Weekly Market Roundup

MG News | September 28, 2025 at 07:09 PM GMT+05:00

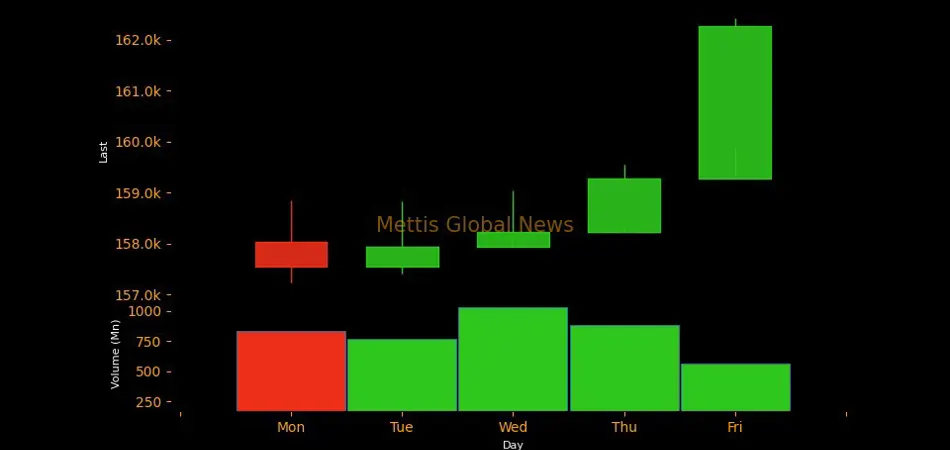

September 28, 2025 (MLN): The bulls came out in

full force this week as the KSE-100 Index roared to 162,257 points, climbing

4,220 points (+2.67% WoW).

Investor sentiment was buoyed by multiple tailwinds,

including the PM’s high-profile meeting with the U.S. President in Washington and

the much-awaited power circular debt resolution deal unlocked a massive Rs1.225trn

bank loan.

Market cap

The KSE-100 market capitalization stood at Rs4.8 trillion, up 2.64% from the previous week’s Rs4.67tr._20250928140302281_b1e08a.jpeg)

This week, the index return in USD terms was 2.7%, compared

to 2.36% the previous week._20250928140012490_b0409d.jpeg)

During the week, the Prime Minister sat-down with the U.S.

President at the White

House that added weight to Pakistan’s global standing, following MoUs with

big-name mining and infrastructure players on critical minerals.

Adding fuel to the fire, the government finally inked the

long-awaited circular

debt resolution agreement, securing a Rs1.225trn loan from banks

on favorable terms.

With circular

debt trimming down to Rs1.6trn (from Rs2.3trn a year ago), the power sector

narrative took a bullish turn.

Meanwhile, Pakistan's Forex

Reserves increased by $57.6m or 0.29% and the total liquid foreign reserves

held by the country stood at $19,793.3m on Sep 19, 2025.

The total money

supply circulating within the economy till August 2025 has been recorded at

Rs44.66 trillion, according to provisional accounts on Monetary Aggregates for

the month, maintained by the State Bank of Pakistan (SBP).

Top Index Movers

During the week, Oil & Gas Exploration Companies,

Commercial Banks, and Power Generation & Distribution contributed 1,084.36,

954.76, and 888.12 points, respectively, to the index._20250928140043116_f72bb2.jpeg)

Among individual stocks, HUBC, MARI, and ENGROH gained 802.29,

538.89, and 438.46 points, respectively._20250928140237845_976f70.jpeg)

FIPI/LIPI

This week, Foreign Investors remained net sellers, selling

equities worth $13.65m.

Foreign Corporates led the selling spree worth $10.68m.

On the other hand, local Investors were net buyers this

week, purchasing equities worth $13.65m.

Mutual Funds bought maximum securities worth $35.64m while Individuals

bought $6.65m worth of securities.

On the other hand, Banks and Companies sold securities worth

$15.77m and $7.96m, respectively.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 163,018.66 138.30M | 0.05% 81.72 |

| ALLSHR | 98,973.80 403.59M | 0.17% 164.66 |

| KSE30 | 49,460.79 51.40M | 0.03% 14.97 |

| KMI30 | 233,011.03 39.62M | 0.13% 295.18 |

| KMIALLSHR | 64,476.20 200.81M | 0.14% 88.53 |

| BKTi | 44,076.19 19.45M | 0.29% 129.30 |

| OGTi | 32,306.98 7.87M | 0.17% 56.15 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 84,015.00 | 88,150.00 81,485.00 | -2425.00 -2.81% |

| BRENT CRUDE | 62.34 | 63.02 62.26 | -1.04 -1.64% |

| RICHARDS BAY COAL MONTHLY | 85.00 | 0.00 0.00 | 0.25 0.30% |

| ROTTERDAM COAL MONTHLY | 96.25 | 0.00 0.00 | 0.00 0.00% |

| USD RBD PALM OLEIN | 1,082.50 | 1,082.50 1,082.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 57.88 | 58.80 57.81 | -1.12 -1.90% |

| SUGAR #11 WORLD | 14.68 | 14.80 14.58 | 0.02 0.14% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Large Scale Manufacturing (LSM)

Large Scale Manufacturing (LSM)