Weekly inflation rises by 0.73%

_20251003092603298_af0c50_20251010094012153_327c07.webp?width=950&height=450&format=Webp)

MG News | November 28, 2025 at 02:13 PM GMT+05:00

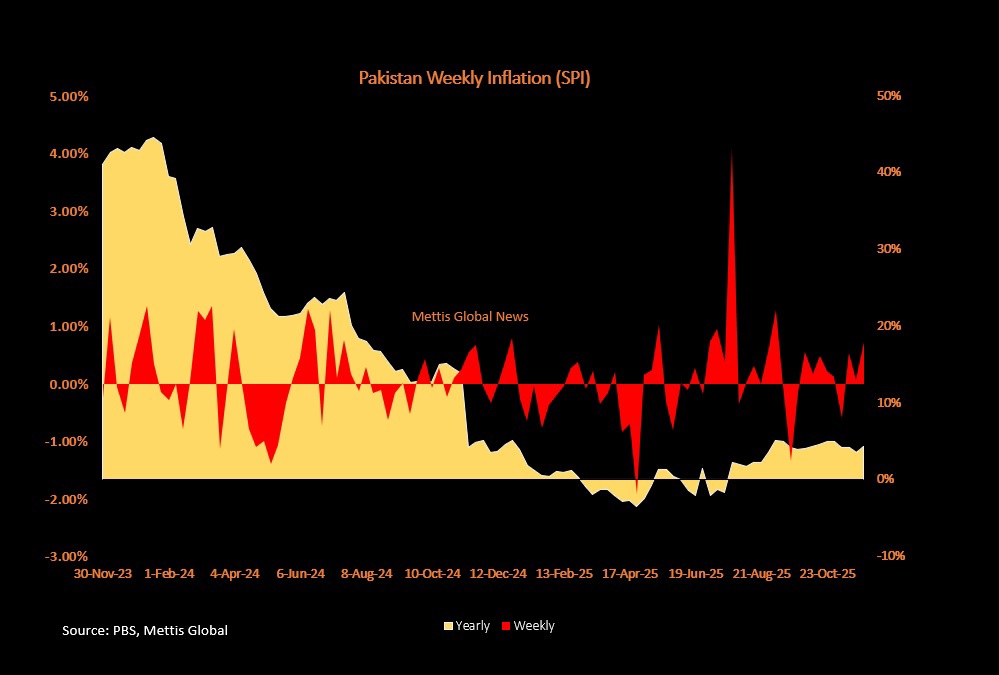

November 28, 2025 (MLN): Pakistan's short-term inflation, measured by the Sensitive Price Indicator (SPI), increased by 0.73% for the week ended November 27, 2025, driven primarily by a sharp hike in electricity charges for the lowest consumption slab and rising LPG costs, according to data released by the Pakistan Bureau of Statistics (PBS)

On a year-on-year (YoY) basis, the SPI trend depicted an increase of 4.32% compared to the corresponding week last year

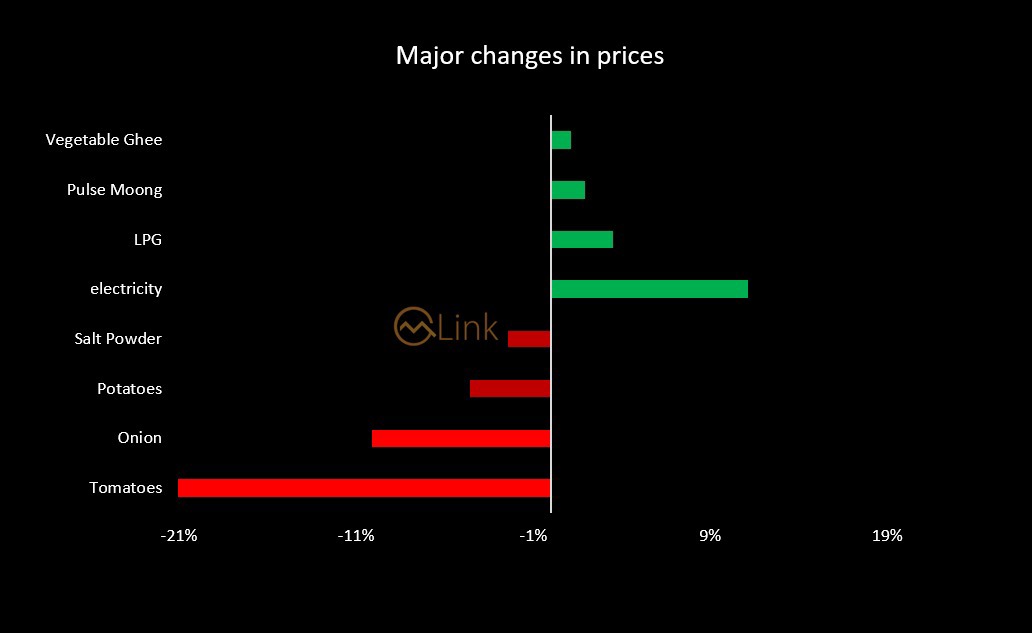

The data highlights that the major upward pressure on the index came from the energy sector, where electricity charges for the first quintile (Q1) witnessed a massive surge of 11.11% week-on-week, while the price of Liquefied Petroleum Gas (LPG) increased by 3.51%

Beyond the energy sector, inflationary pressure was felt in several food commodities.

Pulse Moong recorded a price increase of 1.92%, followed by a 1.12% rise in the cost of Vegetable Ghee (2.5Kg) and a 0.65% increase in Bananas

Additionally, Cooking Oil (5 Litre) saw an uptick of 0.64%, contributing to the overall rise in the index

Out of the 51 items monitored, prices of 14 items increased, 12 items decreased, while 25 items remained stable during the week

Despite the energy price hikes, consumers received significant relief in the prices of perishable vegetables, with the price of tomatoes crashing by 28.39% in a single week

This downward trend in the kitchen basket extended to other staples as well; onion prices decreased by 10.08%, while potatoes became 4.58% cheaper compared to the previous week

Further relief was observed in the prices of Salt Powder and Wheat Flour, which declined by 2.47% and 0.70%, respectively

Comparing the current week to the same period in 2024, the most significant price shock has come from Sugar, which has surged by 44.09%, while utility costs remain a long-term burden, with Gas Charges for Q1 up by 29.85%

Other major annual increases included Wheat Flour, which is up 16.35%, Gur at 16.24%, and Beef, which has risen by 13.46%

On the other end of the spectrum, significant year-on-year relief was recorded for certain crops, with Garlic prices plummeting by 38.54%, Potatoes dropping by 34.96%, Pulse Gram falling by 28.96%, and Tomatoes decreasing by 26.64%

The weekly inflation data revealed a distinct disparity in how price changes affected different income groups.

The lowest income group (Q1), earning up to Rs17,732, actually witnessed a slight decline in their combined SPI by 0.09%, likely due to the heavy weighting of food items like tomatoes and wheat flour which offset the electricity hike

Conversely, the middle-income group (Q2), earning between Rs17,733 and Rs. 22,888, bore the brunt of the inflation, recording the highest weekly increase of 0.99%

The remaining groups also saw increases, with the third (Q3), fourth (Q4), and highest (Q5) quintiles recording weekly spikes of 0.49%, 0.28%, and 0.60% respectively.

Cement prices inched up this week, rising to Rs1,397 per

50kg bag compared to Rs1,390 last week.

Despite the slight

weekly increase, current prices remain lower than the Rs1,426 recorded during

the same period last year, reflecting a modest year-on-year decline in the

construction material’s cost.

Meanwhile, the fertilizer market saw a slight ease in rates

as Sona Urea prices fell to Rs4,339 per 50kg bag, down from Rs4,358 last week.

However, on a yearly basis, urea remains elevated compared

to Rs4,552 last year, indicating continued pricing pressure in the agricultural

input segment.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 169,778.63 52.14M | -1.39% -2391.66 |

| ALLSHR | 101,959.76 114.14M | -1.47% -1516.89 |

| KSE30 | 52,003.22 18.97M | -1.24% -655.57 |

| KMI30 | 237,137.72 16.01M | -1.40% -3373.56 |

| KMIALLSHR | 65,053.16 55.23M | -1.42% -934.88 |

| BKTi | 50,330.50 7.90M | -1.34% -682.40 |

| OGTi | 33,329.58 3.13M | -0.70% -235.89 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,410.00 | 67,665.00 66,880.00 | 205.00 0.31% |

| BRENT CRUDE | 71.92 | 72.16 71.59 | 0.26 0.36% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.10 -3.13% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.75 -1.63% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.65 | 66.86 66.31 | 0.25 0.38% |

| SUGAR #11 WORLD | 13.72 | 13.85 13.62 | -0.04 -0.29% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

Roshan Digital Account

Roshan Digital Account