Weekly Market Roundup

By MG News | June 09, 2025 at 04:46 PM GMT+05:00

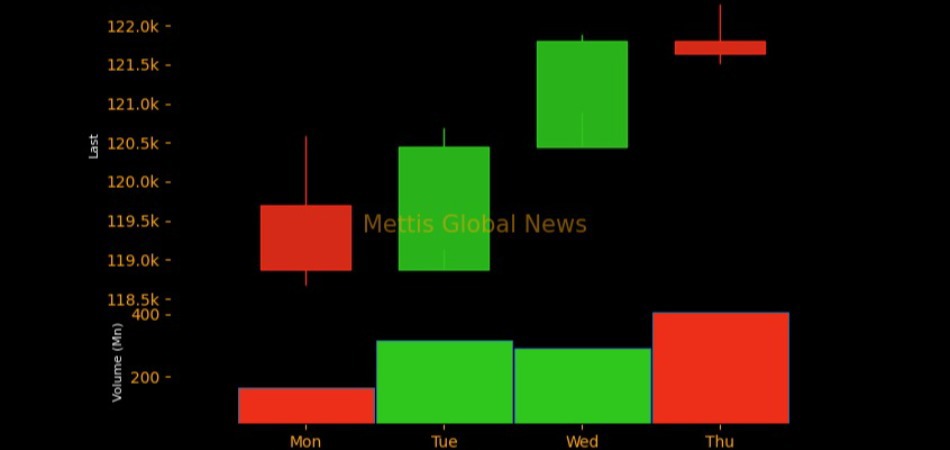

June 09, 2025 (MLN):The market witnessed upward momentum throughout the week , primarily influenced by growing investor confidence ahead of the upcoming budget and expectations of a stable fiscal environment with no major changes to existing tax structures.

Consecutively, the bench mark KSE 100 index gained 1,949.91 points

or 1.63%, closing the session at 121,641 compared

to the previous week’s close of 119,691.09.

Intraday swings were significant, with the index reaching a high of 122,281.58 (+640.58 points) and a low of 118,672.84 (-2,968.16 points).

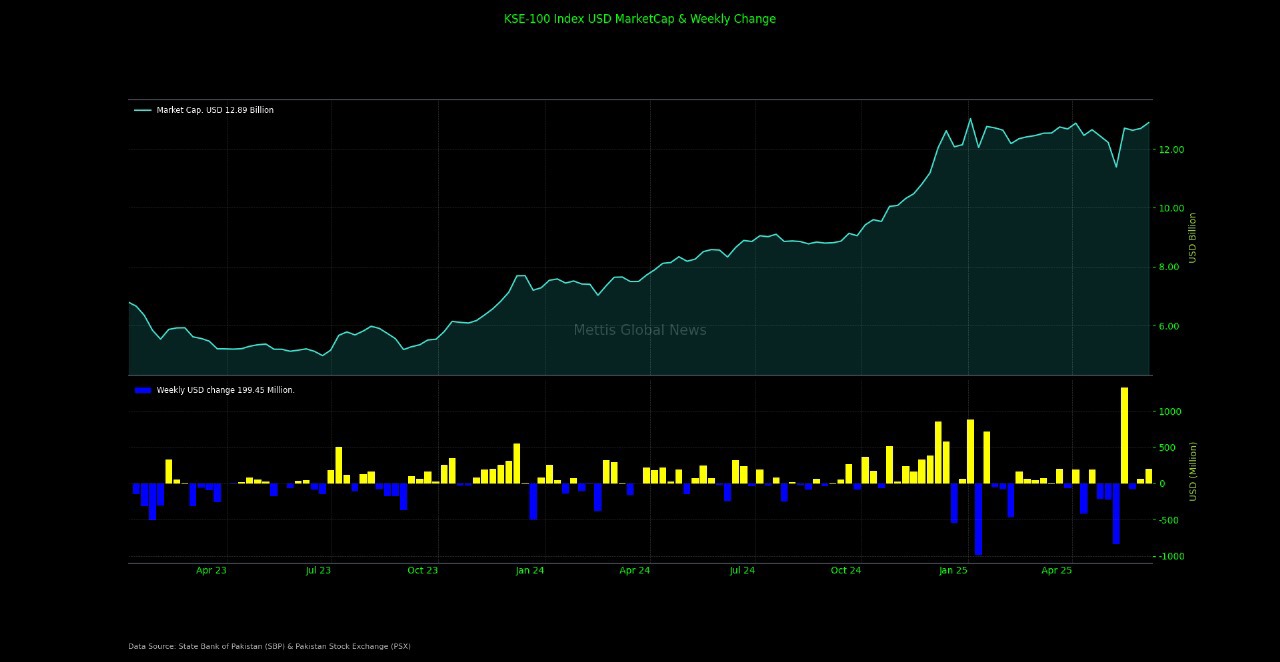

Market cap

The KSE-100 market capitalization

stood at Rs3.63 trillion, up 1.62% from the previous week’s Rs3.57tr.

In USD terms, the market cap was recorded at $12.89 billion, compared to

$12.69bn in the prior week.

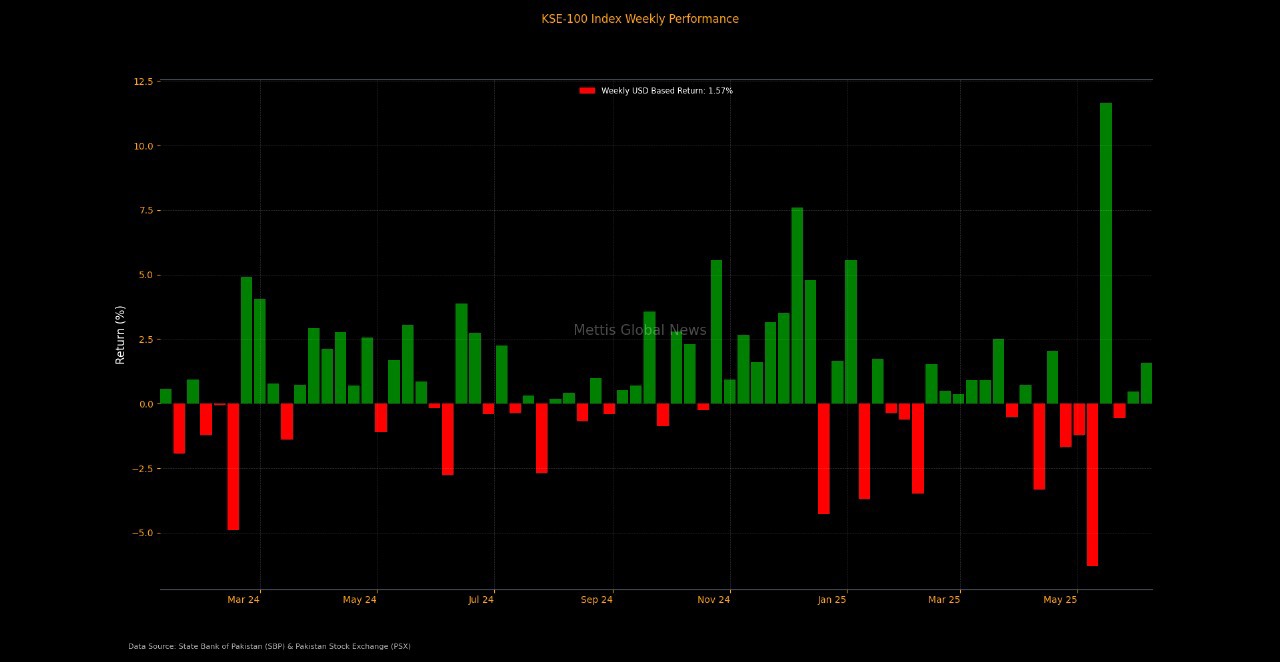

This week, the index return in USD terms was 1.57%, compared to 0.47% the previous week, with the market also marking its all-time high during the week.

On the economic front, Pakistan's

CPI inflation is estimated at 0.88% YoY in April 2025, easing sharply from

17.3% last year, with MoM inflation declining by 0.2%.

Net receipts of National Savings Schemes stood at Rs30.64bn in April 2025, up from Rs27.74bn in March, while Defence Saving Certificates saw a net outflow of Rs457.24m.

Government domestic debt and liabilities increased 17.19% YoY to Rs52.74tr in April 2025, up 1.94% MoM from March.

Furthermore, Central government debt rose 13.39% YoY to Rs74.94tr in April 2025, up 1.69% MoM from March.

Pakistan’s trade deficit fell 23.47% to $2.62bn in May 2025, with exports rising 17.43% to $2.55bn and imports dropping 7.58% to $5.17bn.

Pakistan’s short-term inflation rose 0.02% WoW and fell 0.02% YoY, with prices of 18 items increasing, 6 decreasing, and 27 stable.

The State Bank of Pakistan’s foreign exchange reserves fell $7.2m WoW to $11.51bn, while total reserves declined $39m to $16.6bn.

The positive economic cues helped stabilize investor sentiment, pushing the KSE-100 index’s fiscal year-to-date returns to 55.06%, while CYTD return stood at 5.65%.

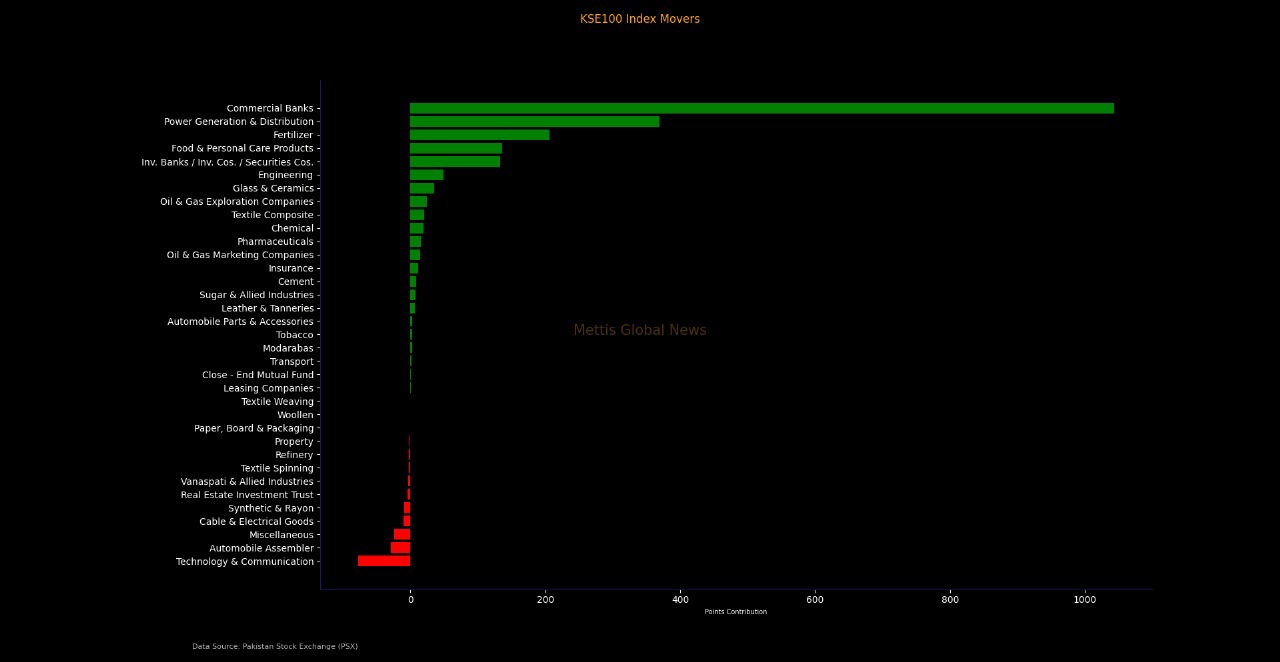

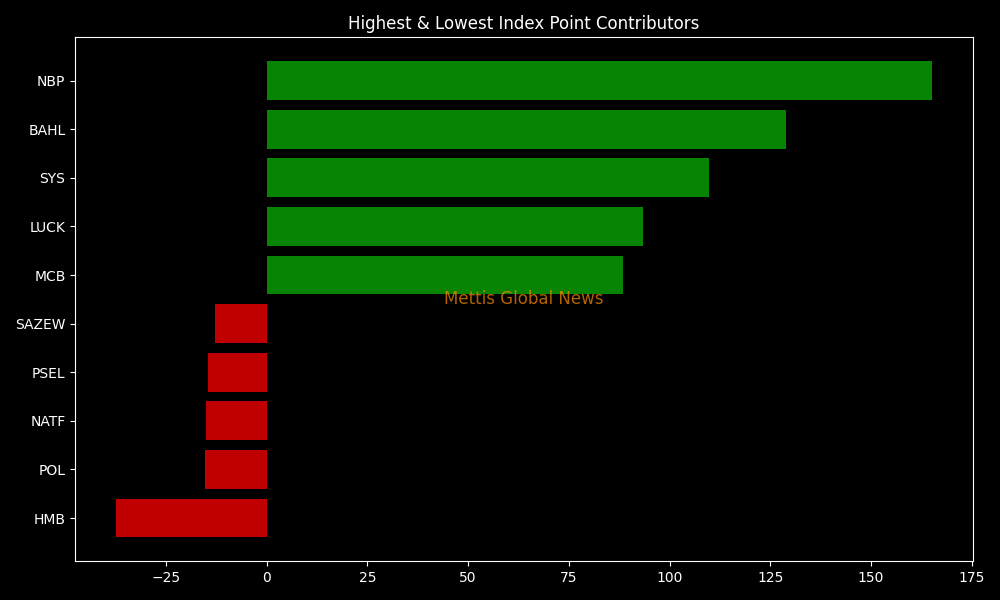

Top Index Movers

During the week, Commercial Bank,

Power Generation & Distribution and fertilizer contributed 1043.64, 368.96,

and 206.42 points to the index.

On the flip side, Technology &

Communication, Automobile Assembler, Oil & Gas Exploration Companies, and

Miscellaneous dented the index by -77.65, -28.9 and -23.79 points,

respectively.

Among individual stocks, PKGP added

326.92 points to the index while BAHL, NBP, and HBL contributed to

the index by 207.59, 165.26, and 159.7, respectively.

Conversely, SYS, FCCL, and HUBC eroded

-146.66, -32.43, and -28.3 points, respectively.

FIPI/LIPI

This week, foreign investors remained net sellers, offloading equities worth $14.69m.

Foreign Corporates led the selling spree worth $14.82m while Overseas Pakistanis bought equities worth $0,065.

On the other hand, local investors were net buyers this week, purchasing equities worth $14.69m.

Companies and Insurance Companies bought securities worth $8.61m and $8.06m, respectively, while Mutual Funds sold securities worth $11.42m.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 128,199.43 336.91M |

2.05% 2572.11 |

| ALLSHR | 79,787.62 1,023.63M |

1.53% 1202.91 |

| KSE30 | 39,105.00 121.90M |

2.49% 951.21 |

| KMI30 | 186,915.61 131.16M |

1.10% 2029.11 |

| KMIALLSHR | 54,201.88 553.60M |

0.81% 438.07 |

| BKTi | 33,476.68 51.49M |

4.87% 1555.00 |

| OGTi | 27,962.58 9.77M |

0.68% 188.60 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 106,325.00 | 108,105.00 105,930.00 |

-1910.00 -1.76% |

| BRENT CRUDE | 67.20 | 67.50 66.34 |

0.46 0.69% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 103.80 103.80 |

-3.45 -3.22% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.66 | 65.98 64.67 |

0.55 0.84% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI