Pakistan not witnessing FDI exodus, but evolving instead

.png?width=950&height=450&format=Webp)

MG News | October 07, 2024 at 09:36 AM GMT+05:00

October 07, 2024 (MLN): Contrary to the widespread narrative, Pakistan is not witnessing an exodus of foreign investment; rather, some foreign companies are being replaced by new players, stated Shahid Ali Habib, CEO of Arif Habib Limited, in the latest report.

Over the past 18 months, while 11 companies have exited or signaled their intent to exit, what is striking, is that around 16 fresh foreign firms are in the process of taking over stakes in the local businesses, he highlighted.

"The narrative of a mass corporate exodus is not only misleading but also completely contrary to the reality of the growing interest from international investors," the report reads.

With the government introducing reforms and the establishment of the SIFC, the country is prepping for flows of fresh foreign investment.

"The future of FDI in Pakistan looks increasingly positive," the report emphasized.

Several global players are focusing on tapping into sectors like energy, mining, refineries, corporate farming, and exploration.

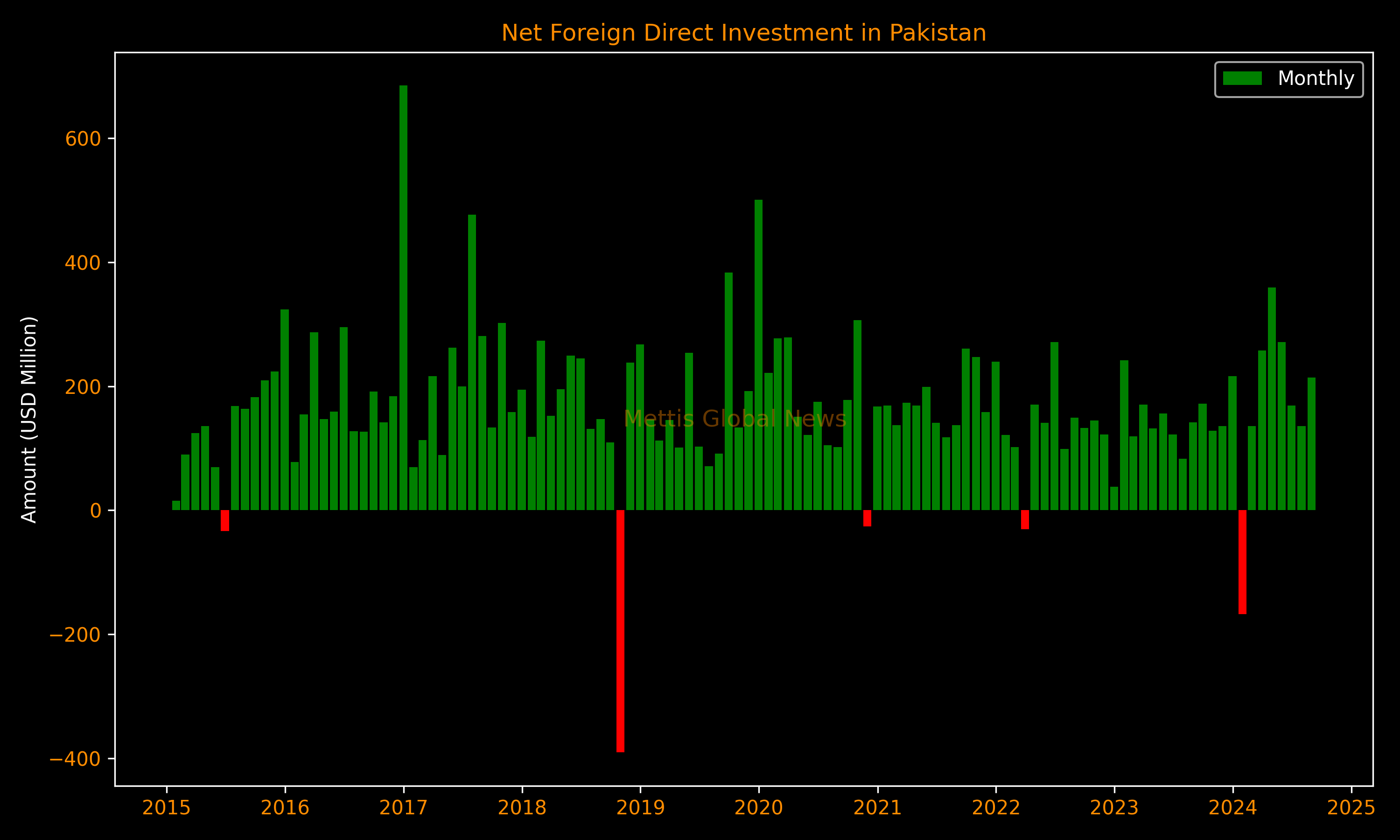

As Pakistan’s macroeconomic conditions improve, we anticipate an acceleration in the inflows of foreign investments. During FY24, net FDI inflows rose by 17% YoY to $1.9bn, compared to an inflow of $1.6bn in FY23.

China emerged as the leading contributor to net FDI, with $568mn, followed by Hong Kong at $359mn.

Sector-wise, the power sector attracted the most significant investment during FY24, totalling $800mn, while the oil and gas exploration sector attracted $304mn.

With Pakistan’s population reaching 241.5mn in 2023—up 31% from 184.4mn in 2013—the consequent surge in demand for commodities is expected to continue, drawing even more foreign companies to the market.

Moreover, the government has recently de-regulated non-essential medicine prices and is considering similar moves for petroleum pricing.

In the technology sector, plans for several IT parks and tech cities are underway. These measures are likely to ignite foreign interest and investment in pharmaceuticals, OMCs, and technology sectors

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 173,169.71 245.48M | 0.58% 999.42 |

| ALLSHR | 103,952.96 533.68M | 0.46% 476.31 |

| KSE30 | 53,042.90 95.92M | 0.73% 384.11 |

| KMI30 | 242,931.39 83.21M | 1.01% 2420.10 |

| KMIALLSHR | 66,507.09 270.16M | 0.79% 519.06 |

| BKTi | 51,058.55 42.50M | 0.09% 45.65 |

| OGTi | 34,159.98 10.77M | 1.77% 594.51 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,925.00 | 68,450.00 66,565.00 | 720.00 1.07% |

| BRENT CRUDE | 71.68 | 72.34 71.06 | 0.02 0.03% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.45 -1.36% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.31 | 67.03 65.81 | -0.09 -0.14% |

| SUGAR #11 WORLD | 13.86 | 14.02 13.61 | 0.16 1.17% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

Roshan Digital Account

Roshan Digital Account