Oil prices slide on hints of U.S., Iran diplomacy

MG News | February 02, 2026 at 12:21 PM GMT+05:00

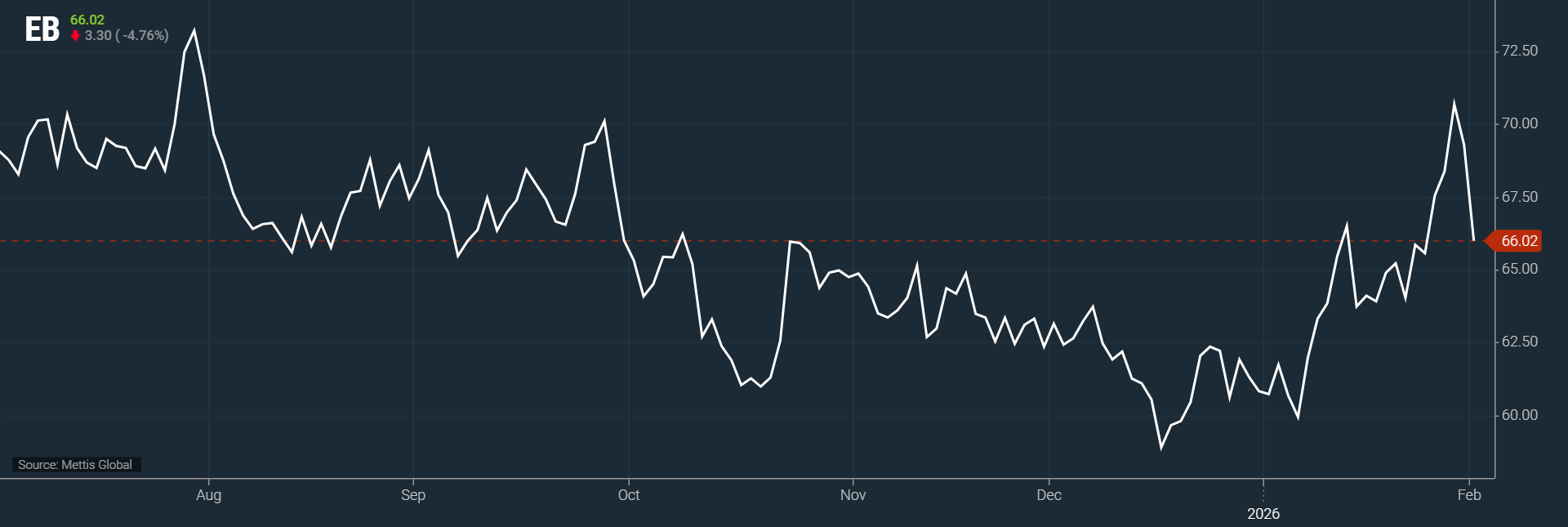

February 2, 2026 (MLN): Global oil prices fell sharply on Monday and reversed from recent six-month highs following eased concerns over a potential supply disruption after signals of renewed diplomatic engagement between the United States and Iran emerged.

Brent crude futures went down by $3.30, or 4.76%, to $66.02

per barrel, according to data by Mettis Global.

West Texas Intermediate (WTI) crude futures decreased by $3.28,

or 5.03%, to $61.93 per barrel by [12:15 pm] PST.

Crude markets had rallied in recent weeks on fears that

escalating tensions between Washington and Tehran could trigger military action

and disrupt Middle Eastern oil supplies.

However, sentiment shifted after U.S. President Donald

Trump indicated that Iran was engaged in serious discussions with the United

States, suggesting a possible reduction in geopolitical risks.

Speaking to reporters over the weekend, Trump said Iran was

“seriously talking,” comments that contrasted with his earlier warnings of

intervention should Tehran fail to reach a nuclear agreement or continue its

domestic crackdown, as reported by CNBC.

Iran, meanwhile, has rejected such accusations, claiming the

protests are being fueled by Western influence.

Adding to the easing tone, Iran’s top security official,

Ali Larijani, stated on X that preparations for negotiations were underway,

reinforcing hopes that diplomacy could replace confrontation.

Oil prices had recently climbed to their highest levels in

six months after reports that Washington had deployed a “massive armada” toward

Iran, stoking fears of an imminent military conflict.

Monday’s pullback shows a reassessment of those risks.

With U.S. midterm elections approaching, gasoline

prices remain a key concern for voters, making oil price stability a critical

political issue.

At the same time, additional crude supply is quietly

entering global markets, further capping price gains.

Venezuelan oil, largely sourced from offshore and onshore

inventories rather than new output, is increasing available supply, even as

global production continues to exceed demand.

While extra supply is weighing on prices, support continues

to come from OPEC+, which remains cautious in its production strategy.

The oil alliance on Sunday decided to keep output levels

unchanged for March, extending a three-month supply freeze.

Lipow noted that while Venezuelan inventory drawdowns are

adding barrels to the market, OPEC+’s decision to maintain current

production levels continues to provide a floor under oil prices.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 184,580.58 129.33M | 0.22% 406.10 |

| ALLSHR | 111,044.53 500.31M | 0.29% 319.06 |

| KSE30 | 56,616.75 61.03M | 0.27% 153.87 |

| KMI30 | 262,014.45 50.24M | 0.37% 964.22 |

| KMIALLSHR | 71,445.07 155.78M | 0.30% 214.08 |

| BKTi | 53,421.72 21.45M | 0.36% 192.68 |

| OGTi | 38,901.19 6.89M | 0.81% 310.77 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 77,220.00 | 78,480.00 74,785.00 | -6885.00 -8.19% |

| BRENT CRUDE | 65.88 | 68.83 65.45 | -3.44 -4.96% |

| RICHARDS BAY COAL MONTHLY | 90.00 | 0.00 0.00 | -0.90 -0.99% |

| ROTTERDAM COAL MONTHLY | 103.70 | 0.00 0.00 | 0.30 0.29% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 61.80 | 64.74 61.43 | -3.41 -5.23% |

| SUGAR #11 WORLD | 14.26 | 14.71 14.15 | -0.44 -2.99% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|