Gold likely to rally further as Fed pivots

By Abdur Rahman | September 15, 2024 at 04:00 PM GMT+05:00

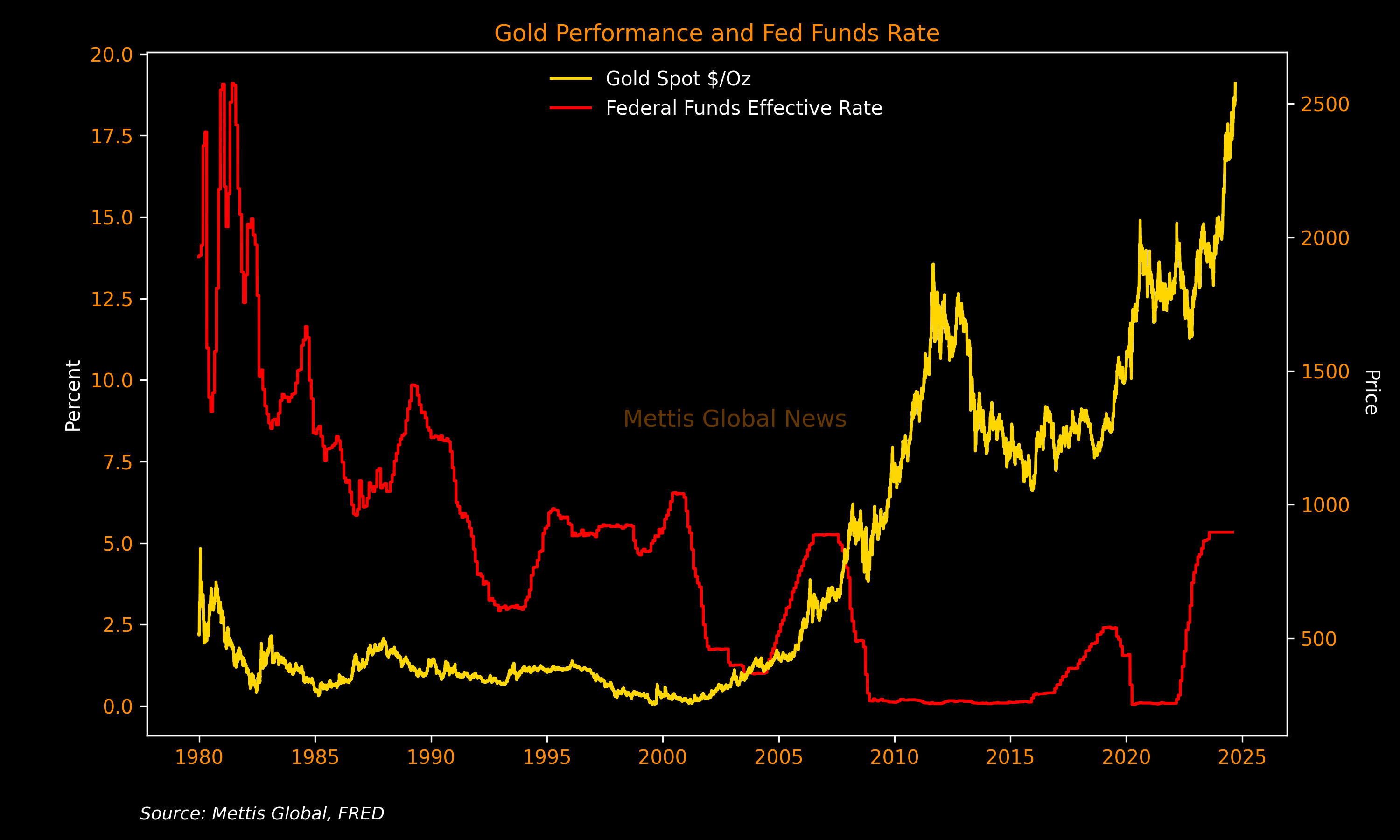

September 15, 2024 (MLN): Gold’s already explosive rally may get another leg up as the US Federal Reserve shifts its gears to monetary easing next week, according to historical data.

The US Federal Reserve on Wednesday is poised to begin cutting rates, though market sentiment regarding the magnitude of the rate reduction, which is seldom divided, remains split this time.

A 25 basis point cut is still seen as the slightly more likely outcome, but traders are ramping up bets on the Fed opting for a 50bps cut.

Traders now see almost a 50% chance of a 50-basis-point cut at the Fed's meeting. That is up from 30% last week, according to the CME FedWatch Tool.

So the question is not really whether the Fed will cut rates, but by how much. Historical data shows the start of a rate-cut cycle bodes really well for the yellow metal prices.

A month following the first rate cut, spot gold has averaged a 3.9% gain.

While over a six-month period, the metal has increased 11.2% on average, data from the past six easing cycles compiled by Mettis Global show.

Moreover, it has advanced 8.6% on average a year after the initial cut, and 13.7% two years later. That would be on top of a 25% surge so far this year.

| Gold Performance After Start of Fed Rate Cut Cycle | |||||||

|---|---|---|---|---|---|---|---|

| Date | 1 Week | 1 Month | 2 Months | 3 Months | 6 Months | 1 Year | 2 Years |

| Jun-89 | 2.9% | 3.1% | 2.2% | -0.6% | 14.1% | -0.9% | -0.2% |

| Jul-95 | 1.0% | -0.2% | -1.2% | -0.4% | 1.6% | -0.7% | -15.6% |

| Sep-98 | 1.5% | 7.3% | 4.4% | 4.9% | 2.3% | -8.8% | -1.2% |

| Jan-01 | -1.4% | -0.4% | -2.2% | -4.3% | 0.3% | 3.6% | 30.7% |

| Sep-07 | 1.1% | 5.9% | 8.8% | 9.4% | 37.2% | 19.4% | 39.9% |

| Jul-19 | 6.2% | 7.5% | 5.9% | 5.2% | 11.9% | 38.7% | 28.3% |

| Average | 1.9% | 3.9% | 3.0% | 2.4% | 11.2% | 8.6% | 13.7% |

Note: Prior to 1989, the Federal Reserve only announced discount rate moves

Disclaimer: The views and analysis in this article are the opinions of the author and are for informational purposes only. It is not intended to be financial or investment advice and should not be the basis for making financial decisions.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 133,547.86 110.35M |

0.73% 970.87 |

| ALLSHR | 83,550.94 376.62M |

0.68% 567.26 |

| KSE30 | 40,555.66 17.18M |

0.49% 196.86 |

| KMI30 | 191,594.01 21.71M |

0.45% 866.69 |

| KMIALLSHR | 56,042.85 184.26M |

0.62% 344.38 |

| BKTi | 36,720.44 7.48M |

1.32% 478.38 |

| OGTi | 28,242.93 2.35M |

-0.28% -80.49 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 111,640.00 | 112,170.00 111,395.00 |

-605.00 -0.54% |

| BRENT CRUDE | 70.29 | 70.34 69.91 |

0.10 0.14% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.45 1.51% |

| ROTTERDAM COAL MONTHLY | 108.00 | 109.00 107.95 |

0.90 0.84% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.43 | 68.48 68.04 |

0.05 0.07% |

| SUGAR #11 WORLD | 16.54 | 16.61 16.08 |

0.41 2.54% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Worker Remittances

Worker Remittances