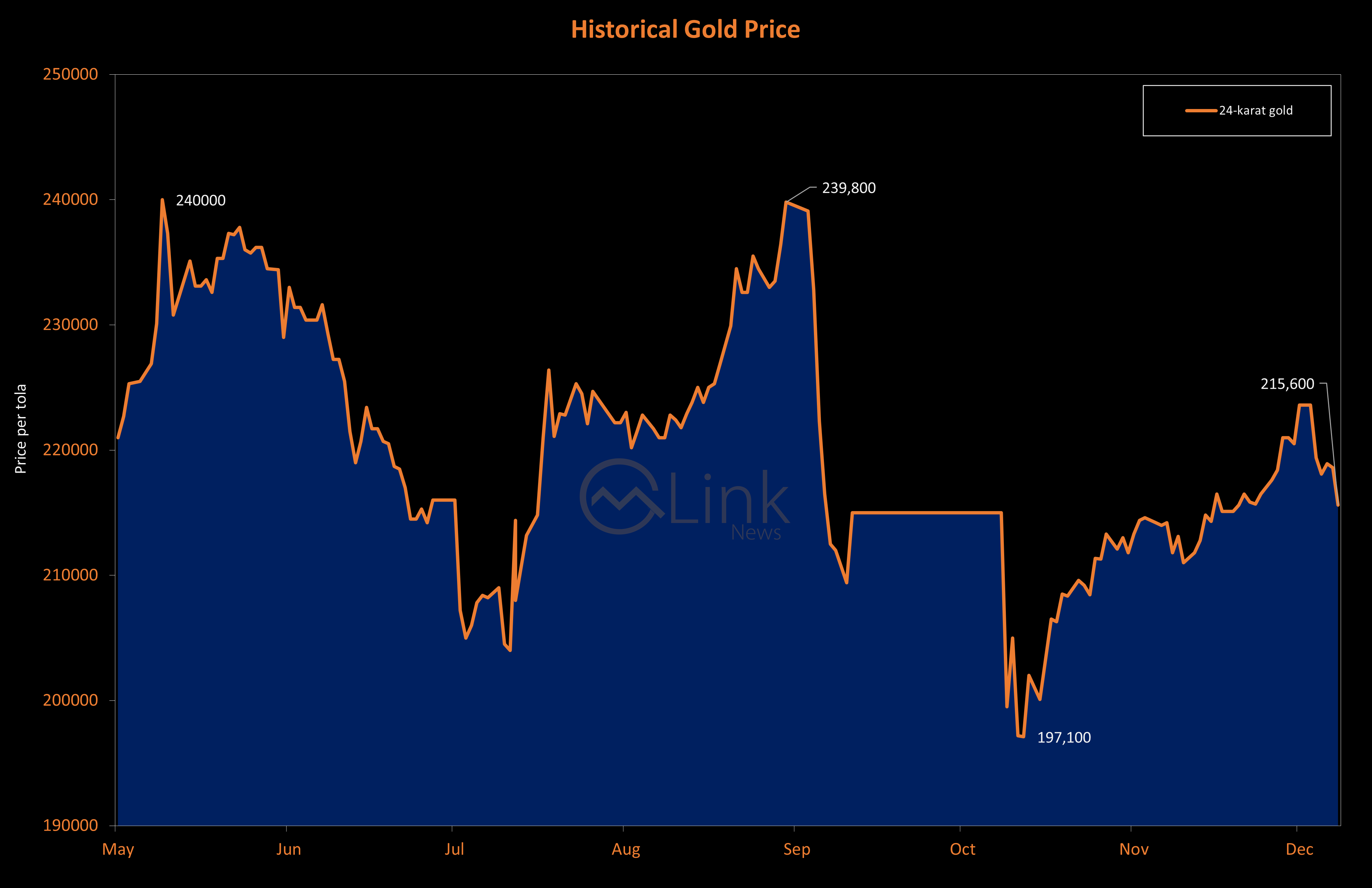

December 09, 2023 (MLN): Gold investors in the domestic bullion market experienced a major setback this week as the price of 24-Karat gold plunged by Rs8,000 per tola, driven by a significant decline in international prices and a strengthened local unit.

The Karachi Sarafa Association reported that the 24-Karat gold closed the week at Rs215,600 per tola.

This week's setback signifies the conclusion of a three-week-long historic upward trajectory for domestic gold, during which the commodity experienced a cumulative surge of Rs12,600 per tola.

The rally in the international market cooled off this week, as the international spot witnessed a decline of 3.26% to settle at $2,004.44 per ounce compared to its closing value of $2,071.88 in the preceding week.

International spot gold retreated under $2,000 per ounce on Friday, influenced by a strengthened U.S. Dollar and treasury yields.

This shift occurred as investors adjusted their expectations over the conclusion of the US Federal Reserve's tightening cycle, particularly in response to robust U.S. job data.

The latest data released by the U.S. Bureau of Labor Statistics showed a strengthened labor market, as the unemployment rate for the month of November edged down to 3.7% and the non-farm payrolls (NFP) added a robust 199,000 jobs.

It is crucial to note that earlier this week, international gold was on a surge, fueled by the hefty anticipation that the Federal Reserve has reached the end of its tightening cycle. As a result, the dollar and treasury yields came under pressure, providing a beneficial environment for gold prices.

However, with the robust labor data in US, the 10-year U.S. government bond yield bounced up to 4.229% in contrast to the rate of 4.197% at the close of the preceding week.

Likewise, the U.S. Dollar Index (DXY), which tracks the value of the greenback against six other top currencies rebounded by 0.77% WoW after experiencing three straight weekly declines.

A stronger dollar makes gold more expensive for holders of other currencies, exerting a negative impact on gold prices.

Similarly, higher bond yields also impose a negative impact on the metal as they increase the opportunity cost of holding the safe-haven asset.

Apart from declining international prices, the domestic metal market witnessed further setback due to strengthening of the domestic currency.

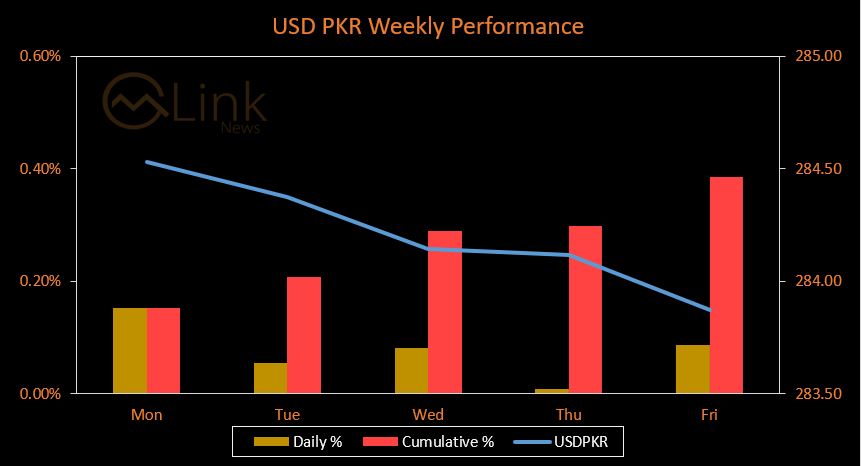

The Pakistani rupee (PKR) extended its upward momentum for the fourth consecutive week by appreciating 1.09 rupees against the US dollar to settle at PKR 283.87 per USD, compared to the previous week's closing of PKR 284.97 per USD.

The positivity arising from the successful staff-level agreement (SLA) between the International Monetary Fund (IMF) and Pakistani authorities during the first review under the Stand-By Arrangement (SBA) continue to support the local unit.

Additionally, upon approval from the IMF of the loan tranche, more opportunities for additional funds from global lenders will open up, as stated by the Caretaker Minister for Finance and Revenue, Dr. Shamshad Akhtar.

The positivity is further fueled by the latest trade numbers for November which showed a 13.16% MoM and a 31.72% YoY improvement in the trade deficit to clock in at $1.89 billion.

Since gold is denominated in U.S. dollars, when the local unit strengthens against the greenback, the value of PKR-denominated gold falls.

Copyright Mettis Link News

Posted on: 2023-12-09T22:26:24+05:00