Loan demand drops sharply in Q3 FY24: SBP

MG News | May 30, 2024 at 01:14 PM GMT+05:00

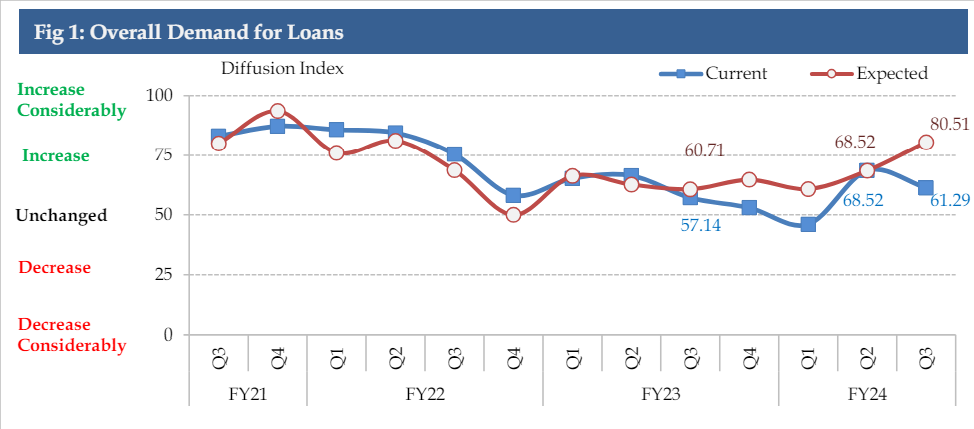

May 30, 2024 (MLN): Demand for loans decreased in the third quarter of fiscal year 2023-24 compared to the previous quarter, while it increased over the corresponding quarter of the previous year, according to the central bank’s survey.

However, the Bank Lending Survey (BLS) for Q3-FY24 showed that the respondents expect an increase in overall demand for loans in the next quarter.

To note, the survey was conducted from April 01 to 19, 2024. 62 senior officers from banks and investment companies shared their views through the survey as compared to 54 respondents in the previous survey.

There are various factors affecting overall demand for loans. The results show that majority of the factors contributed negatively on the overall demand in Q3-FY24 over the previous quarter.

Seasonal effects followed by general economic activity and fixed investment needs had a significant contribution in the overall decrease in demand.

However, seasonal effects and fixed investment needs remained in the positive zone.

Contribution of security conditions and monetary policy decisions improved slightly but remained within the negative zone.

While analyzing sector-wise demand for loans on QoQ basis, the highest decrease was observed in the Agriculture sector followed by corporate sector.

On the other hand, the demand of Consumer and SME sectors improved.

On YoY basis, all sectors exhibited significant increase in the demand for loans in Q3-FY24.

Meanwhile, the respondents reported a considerable decrease in the number of loan applications in Q3-FY24 (Fig 4) over the previous quarter.

However, they expect increase in the number of loan applications in the next quarter.

The overall perception on the cost of borrowing remained unchanged in Q3-FY24 compared to the previous quarter.

However, it decreased significantly as compared to the corresponding quarter of previous year.

The respondents expect the cost of borrowing to increase in the next quarter of FY24.

The overall perception on availability of funds has decreased during the quarter under review when compared to both the previous quarter and the corresponding quarter last year (YoY).

However, the respondents expect a considerable increase in the availability of funds in the next quarter of FY24.

All the factors affecting the availability of funds for loans contributed to the decrease in Q3- FY24 when comparing with previous quarter.

Factors such as volume of deposits and bank liquidity position weakened compared to the previous quarter but remained in the positive zone.

Competition from other banks affected negatively and entered into negative zone again in FY24.

On YoY basis, however, all the factors except competition from other banks and government borrowings improved over the same quarter of preceding year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 153,866.17 113.04M | -0.36% -555.27 |

| ALLSHR | 92,322.41 289.91M | -0.18% -165.37 |

| KSE30 | 47,054.02 67.50M | -0.57% -268.71 |

| KMI30 | 220,139.18 52.42M | -0.81% -1787.82 |

| KMIALLSHR | 59,630.44 114.87M | -0.43% -258.98 |

| BKTi | 44,089.65 23.49M | -0.09% -38.05 |

| OGTi | 31,668.31 6.28M | -0.15% -47.11 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 73,760.00 | 74,210.00 70,200.00 | 3115.00 4.41% |

| BRENT CRUDE | 100.33 | 102.75 97.60 | -0.13 -0.13% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -10.80 -9.80% |

| ROTTERDAM COAL MONTHLY | 123.80 | 123.80 123.80 | 0.00 0.00% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 95.14 | 98.09 92.04 | -0.59 -0.62% |

| SUGAR #11 WORLD | 14.39 | 14.53 14.32 | 0.01 0.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

Auto Numbers

Auto Numbers