GLAXO set to hit Rs610 by June 2026

.png?width=950&height=450&format=Webp)

MG News | September 23, 2025 at 04:19 PM GMT+05:00

September 23, 2025 (MLN): GlaxoSmithKline

Pakistan Limited (PSX: GLAXO) is expected to reach a target price of Rs610 per

share by June 2026, implying a potential upside of 36% from current levels of Rs451

JS Global, in its latest coverage report, has placed a “Buy”

rating on the stock, citing strong earnings momentum, margin expansion, and

attractive valuations as the key drivers.

The brokerage pointed out that GLAXO’s earnings grew 3.6x YoY

over the last four quarters, with future growth expected to be fueled by price

hikes in the non-essential drug segment (around 50% of sales) and easing raw

material costs, particularly Amoxicillin, which has fallen over 40% CYTD.

The report noted that GLAXO has one of the highest net

profit margins in the sector, supported by declining API prices, an improving

product mix, and a debt-free balance sheet with negligible finance costs.

Valuations also remain compelling, with the stock trading at

forward P/E multiples of 13.9x for CY25 and 11.9x for CY26, compared with its

five-year average of 18x and the sector’s 23x trailing P/E.

As the largest multinational pharmaceutical in Pakistan,

GLAXO manufactures around 400 million packs annually, with antibiotics making

up half of its revenues and dermatology contributing around 25%.

Its portfolio includes household brands such as Augmentin,

Calpol, Vates, Amoxil, and Velosef. The parent company, GSK International

Holding and Finance B.V., owns 82.6% of the local subsidiary.

GLAXO has a well-established antibiotics portfolio, which

contributed Rs31.6bn in sales during CY24 (up 19% YoY), accounting for 52% of

the company’s total revenues.

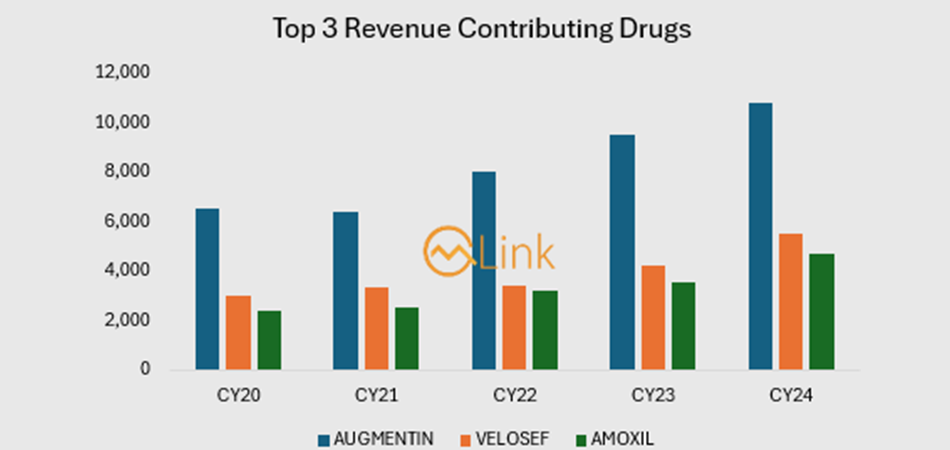

The most significant driver within this portfolio is Augmentin,

which became the first-ever antibiotic in Pakistan’s pharmaceutical market to

surpass Rs11bn in annual sales.

Augmentin remains the market leader in value, volume, and prescriptions in the anti-infectives space. Other key antibiotic brands include Amoxil, commonly prescribed for upper respiratory tract infections, and Velosef, Pakistan’s leading cephalosporin brand.

SOURCE:IQVIA

The segment is expected to recover with projected growth of

2–4% going forward, supported by population growth and rising demand.

JS Global expects GLAXO’s revenues and earnings to grow at a

5-year CAGR of 10% and 24% respectively, with the stock also offering a 4%

dividend yield and an anticipated payout ratio of 50%.

The Rs610 target

price is based on a blended DCF and relative valuation approach, using an 18%

WACC, 8% terminal growth, and historical multiples.

However, the brokerage cautioned on risks such as regulatory

changes in drug pricing, weak volumetric growth, exchange rate depreciation (as

90% of APIs are imported), counterfeit medicines in rural markets, and

inflationary shocks.

A 5% steeper than expected rupee depreciation, for instance,

could trim CY26 EPS by about 2%.

Despite these risks, JS Global maintains that GLAXO’s solid fundamentals, improving margins, and discounted valuations provide a strong case for further upside.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 0.00 0.00 | -175.00 -0.20% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 0.00 0.00 | 0.06 0.10% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes