Pakistan faces almost $32bn external debt in next 12 months

Nilam Bano | December 02, 2025 at 11:11 AM GMT+05:00

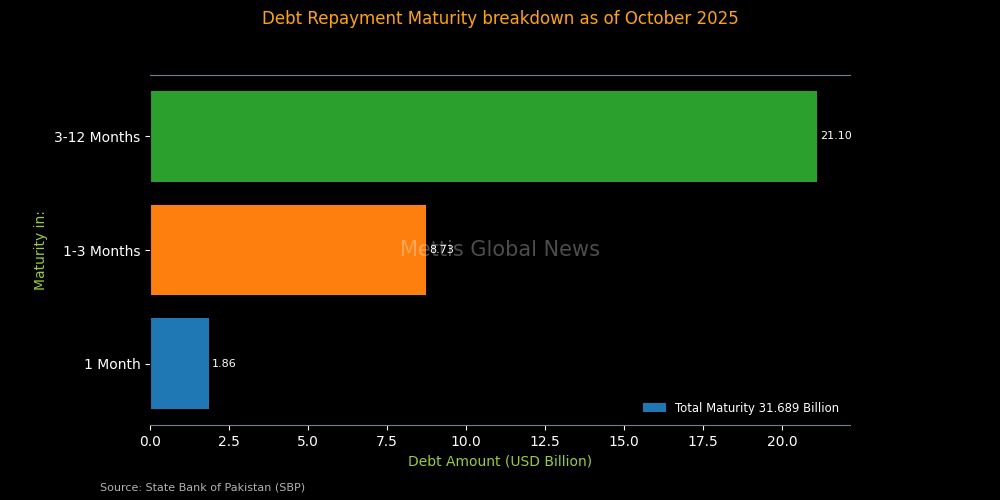

December 2, 2025 (MLN): Pakistan’s scheduled external debt repayments for the next 12 months stand at $31.69 billion, according to the latest data released by the State Bank of Pakistan (SBP) on the maturity profile of external debt obligations as of October 2025

The central bank’s data on predetermined short-term net drains on foreign currency assets reveals that the country faces significant external account pressure, with scheduled outflows surpassing the total official reserve assets

The immediate obligation standing due within one month is recorded at $1.86 billion

The heaviest load, however, is concentrated in the three-to-twelve-month period, where obligations accumulate to a substantial $21.10 billion

Crucially, the composition of this debt indicates that $28.13 billion of the total amount represents principal repayments, while $3.56 billion is owed in interest payments

In terms of liquidity available to meet these obligations, the SBP’s total official reserve assets stood at $24.03 billion as of October 31, 2025

This reserve buffer is composed of $8.72 billion in foreign currency reserves (convertible currencies and securities), $8.35 billion in gold reserves, and $6.81 billion classified as other reserve assets

Within the foreign currency assets, the report highlights specific IMF-related figures: the reserves include $140.89 million in Special Drawing Rights (SDRs) and an IMF reserve position of $0.16 million

Furthermore, the SBP holds $3.35 billion in deposits with other national central banks, the BIS, and the IMF

The SBP also reported aggregate short and long positions in forwards and futures in foreign currencies, showing a net short position of $2.08 billion

However, on the other side of the ledger, the central bank holds long positions totaling $290 million

Breaking this down further, the SBP has long positions worth $151 million maturing within one month and another $139 million in the one-to-three-month bracket, providing a minor offset against the larger volume of short positions

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 169,842.71 58.01M | -1.35% -2327.58 |

| ALLSHR | 101,959.41 125.89M | -1.47% -1517.23 |

| KSE30 | 51,994.55 20.46M | -1.26% -664.23 |

| KMI30 | 237,197.45 17.70M | -1.38% -3313.84 |

| KMIALLSHR | 65,082.44 62.39M | -1.37% -905.59 |

| BKTi | 50,290.72 8.39M | -1.42% -722.19 |

| OGTi | 33,357.70 3.30M | -0.62% -207.77 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,270.00 | 67,665.00 66,880.00 | 65.00 0.10% |

| BRENT CRUDE | 71.91 | 72.16 71.59 | 0.25 0.35% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.10 -3.13% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.75 -1.63% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.65 | 66.86 66.31 | 0.25 0.38% |

| SUGAR #11 WORLD | 13.72 | 13.85 13.62 | -0.04 -0.29% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account