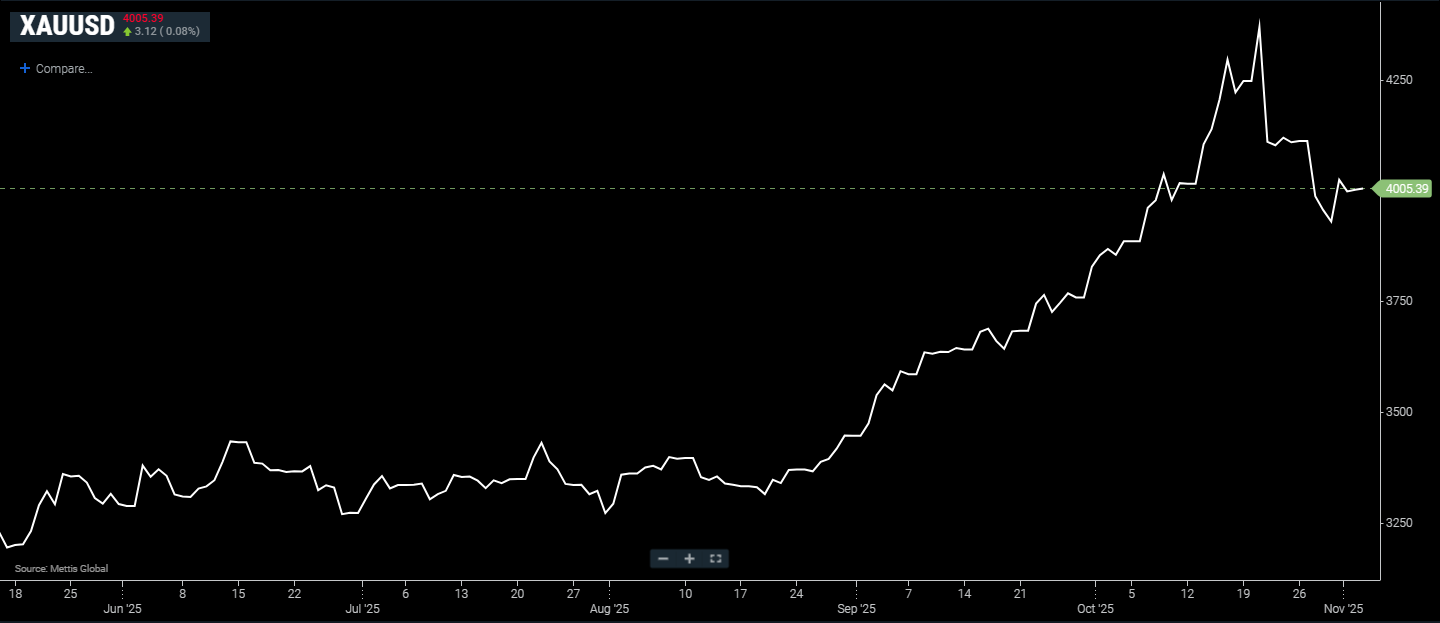

Gold holds ground near $4,000 amid softer safe-haven demand

MG News | November 03, 2025 at 09:56 AM GMT+05:00

November 03, 2025 (MLN): Gold prices held near the flat line on Monday

as a firmer U.S. dollar and reduced expectations for additional Federal Reserve

rate cuts limited demand for the metal, while easing trade tensions between

Washington and Beijing further dampened safe-haven appeal.

Spot gold was stable, up 0.08% at $4,005.39 an ounce as of [9:50 am] PST, according to data reported by Mettis Global.

U.S. gold futures for December delivery edged up 0.3% to $4,008.60.

The metal has slid roughly 10% since reaching a record high of $4,381.21 on October 20, pressured by the dollar’s advance to a near three-month peak.

The Fed lowered its benchmark rate by 25 basis points earlier,

its second cut this year.

However, after Chair Jerome Powell’s recent comments

emphasizing a cautious stance, traders trimmed expectations for another

reduction in December.

According to the CME FedWatch Tool, the probability of a

December cut has fallen to 71% from more than 90% prior to Powell’s remarks.

Gold typically benefits in periods of economic uncertainty

or when borrowing costs decline, as the non-yielding asset becomes more

attractive relative to interest-bearing investments.

The metal has slid roughly 10% since reaching a record high

of $4,381.21 on October 20, pressured by the dollar’s advance to a near

three-month peak.

Market participants are now awaiting key U.S. data releases,

including ADP employment figures and ISM purchasing manager indexes, for clues

on whether the Fed will maintain its hawkish tone.

Last week, U.S. President Donald Trump said he had reached

an understanding with Chinese President Xi Jinping to scale back tariffs in

return for Beijing’s commitments on fentanyl control, agricultural imports, and

rare earth exports.

Among other precious metals, spot silver rose 0.3% to $48.77 per ounce, platinum advanced 1% to $1,583.28, and palladium added 0.4% to $1,439.21.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 179,603.73 379.80M | -0.50% -908.92 |

| ALLSHR | 108,021.19 705.75M | -0.35% -379.48 |

| KSE30 | 54,828.33 124.04M | -0.69% -379.24 |

| KMI30 | 253,396.08 110.85M | -0.77% -1976.44 |

| KMIALLSHR | 69,330.18 392.81M | -0.57% -398.02 |

| BKTi | 51,913.39 44.12M | -0.50% -259.93 |

| OGTi | 35,053.03 27.27M | -0.84% -295.86 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,980.00 | 69,580.00 65,970.00 | 3480.00 5.31% |

| BRENT CRUDE | 67.73 | 68.05 66.89 | 0.21 0.31% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -1.50 -1.54% |

| ROTTERDAM COAL MONTHLY | 104.60 | 104.60 104.60 | 1.30 1.26% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 62.81 | 63.26 62.14 | -0.03 -0.05% |

| SUGAR #11 WORLD | 13.55 | 13.57 13.42 | 0.07 0.52% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260214163216790_15a0d7.jpg?width=280&height=140&format=Webp)

.png?width=280&height=140&format=Webp)

Weekly Inflation

Weekly Inflation