Dun & Bradstreet shares an overview of the impact of COVID-19 on Pakistan’s economy

MG News | April 07, 2020 at 03:25 PM GMT+05:00

April 7, 2020: Dun & Bradstreet Company has shared its insights and an overview of the impact of Coronavirus on the economy of Pakistan, along with the actions by the Government to deal with the economic ramifications of this crisis

Economies all over the world, including Pakistan, are now experiencing a slowdown. The impact of COVID-19 on Pakistan’s economy can be severe and may lead to a reduction in GDP growth, deterioration in current & fiscal balances, disruption in supply chain and increased unemployment.

Gross Domestic Product (GDP)

Pakistan’s GDP at current market prices was PKR 38.6 Trillion for the Fiscal Year (FY) 2019. Economic growth during FY 2019 was 3.3% and the Government had projected it to be 2.6% during FY 2020. However, this projection did not account for the impact of the recent COVID-19 outbreak. According to the recent estimates by the Planning Commission of Pakistan1, COVID-19 is expected to cause ~10% loss, estimated at PKR 1.1 Trillion, of total GDP during the last quarter (Apr-Jun 2020) of FY 2020. Additionally, according to the Pakistan Institute of Development Economics (PIDE),2 due to trade disruptions as a result of COVID-19, if both imports and exports of Pakistan fall by 20%, the economy can face a loss of up to 4.64% in GDP.

Exports

According to the Pakistan Bureau of Statistics (PBS), total exports of Pakistan stood at PKR 287.7 Bn during March 2020, down 12.9% m-o-m. As per the State Bank of Pakistan (SBP), Pakistan’s largest export partners are the USA, UK, China, Germany, and the Netherlands contributing to about 40% of the total exports. All trading partners have been impacted due to the COVID-19 outbreak. Trade globally is on a downward trajectory and is expected to decline further due to slow down in demand on the back of lockdowns. According to the report published by PIDE2, the Ministry of Commerce has estimated that the decline in exports of Pakistan could be as high as 20%, translating into a dollar value of USD 4.0 Bn fall in exports by June 2020, on account of export order cancellations.

Imports

According to the Pakistan Bureau of Statistics (PBS), total imports of Pakistan stood at PKR 525.0 Bn during March 2020, down 18.7% y-o-y. As per SBP, the largest import partners from July 2019 to February 2020 were China, UAE, Singapore, USA, and Saudi Arabia cumulatively consisting of 51% of the total imports. China alone accounted for 21% of the total imports during this period. The decline in import value can be attributed to multiple factors, including disruptions in supply chains, lower demand in Pakistan, and a fall in prices of goods and commodities.

A decline in imports will have a positive impact on Pakistan’s current account deficit; However, delays in imports of essential items could disrupt the supply chains of multiple industries. According to PIDC2, 32% of the total imports of Pakistan are final products which will not have a direct impact on the country’s GDP. However, 68% of imports constitute raw materials, intermediate goods, and capital goods which are used to produce final goods that are consumed domestically or exported. A decline in these will, therefore, have a negative effect on investment spending as well as on exports. Consequently, Pakistan is likely to experience a cascading effect of falling imports, leading to an impact on the GDP.

Remittances

According to the SBP, inward remittances Pakistan stood at USD 1,824 Mn for February 2020, down 4.4% m-o-m. This decline was attributed to the spread of COVID19 in various parts of the world. While the numbers for March 2020 are not yet available, remittances are expected to further decline on the back of spread in COVID-19. Remittances to Pakistan are primarily from oil-exporting GCC countries. The largest shares of remittances during February 2020 were from Saudi Arabia (USD 422.0 Mn), UAE (USD 387.1 Mn) and USA (USD 333.5 Mn).

According to the World Bank, for over 66 countries, especially emerging and developing economies, remittances represented more than five percent of GDP in 2019. For Pakistan, remittances accounted for 7.7% of the total GDP during the same year. Additionally, the World Bank also highlighted that sending and receiving remittances might be severely affected amid shutdowns in major countries amid the COVID-19 outbreak. Since Saudi Arabia, UAE, and the USA, amongst major other countries are facing a lockdown situation; hence, remittances to Pakistan are expected to decline.

Poverty and Unemployment

According to the ‘Employment Trends’ report published by the Pakistan Bureau of Statistics (PBS) in 2018, the total labor force in Pakistan stands at 63.4 Mn of which vulnerable Employment was 26.41 Mn (41.6%). Vulnerable employment is measured as the proportion of own-account workers and contributing family workers in total employment (poor workers generally dependent on daily wages). These workers are likely to be the largest impacted individuals and could lose their employment due to the COVID-19 pandemic.

Due to the slowdown in economic activity and a high proportion of vulnerable employment in the country, we could be seeing a significant increase in poverty and unemployment, in the coming months. According to the PIDE report3, approximately 12.3 Mn people are expected to face unemployment in under a scenario of moderate restrictions by the Government (similar to those implemented currently). This is approximately 46.3% of the total vulnerable employment and 19.4% of the total employment in Pakistan. Wholesale & Retail Trade is expected to witness the highest layoffs of ~4.55 Mn people. Thus, the poverty rate in Pakistan could increase from 23.4% to 44.2%.

Interest Rates

The Monetary Policy Committee (MPC) of the State Bank of Pakistan reduced the benchmark policy rate on two separate occasions in March 2020. The first reduction was during the planned bi-monthly meeting of the MPC on 17th March 2020, where interest rates were reduced by 75 bps. The subsequent cut came in an emergency meeting of the MPC where an additional reduction of 150 bps was implemented, taking the policy rate to 11.0%.

Similar rate cuts have been witnessed globally as well. The monetary policy statement released by the MPC highlights that the IMF downgraded its global growth outlook to a recession where Pakistan’s growth and inflation are likely to be revised down further. The latest available data puts inflation during March 2020 at 10.2% Y-o-Y, down from 12.4% in the previous month. If the downtrend in inflation persists, it would provide further room to the State Bank to reduce the policy rate.

Amid growing concerns about the potential economic impact of the COVID – 19 pandemic, the Government of Pakistan and SBP, in collaboration with Pakistan Bank’s Association (PBA), are taking various measures to provide relief to the industry as well as the general public. The announced relief packages are highlighted below:

Relief Package by the Government

- Economic Relief Package worth PKR 1,200 Bn

- Establishment of the “Corona Tigers Relief Force” fund which will work in coordination with the Pakistan Army and other authorities in wake of the coronavirus outbreak. It is a donation fund established to counter the impact of the coronavirus.

Relief Package by SBP

- SBP has allowed all federal and provincial government departments, hospitals in public and private sectors, charitable organizations, manufacturers and commercial importers to make Import Advance Payment and Import on Open Account, without any limit, for the import of medical equipment, medicines and other ancillary items for the treatment of COVID-19.

- To support the banking sector to supply additional loans to businesses and households, SBP has reduced the Capital Conservation Buffer (CCB) from its existing level of 2.50% to 1.50%. This will enable banks to lend an additional amount of around PKR 800 Bn.

- As a tool to incentivize banks to provide additional loans to retail SMEs, the existing regulatory retail limit of PKR 125 Mn per SME has been permanently enhanced to Rs. 180 Mn.

- SBP has relaxed the Debt Burden Ration (DBR) for consumer loans from 50% to 60%. This measure will allow about 2.3 Mn individuals to borrow more from banks in this time of need.

- Banks & DFIs will defer the payment of principal on loans and advances by one year.

- SBP has relaxed the regulatory criteria for restructuring/rescheduling of loans. The loans that are re-scheduled/restructured within 180 days from the due date of payment will not be treated as defaults.

- Keeping in view the steep decline in share prices, the margin call requirement of 30% visà-vis banks’financing against listed shares has been significantly reduced to 10%.

Conclusion

While the Government has implemented various measures to slow down the spread of COVID-19 and to provide relief measures to industries and the general public, the economy is likely to continue to deteriorate in the short run. It is important to ensure that all the relief packages announced by the government, are implemented swiftly, and reach the intended beneficiaries. The policymakers should continue to closely monitor the situation and remain on standby for further interventions.

While businesses should continue to plan tactically for sustaining current business operations and seeing through the lockdown period. The government should also plan for return to normalcy, and prepare revival plans for key sectors of the economy.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 161,210.68 402.54M | 3.49% 5433.46 |

| ALLSHR | 96,097.29 718.60M | 3.34% 3102.77 |

| KSE30 | 49,781.74 146.66M | 3.95% 1890.99 |

| KMI30 | 230,597.11 158.11M | 4.81% 10582.05 |

| KMIALLSHR | 62,183.27 382.16M | 3.79% 2272.55 |

| BKTi | 46,523.21 43.62M | 2.50% 1134.61 |

| OGTi | 32,678.22 24.62M | 6.68% 2046.87 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 71,355.00 | 73,825.00 70,845.00 | -2090.00 -2.85% |

| BRENT CRUDE | 84.88 | 86.28 81.50 | 3.48 4.28% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -9.60 -8.81% |

| ROTTERDAM COAL MONTHLY | 125.00 | 125.00 125.00 | 3.50 2.88% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 80.09 | 82.16 74.97 | 5.43 7.27% |

| SUGAR #11 WORLD | 13.71 | 13.82 13.61 | -0.02 -0.15% |

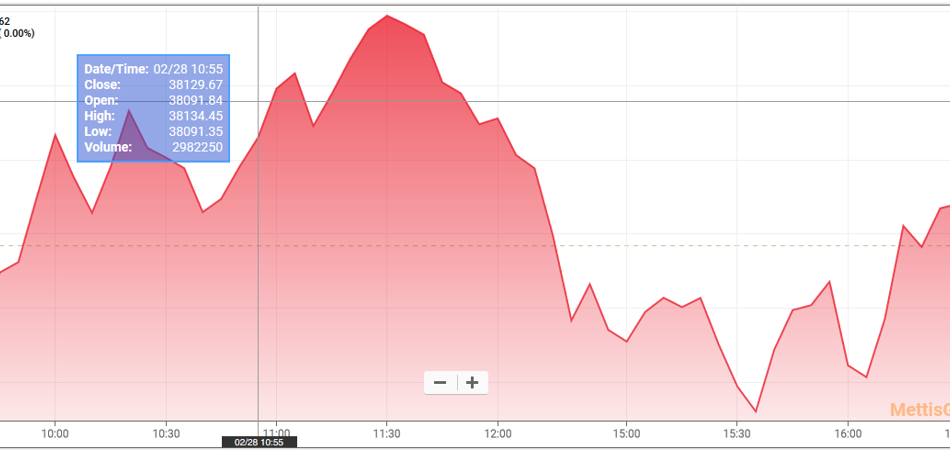

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260101112329999_0153db_20260209062258909_9180ec.webp?width=280&height=140&format=Webp)

MTB Auction

MTB Auction