Oil prices slip on US inventory build-up

MG News | March 27, 2024 at 09:33 AM GMT+05:00

March 27, 2024 (MLN): Oil prices extended a decline on Wednesday following an industry report that indicated a significant increase in US stockpiles.

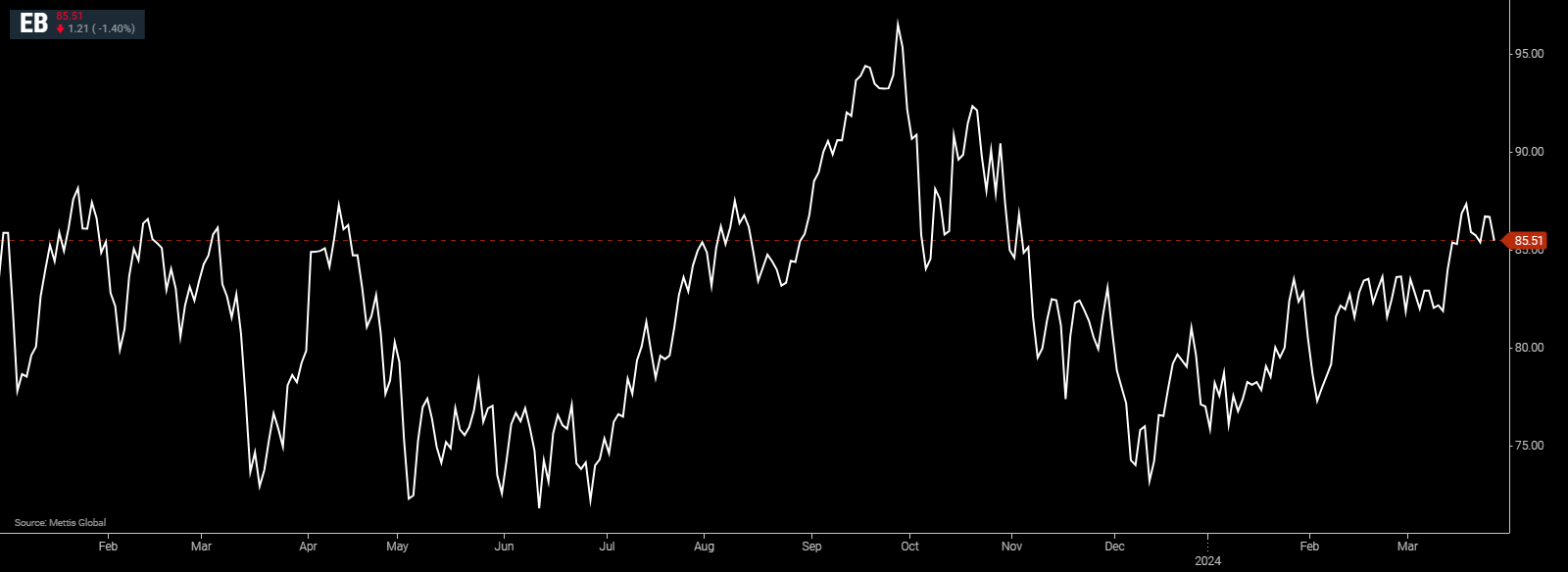

Brent crude traded near $85.51 per barrel, down by 0.86% on the day.

While West Texas Intermediate crude (WTI) was at $80.99 per barrel, down by 0.77% on the day.

The industry-funded American Petroleum Institute said nationwide stockpiles expanded 9.3 million barrels last week, according to people familiar with the data, as Bloomberg reported.

The API also reported a 2.4 million barrel rise in crude at the Cushing, Oklahoma, hub, although gasoline stockpiles shrank.

If confirmed by government data due later Wednesday, levels of crude at Cushing would have posted the biggest weekly gain in barrel terms since January 2023.

Meanwhile, gasoline inventories would have fallen for an eighth week, the longest run of declines in almost a year.

Broader financial markets were weaker, weighing on crude and other commodities such as copper.

Equity markets in Asia were mixed after US benchmarks wiped out gains in the final half hour of trading as investors rebalanced their portfolios.

Oil has rallied this quarter after breaking out from a tight range that held for the year’s first couple of months.

Geopolitical uncertainty amid Ukrainian drone attacks on Russian oil infrastructure and extended supply cutbacks by OPEC+ have buoyed prices, although a challenging economic outlook in China and robust non-OPEC supply growth remain headwinds.

“We should see a slightly tighter market in the second quarter, given OPEC+’s voluntary cuts are being extended,” and as demand picks up, said Sean Lim, an analyst for RHB Investment Bank Bhd in Kuala Lumpur.

Still, prices “are getting less sensitive and responsive to any rolling over of voluntary cuts.”

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 169,864.53 309.70M | 0.77% 1289.83 |

| ALLSHR | 102,725.13 871.92M | 0.54% 553.85 |

| KSE30 | 51,670.42 144.06M | 0.97% 495.07 |

| KMI30 | 244,230.82 127.19M | 0.88% 2126.86 |

| KMIALLSHR | 67,141.83 400.81M | 0.66% 438.06 |

| BKTi | 45,511.25 34.21M | 0.74% 335.27 |

| OGTi | 33,787.05 15.45M | 0.86% 288.90 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 90,330.00 | 93,070.00 89,640.00 | -1680.00 -1.83% |

| BRENT CRUDE | 61.22 | 61.86 60.81 | -0.06 -0.10% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 1.00 1.11% |

| ROTTERDAM COAL MONTHLY | 97.30 | 97.30 97.30 | 0.90 0.93% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 57.53 | 58.19 57.15 | -0.07 -0.12% |

| SUGAR #11 WORLD | 15.10 | 15.27 14.83 | 0.25 1.68% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Inflation

Weekly Inflation