Oil holds steady amid U.S. Iran talks

MG News | February 03, 2026 at 05:14 PM GMT+05:00

February 3, 2026 (MLN): Oil prices held steady on Tuesday after sharp losses on Monday, as traders weighed signs of easing tensions between the United States and Iran, while a stronger U.S. dollar continued to pressure crude demand.

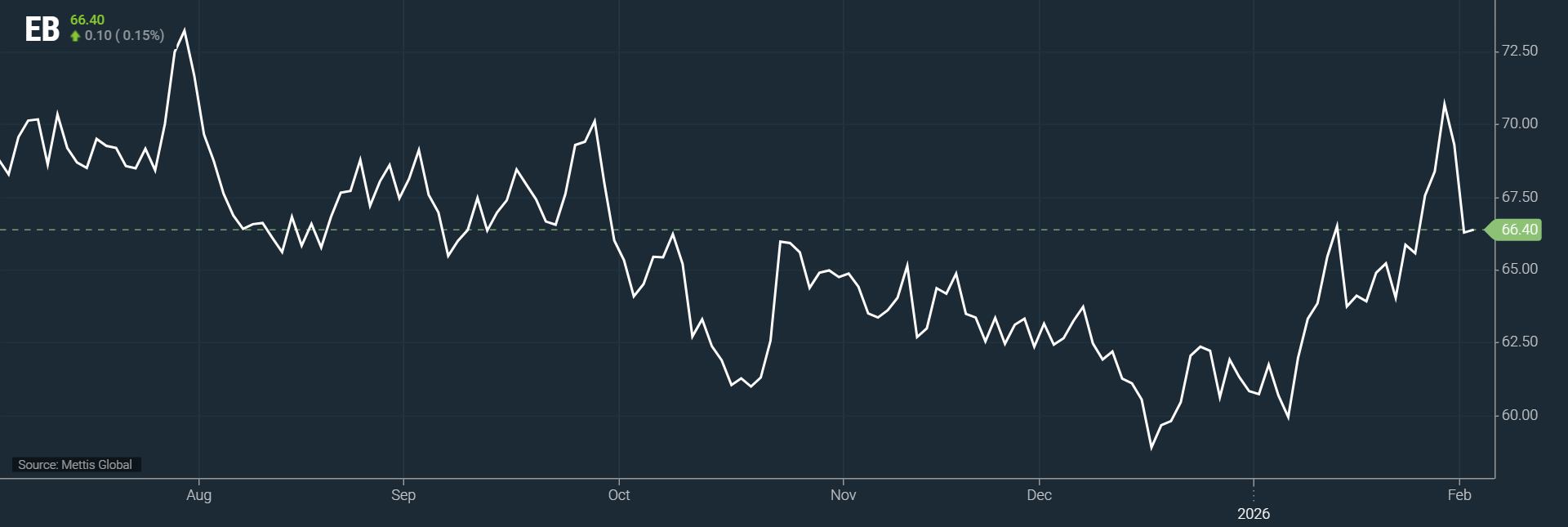

Brent crude futures went up by $0.10, or 0.15%, to $66.40

per barrel, according to data by Mettis Global.

West Texas Intermediate (WTI) crude futures increased by

$0.14, or 0.23%, to $62.28 per barrel by [5:11 pm] PST.

Brent and WTI crude had plunged more than 4% on Monday

following remarks from U.S. President Donald Trump, who said Iran was

“seriously talking” with Washington, suggesting a possible de-escalation of

geopolitical risks in the Middle East.

Market participants are now focusing on the upcoming U.S.

Iran nuclear talks scheduled for Friday in Turkey, which could influence oil

volatility further.

Oil prices were further pressured by the U.S. dollar

index hovering near a weekly high, making dollar-denominated crude more

expensive for foreign buyers, according to CNBC.

The nomination of Kevin Warsh as the next Federal Reserve

chair added to the greenback’s strength, indirectly weighing on crude.

On the trade front, President Trump revealed a deal with

India, reducing U.S. tariffs on Indian goods from 50% to 18% in exchange for

India cutting Russian oil purchases and lowering trade barriers.

This development could increase the global supply of

Russian oil, adding further downside risk for crude prices.

Looking ahead, market experts expect oil to remain

volatile and range-bound in February, with prices highly sensitive to

geopolitical headlines, macroeconomic cues, and trade developments, while

downside risks appear more pronounced.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 186,900.74 390.19M | 1.00% 1842.91 |

| ALLSHR | 112,154.62 846.50M | 0.86% 955.62 |

| KSE30 | 57,292.13 173.90M | 0.85% 483.13 |

| KMI30 | 264,696.41 110.49M | 0.72% 1889.84 |

| KMIALLSHR | 72,112.94 399.43M | 0.73% 521.00 |

| BKTi | 54,367.28 106.69M | 1.37% 732.43 |

| OGTi | 38,783.78 9.59M | -0.26% -101.63 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 78,550.00 | 79,435.00 77,870.00 | 345.00 0.44% |

| BRENT CRUDE | 66.50 | 66.66 65.19 | 0.20 0.30% |

| RICHARDS BAY COAL MONTHLY | 90.00 | 0.00 0.00 | -4.75 -5.01% |

| ROTTERDAM COAL MONTHLY | 101.65 | 101.75 100.90 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 62.44 | 62.60 61.12 | 0.30 0.48% |

| SUGAR #11 WORLD | 14.60 | 14.60 14.21 | 0.34 2.38% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance