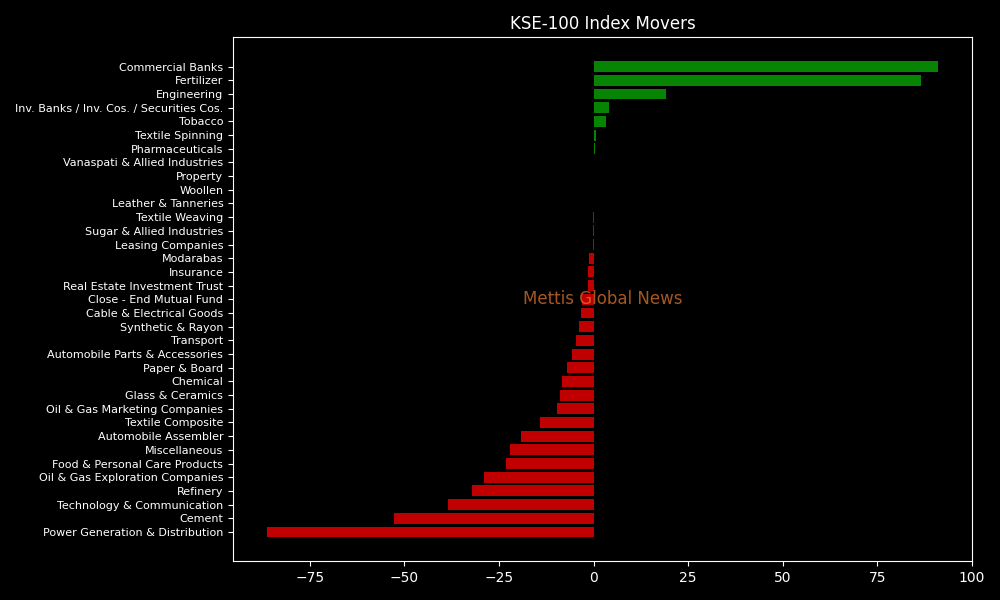

KSE-100 index was let down by Power Generation & Distribution with 86.46, Cement with 52.75, Technology & Communication with 38.48, Refinery with 32.05, and Oil & Gas Exploration Companies with 28.91 points.

On the flip-side, the index was supported by Commercial Banks with 91.15, Fertilizer with 86.69, Engineering with 19.19, Inv. Banks / Inv. Cos. / Securities Cos. with 4.07, and Tobacco with 3.4 points.

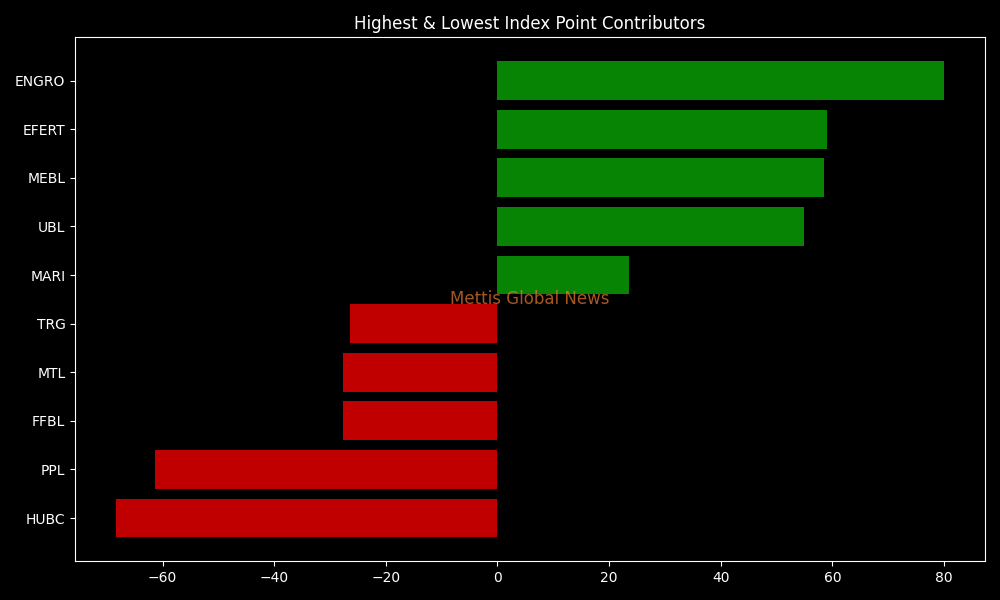

Companies that dragged the index lower were HUBC with 68.25, PPL with 61.27, FFBL with 27.73, MTL with 27.6 and TRG with 26.44 points.

On the other hand, companies that added points to the index were ENGRO with 79.94, EFERT with 59.13, MEBL with 58.48, UBL with 54.88, and MARI with 23.52 points.

In the broader market, the All-Share index closed at 43,068.53 with a net loss of 105.19 points.

Total market volume was 420.635 million shares compared to 407.544 from the previous session while traded value was recorded at Rs18.57 billion showing an increase of Rs5.92bn.

There were 187,097 trades reported in 329 companies with 109 closing up, 202 closing down and 18 remaining unchanged.

| Company | Volume |

|---|---|

| PTC | 45,978,785 |

| KEL | 41,567,872 |

| TREET | 36,390,498 |

| PIAA | 27,071,000 |

| FFBL | 22,432,023 |

| PPL | 16,519,053 |

| WTL | 13,200,312 |

| PSO | 11,099,585 |

| PIBTL | 11,001,000 |

| FFL | 10,966,294 |

To note, the KSE-100 has gained 22,115 points or 53.35% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 1,116 points, equivalent to 1.79%.

Yesterday, the State Bank of Pakistan (SBP) conducted an auction of fixed-rate Pakistan Investment Bonds (PIBs) in which a decline of up to 50bps was witnessed in yields.

The persistent drop in yields is attributed to market participants' expectations that interest rates have peaked and are expected to fall in the coming months.

Copyright Mettis Link News

Posted on: 2024-01-17T16:20:18+05:00