Oil gains on hopes of U.S. shutdown deal

MG News | November 10, 2025 at 09:40 AM GMT+05:00

November 10, 2025 (MLN): Oil prices climbed on Monday amid optimism that a resolution to the U.S. government shutdown could soon boost demand in the world’s largest oil-consuming nation, despite lingering worries over increasing global supply.

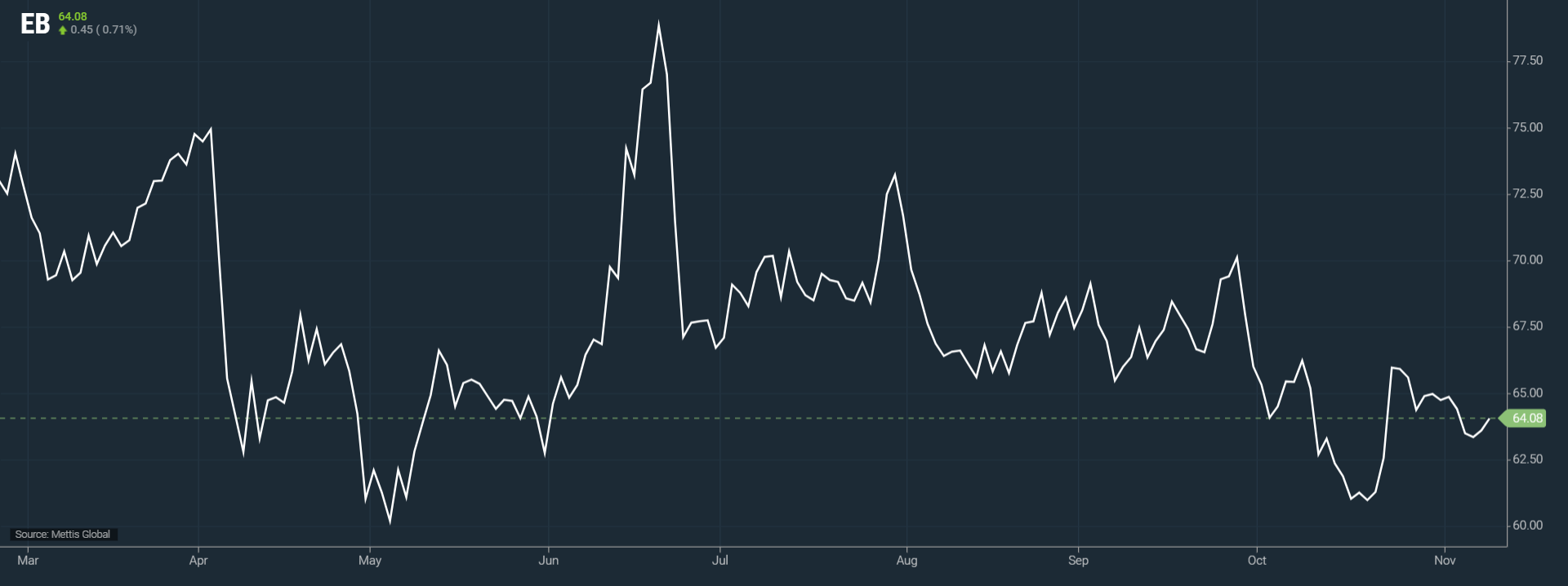

Brent crude futures went up by $0.45, or 0.71%, to $64.08

per barrel.

West Texas Intermediate (WTI) crude futures decreased by

$0.46, or 0.77%, to $60.21 per barrel by [9:40 am] PST.

The U.S. Senate is moving toward a vote to reopen the

federal government, a development expected to restore pay to around 800,000

federal employees and revive critical programs.

“The imminent reopening is a welcome boost, restoring pay to

federal workers and reigniting consumer confidence, spending, and overall

market activity,” said IG Market analyst Tony Sycamore. “This should also help

improve risk sentiment across markets and push WTI prices toward $62 per

barrel,” he added.

Both Brent and West Texas Intermediate (WTI) crude

benchmarks slipped about 2% last week, marking their second consecutive weekly

decline amid growing fears of a global supply glut. OPEC+ members agreed to a

modest output increase for December but decided to hold off on further hikes in

the first quarter of 2026, cautious of worsening oversupply conditions.

In the U.S., crude inventories continue to build, while

floating storage in Asian waters has nearly doubled in recent weeks. This surge

follows tighter Western sanctions that have limited oil imports to China and

India, alongside a shortage of import quotas that has restrained demand from

China’s independent refiners.

Meanwhile, Indian refiners have been increasingly sourcing

oil from the Middle East and the Americas to offset the shortfall in sanctioned

Russian crude.

Russian oil producer Lukoil is facing growing operational

challenges as the U.S. deadline to cease business dealings with the company

approaches on November 21. Hopes of selling its assets to Swiss trader Gunvor

have collapsed, further complicating Russia’s oil export situation.

Adding to global oversupply concerns, U.S. President Donald

Trump granted Hungary a one-year exemption from sanctions on Russian oil

imports a move analysts say could temporarily exacerbate supply imbalances in

the market.

Despite supply-side headwinds, analysts remain cautiously

optimistic that a U.S. government reopening could support oil demand recovery

and help stabilize prices in the coming weeks.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes