PKR slips by 74 paisa per USD

MG News | May 22, 2023 at 05:24 PM GMT+05:00

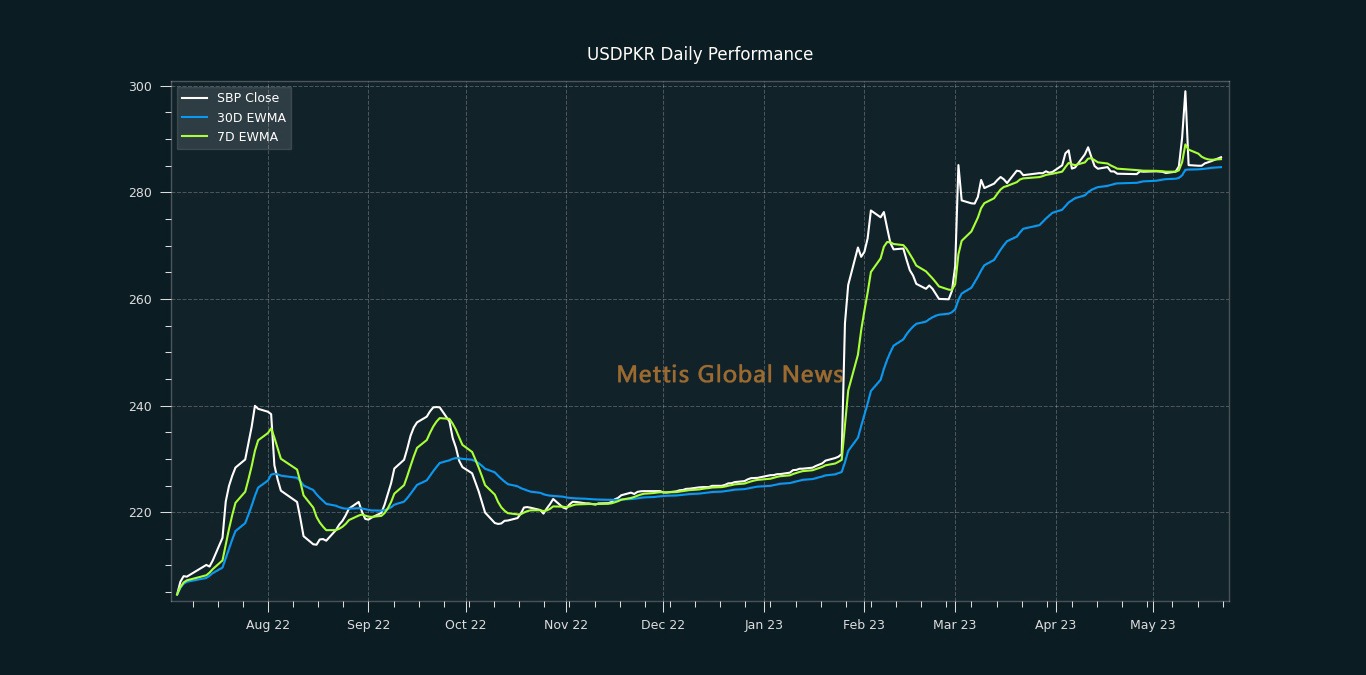

May 22, 2023 (MLN): Riding on a downward trail, the Pakistani rupee (PKR) on Monday depreciated by 74 paisa against the US dollar in the interbank session as the currency settled the trade at PKR 286.56 per USD, against last session's closing of PKR 285.82 per USD.

Throughout today’s session, the local unit traded in a band of 2.1 rupees, showing an intraday high bid of 287.50 and a low offer of 285.40 while in the open market, PKR was traded at 302/306 per USD.

Today's appreciation of the dollar in the open market is primarily due to increasing demand from the Hajj pilgrims as the Hajj flights have been started from Sunday.

In addition to the default noise, and political instability, Ishaq Dar's latest statement wherein he asked banks to facilitate export-oriented sectors to open LCs for raw material to restore the industry’s supply line without any reference to SBP, has increased the demand for dollars in the market.

The local unit is already in the doldrums mainly on the back of the longer-than-expected delay. There were rumors that the delay in signing the IMF’s agreement was because the IMF wants assurance from the Ministry of Finance that the funds will not be utilized for political purposes.

However, in a recent clarification statement by the Ministry of Finance, it was stated that IMF never raised any such concern with the government nor any funds can be utilized for any purpose without the approval of the Parliament through the budget.

Meanwhile, the currency lost 1.6 rupees to the Pound Sterling as the day's closing quote stood at PKR 356.34 per GBP, while the previous session closed at PKR 354.76 per GBP.

Similarly, PKR's value weakened by 1.6 rupees against EUR which closed at PKR 309.76 at the interbank today.

In FYTD, PKR lost 80.97 rupees or 28.33%, while it plummeted by 59.38 rupees or 20.78% against the USD in CYTD. Within the last seven sessions, the local unit moved down by 0.26%, as per data compiled by Mettis Global.

On another note, within the money market, the State Bank of Pakistan (SBP) conducted an Open Market Operation (OMO), and Shariah-compliant Mudarabah OMO today, in which it cumulatively injected a total of Rs235.2 billion into the market, from which Rs175.2bn injected into the market under reverse repo.

While the remaining Rs60bn has been injected through Shariah-Compliant Modarabah-based OMO.

The overnight repo rate towards the close of the session was 21.2%/21.5%, whereas the 1-week rate was 20.95%/21.05%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 183,016.95 344.63M | 0.35% 632.80 |

| ALLSHR | 110,072.44 803.26M | 0.52% 572.81 |

| KSE30 | 56,115.17 168.45M | 0.38% 213.34 |

| KMI30 | 255,586.03 109.94M | 0.06% 142.66 |

| KMIALLSHR | 69,982.70 323.92M | 0.04% 30.27 |

| BKTi | 53,883.56 94.49M | 1.34% 713.23 |

| OGTi | 35,761.22 13.15M | 0.48% 170.60 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 92,435.00 | 92,525.00 91,145.00 | 775.00 0.85% |

| BRENT CRUDE | 64.58 | 64.60 63.84 | 0.71 1.11% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -1.75 -1.98% |

| ROTTERDAM COAL MONTHLY | 97.30 | 0.00 0.00 | 0.25 0.26% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.18 | 60.19 59.47 | 0.68 1.14% |

| SUGAR #11 WORLD | 14.84 | 14.87 14.81 | 0.00 0.00% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260101112329999_0153db.webp?width=280&height=140&format=Webp)