Weekly Market Roundup

MG News | February 13, 2026 at 11:37 PM GMT+05:00

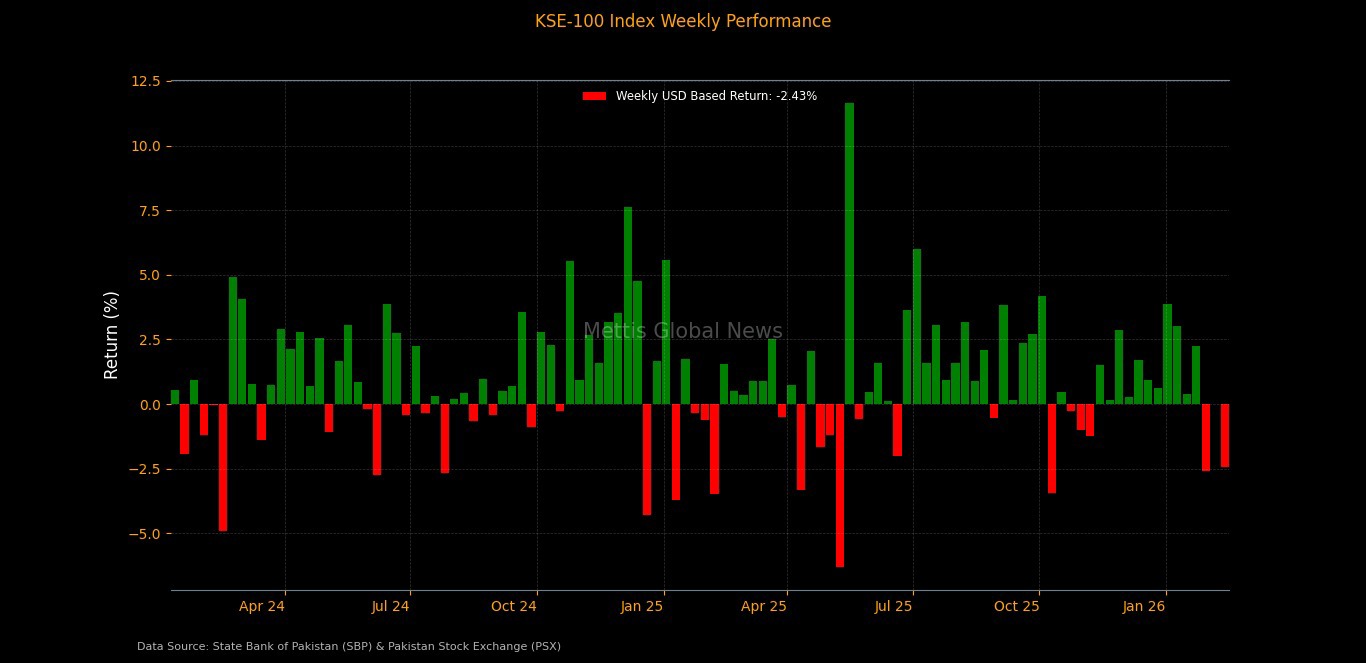

February 13, 2026 (MLN): The Pakistan Stock

Exchange (PSX) ended the week on a sharply negative note, with the benchmark

KSE-100 Index declining by 4,525.85 points, or 2.46% WoW, to close at

179,603.73 on February 13, 2026, compared to 184,129.58 on February 6, 2026.

Notably, the index fell below the 180,000 level for the

first time since January 2, 2026. The benchmark had crossed the 180,000 mark on

January 5 and remained above that psychological threshold for over a month, making

this week’s breach a significant technical setback.

The government is considering imposing a windfall profit

cess on fertilizer companies, with the proceeds planned to support farmers,

raising concerns over potential pressure on sector earnings._20260213183050001_9743e2.jpeg)

Market Capitalization

In terms of market capitalization, total market cap in rupee

terms declined to Rs5.30 trillion on February 13, 2026, from Rs5.43tr a week

earlier.

This represents a contraction of Rs134.26bn, showing

broad-based erosion in large-cap stocks.

In dollar terms, market capitalization fell from $19.43bn on

February 6, 2026, to $18.95bn on February 13, 2026, marking a decline of

approximately $473.96m during the week. _20260213183032078_73a76d.jpeg)

Consequently, USD returns stood at -2.4269%, compared to

-0.0027% in the prior week, highlighting a sharp deterioration in

foreign-adjusted equity performance.

On the Macroeconomic Front, Pakistan’s weekly inflation, measured by the SPI, eased 0.59% WoW but rose 4.26% YoY, with declines in eggs, tomatoes and chicken offsetting gains in select food and utility items, according to the Pakistan Bureau of Statistics.

Net savings mobilization under National Savings Schemes

plunged 80.8%

MoM to Rs4.19bn in December from Rs21.84bn in November, according to the State

Bank of Pakistan, amid weaker inflows across key instruments.

Pakistan’s central government debt climbed 9.6%

YoY to Rs78.53tr in December 2025, rising 1.28% MoM, driven largely by

higher domestic borrowing, according to the State Bank of Pakistan.

Pakistan received

$3.46bn in workers’ remittances in January 2026, down 3.6% MoM but up 15.4%

YoY, taking 7MFY26 inflows to $23.20bn (+11.3%), according to the State Bank of

Pakistan, with Saudi Arabia, the UAE and the UK remaining the top contributors.

Pakistan’s auto sector saw a strong start to 2026, with car

sales rising 35.5%

YoY to 23,055 units in January, led by robust demand for passenger cars,

while overall production also surged 42%.

Toyota and Honda dominated the market, with Honda sales exceeding production, signaling strong consumer demand.

The Pakistani rupee remained broadly stable during the week, limiting currency-driven volatility in valuations.

The PKR slightly appreciated to Rs279.6231 per USD on

February 13, 2026, compared to Rs279.712 a week earlier.

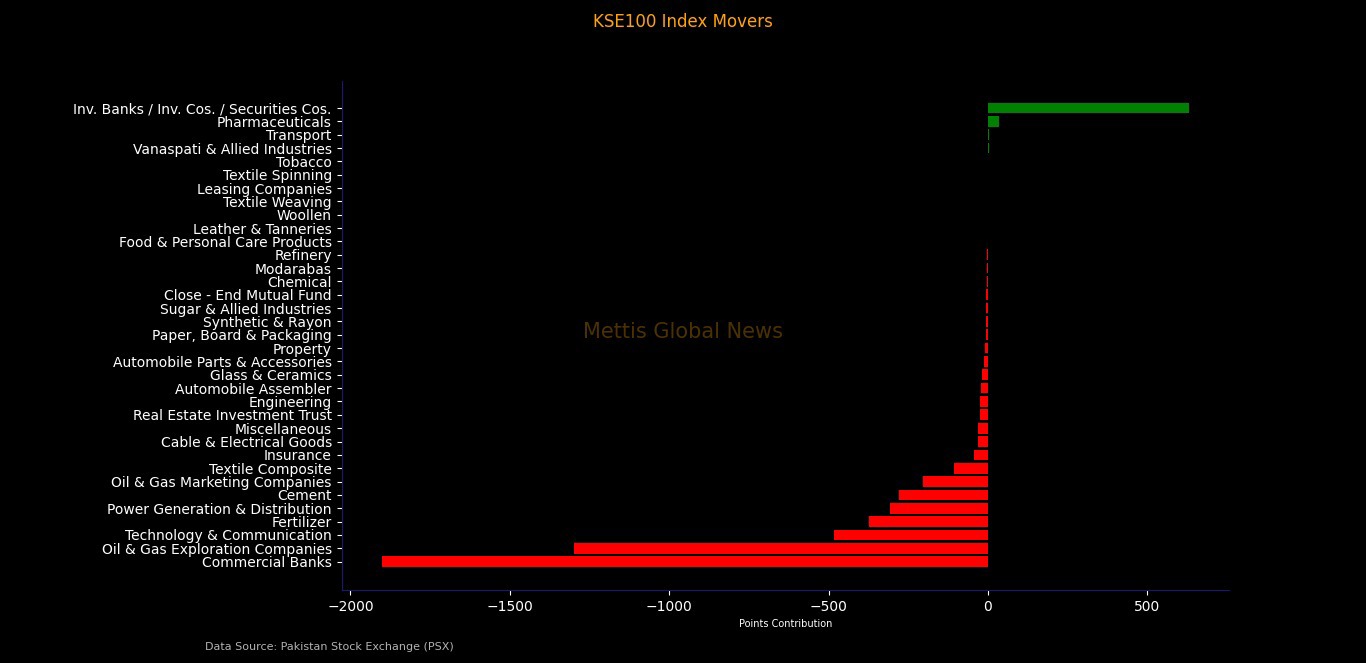

Index Movers

Sector-wise, performance was overwhelmingly negative.

Commercial Banks emerged as the largest drag, shaving off 1,901.36 points from

the index.

Oil & Gas Exploration Companies followed, subtracting

1,298.09 points, while Technology & Communication erased 483.61 points.

Fertilizer stocks reduced the index by 371.69 points, Power

Generation & Distribution by 306.34 points, and Cement by 280.04 points.

Oil & Gas Marketing Companies also weighed on the

benchmark by 204.74 points, while Textile Composite contributed a negative

105.83 points.

Insurance (-44.41 points), Cable & Electrical Goods

(-31.67 points), Engineering (-23.48 points), Automobile Assemblers (-20.84

points), Glass & Ceramics (-17.12 points), Automobile Parts &

Accessories (-11.10 points).

Property (-9.12 points), Paper & Packaging (-7.31

points), and Chemicals (-3.86 points) further kept overall index movement

subdued.

On the positive side, Investment Banks / Investment Companies / Securities Companies added 630.90 points.

Pharmaceuticals

contributed 35.72 points, Transport added 4.63 points, Tobacco gained 1.31

points, and Textile Spinning posted a marginal 0.52-point increase.

However, these gains were insufficient to counterbalance

heavy losses in major sectors.

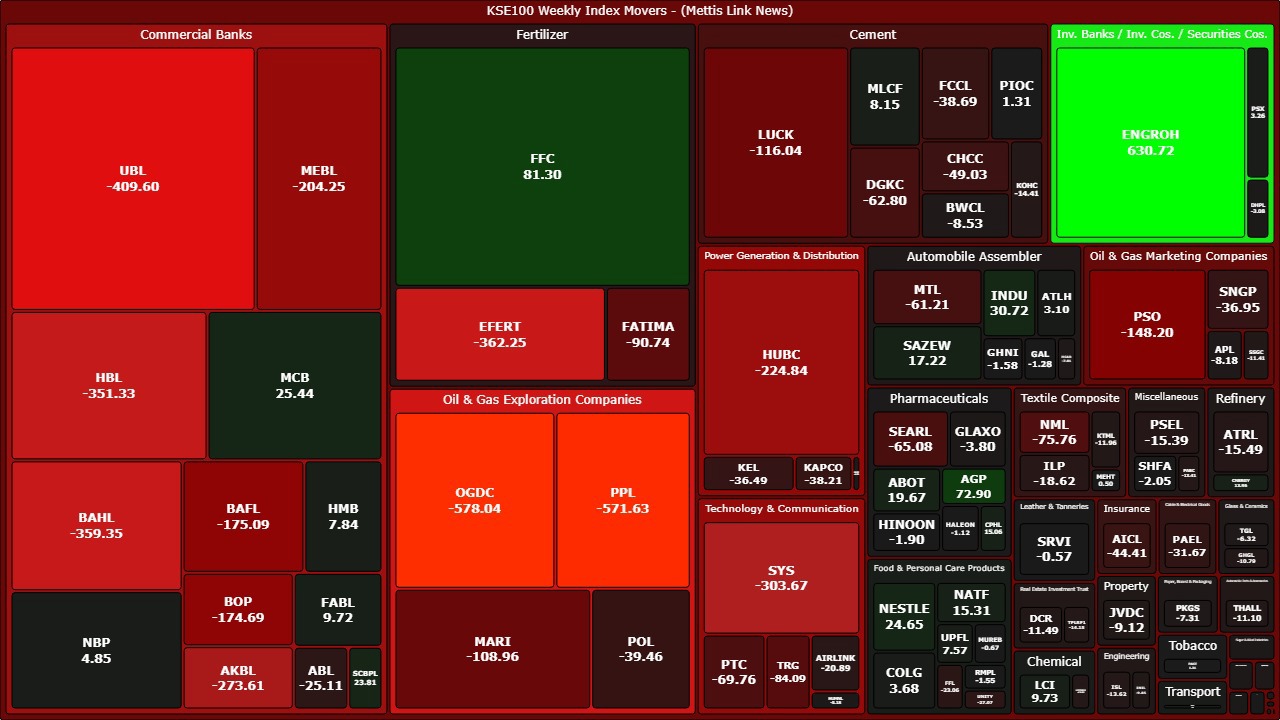

On a scrip-wise basis, ENGROH was the single largest

positive contributor, adding 630.72 points to the index. Other gainers included

FFC (+81.30 points).

AGP (+72.90 points), INDU (+30.72 points), MCB (+25.44

points), NESTLE (+24.65 points), SCBPL (+23.81 points), ABOT (+19.67 points),

SAZEW (+17.22 points), and NATF (+15.31 points).

However, the downside was dominated by heavyweight stocks.

OGDC emerged as the biggest laggard, shaving off 578.04 points, closely

followed by PPL (-571.63 points).

UBL dragged the index by 409.60 points, EFERT by 362.25

points, BAHL by 359.35 points, HBL by 351.33 points, SYS by 303.67 points, AKBL

by 273.61 points, HUBC by 224.84 points, and MEBL by 204.25 points.

Persistent selling in major banks, E&Ps, fertilizer, and

power stocks accounted for the bulk of the weekly decline.

FIPI / LIPI

From an investor flow perspective, foreign investors

remained aggressive net sellers, with total FIPI outflows of $25.89m during the

week.

Foreign corporates led the selling with net outflows of

$24.92m, while foreign individuals sold $0.21m and overseas Pakistanis recorded

net outflows of $0.76m.

In contrast, local investors fully absorbed foreign selling,

with total LIPI inflows of $25.89m.

Buying was primarily driven by mutual funds, which posted

net inflows of $29.64m, followed by individuals at $13.00m, companies at $4.04m,

and other organizations at $3.08m.

On the other hand, broker proprietary trading recorded net

selling of $15.95m, while insurance companies offloaded $8.28m.

Despite strong local support, the scale of selling in index

heavyweights resulted in a decisive 2.46% weekly decline and a break below the

key 180,000 level._20260213183017578_02b32f.jpeg)

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 157,496.10 196.19M | -2.30% -3714.58 |

| ALLSHR | 94,227.01 359.74M | -1.95% -1870.28 |

| KSE30 | 48,330.20 95.67M | -2.92% -1451.54 |

| KMI30 | 224,687.33 101.59M | -2.56% -5909.78 |

| KMIALLSHR | 60,839.09 199.88M | -2.16% -1344.18 |

| BKTi | 45,489.96 23.93M | -2.22% -1033.26 |

| OGTi | 32,083.47 15.22M | -1.82% -594.75 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,400.00 | 71,645.00 67,860.00 | -3130.00 -4.38% |

| BRENT CRUDE | 92.77 | 94.64 83.16 | 7.36 8.62% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -11.85 -10.65% |

| ROTTERDAM COAL MONTHLY | 127.00 | 129.00 123.00 | 3.55 2.88% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 90.95 | 92.61 78.24 | 9.94 12.27% |

| SUGAR #11 WORLD | 14.09 | 14.17 13.69 | 0.37 2.70% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes