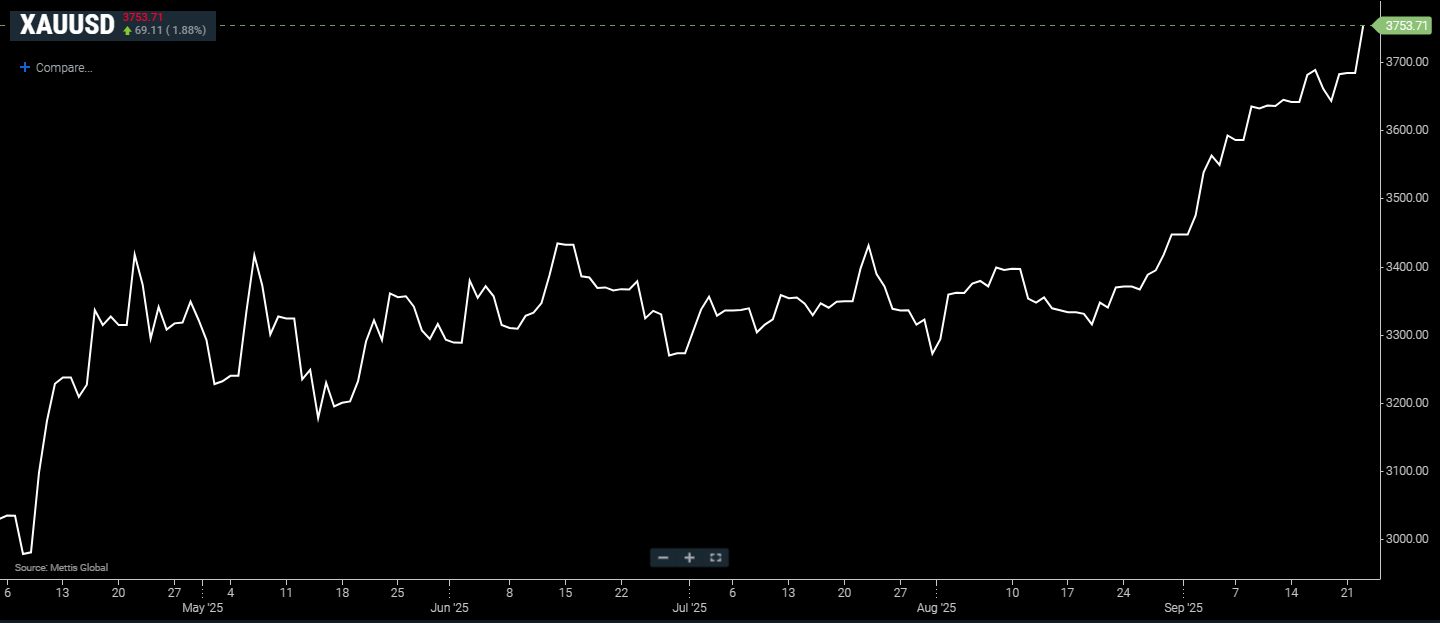

Gold holds near record high ahead of Powell's speech

MG News | September 23, 2025 at 11:53 AM GMT+05:00

September 23, 2025 (MLN): Gold prices steadied

on Tuesday after touching a fresh record high, supported by expectations of

further U.S. interest rate cuts and a softer dollar, as investors awaited

Federal Reserve Chair Jerome Powell’s remarks for policy direction.

Spot gold was up 1.88% at $3,753.71 an ounce as of [11:47am] PST, according to

data reported by Mettis Global.

December U.S. gold futures edged up 0.1% to $3,779.50.

Meanwhile, the U.S. dollar index slipped 0.1%, making

dollar-priced bullion more attractive to overseas buyers.

“The short-term trend remains bullish, though we could see a

brief pullback due to technical factors,” said Kelvin Wong, senior market

analyst at OANDA to CNBC.

He noted that the weaker dollar was providing support,

adding that key levels to watch lie around $3,710 and $3,690.

Attention is now fixed on Powell’s speech, which could

provide fresh signals on the central bank’s stance.

On Monday, newly appointed Fed Governor Stephen Miran argued

that policymakers risk harming the job market unless they adopt more aggressive

rate cuts., according to CNBC.

His comments were at odds with several Fed officials who

cautioned against easing too quickly amid persistent inflation.

The Fed lowered rates by 25 basis points last week, citing

softening labor market conditions, and signaled more cuts may follow.

According to the CME FedWatch tool, markets are pricing in a

90% chance of another quarter-point cut in October and a 75% probability of an

additional move in December.

“Slowing growth, stubborn inflation, geopolitical

uncertainties, and a weaker dollar will continue to support strong investment

demand for gold,” ANZ analysts wrote in a note. “As long as gold remains

attractive, silver will benefit as well.”

Silver prices slipped 0.9% to $43.67 an ounce, still hovering near a 14-year peak. Platinum dipped 0.3% to $1,412.80, while palladium eased 0.2% to $1,176.44.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes