Oil prices drop for third day as US stocks decline

MG News | May 31, 2024 at 10:08 AM GMT+05:00

May 31, 2024 (MLN): Oil fell for a third day after data showed U.S. crude stocks fell more than expected last week, with traders eyeing OPEC+ supply meeting on Sunday.

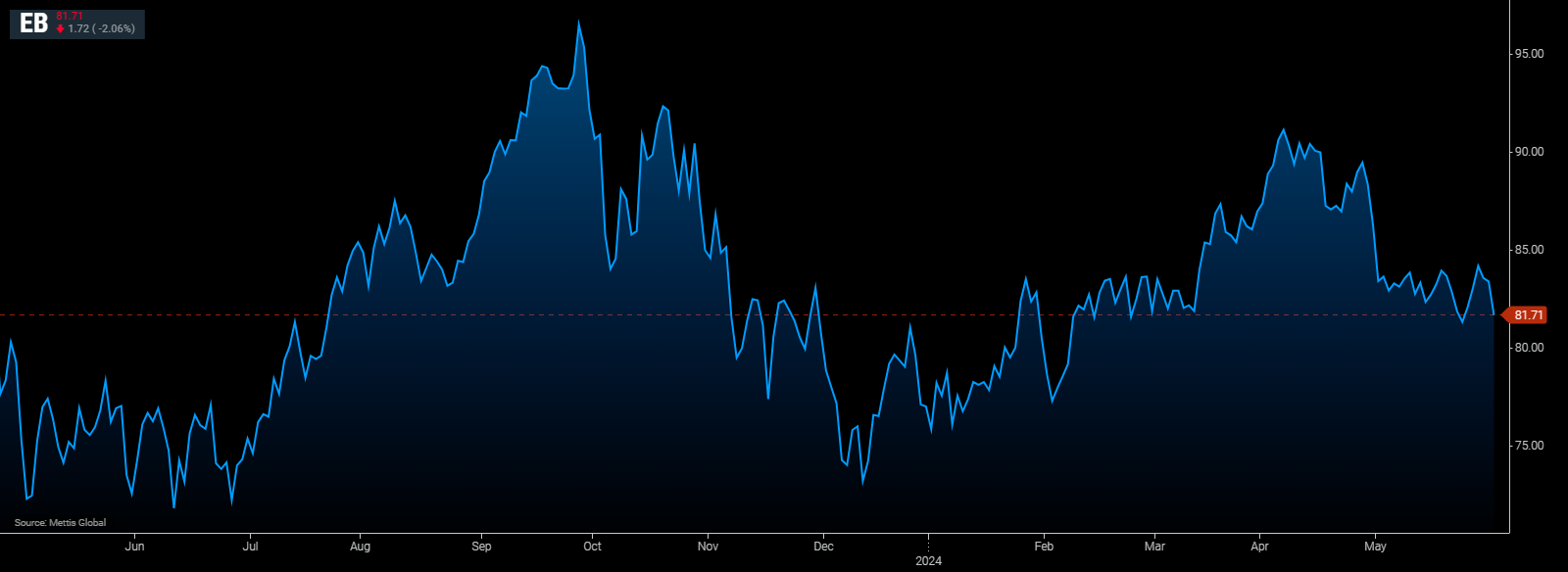

Brent crude traded near $81.71 per barrel, 0.1% lower on the day. It closed 1.77% lower on Thursday

While West Texas Intermediate crude (WTI) was at $77.65 per barrel.

Both benchmarks are headed for a monthly drop.

The prompt timespread for Brent weakened into a bearish contango structure for the first time since January, indicating oversupply, as Bloomberg reported.

Oil is set to end the week little changed after being buffeted by bullish drivers — including attacks on a ship in the Red Sea — and bearish sentiment from wider financial markets and signals of a slowdown in Chinese demand.

This month’s drop has pared Brent’s gain to less than 10% this year, and OPEC+ is expected to prolong output cuts, with the possibility of some restrictions lasting into 2025.

“A significant driver for oil prices ahead will revolve around the upcoming OPEC+ meeting this weekend,” said Yeap Jun Rong, market strategist at IG Asia Pte. “Any further cuts may be unlikely and will be seen as a huge surprise.”

The cartel is also reviewing production capacity levels for members.

The United Arab Emirates, Kazakhstan, Iraq, Kuwait, and Algeria are among countries whose potential to pump more next year is under scrutiny, according to people familiar with the discussions.

Traders will also be looking for further signals that consumption is picking up in the US at the start of the summer driving season.

Implied gasoline demand is mounting a recovery, while crude inventories dropped by the most since January, Energy Information Administration data showed Thursday.

Other timespreads are also turning more bearish. Brent’s for August against September, which will become the prompt on Monday, has narrowed to 30 cents in the bullish backwardation pattern, from 44 cents last week.

Dubai’s for June against July has almost halved in the period, to 39 cents in backwardation.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 182,384.15 418.83M | -1.10% -2025.52 |

| ALLSHR | 109,499.63 1,055.68M | -0.80% -882.95 |

| KSE30 | 55,901.83 133.16M | -1.22% -692.05 |

| KMI30 | 255,443.37 167.24M | -1.45% -3765.05 |

| KMIALLSHR | 69,952.43 541.42M | -1.07% -758.35 |

| BKTi | 53,170.34 58.49M | -1.12% -604.38 |

| OGTi | 35,590.62 8.63M | -1.26% -454.42 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 91,265.00 | 91,650.00 91,145.00 | -395.00 -0.43% |

| BRENT CRUDE | 63.94 | 64.38 63.84 | 0.07 0.11% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -1.75 -1.98% |

| ROTTERDAM COAL MONTHLY | 97.30 | 97.35 97.25 | 0.30 0.31% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 59.57 | 59.99 59.47 | 0.07 0.12% |

| SUGAR #11 WORLD | 14.84 | 14.94 14.71 | -0.05 -0.34% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|