Fiscal indicators show improvement in FY25: Economic Survey

MG News | June 09, 2025 at 05:35 PM GMT+05:00

June 09, 2025 (MLN): Pakistan’s fiscal consolidation efforts remained on track in FY2025 for a second consecutive year, reinforcing fiscal discipline and reflecting notable improvement in major fiscal indicators, as outlined in the Pakistan Economic Survey 2024–25.

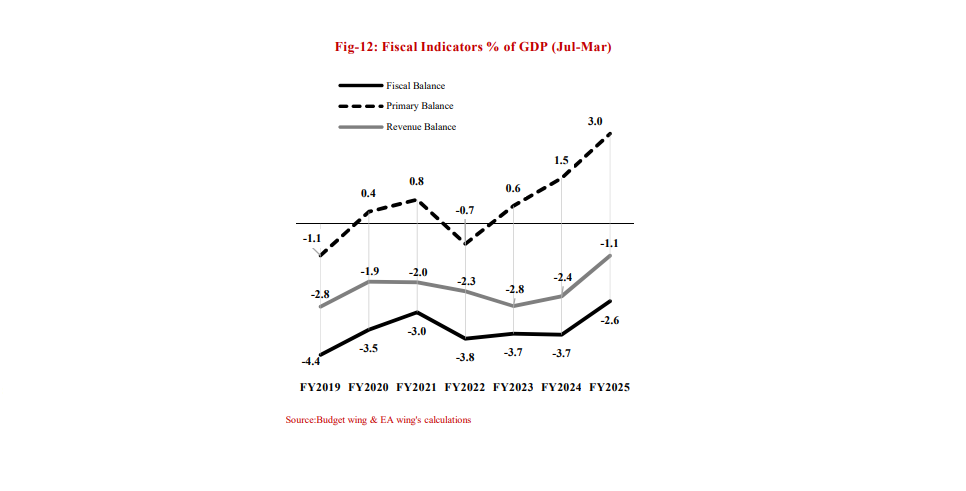

The fiscal deficit narrowed to 2.6% of GDP during July–March FY2025, down from 3.7% in the same period last year.

The primary surplus improved significantly to Rs3.4 trillion (3.0% of GDP) from Rs1.6tr (1.5% of GDP) last year.

The revenue deficit also improved to 1.1% of GDP from 2.4%.

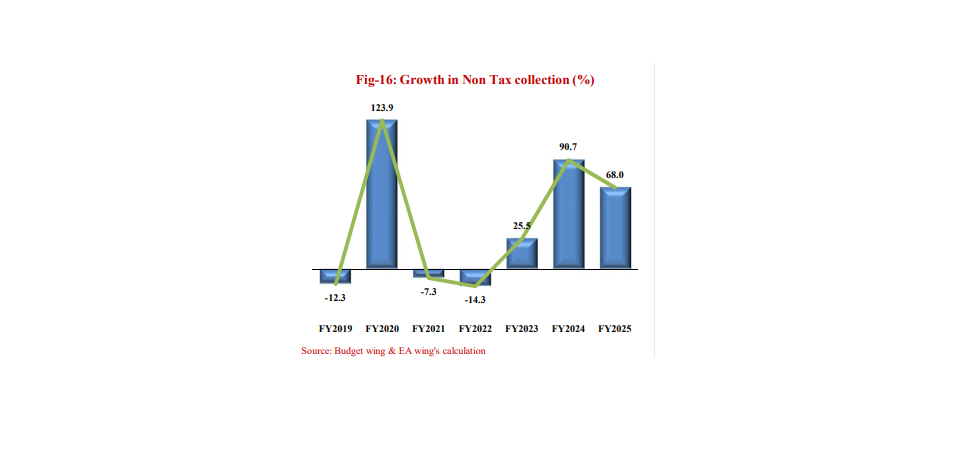

Total revenue grew by 36.7%, reaching Rs13.3tr, with tax revenues increasing by 25.8% to Rs9.1tr and non-tax revenues rising by 68.0% to Rs4.23tr.

Federal tax collection rose by 25.9%, while provincial tax collection increased by 24.2%.

On the expenditure side, total expenditure rose by 19.4% to Rs16.34tr.

Current expenditure increased by 18.3% to Rs14.5tr.

Within this, markup payments grew by 16.7% to Rs6.4tr, while defence spending increased by 16.5% to Rs1.4tr.

Development expenditure and net lending saw a growth of 35.0%, reaching Rs1.5tr.

The federal PSDP, including development grants to provinces, rose by 32.6%.

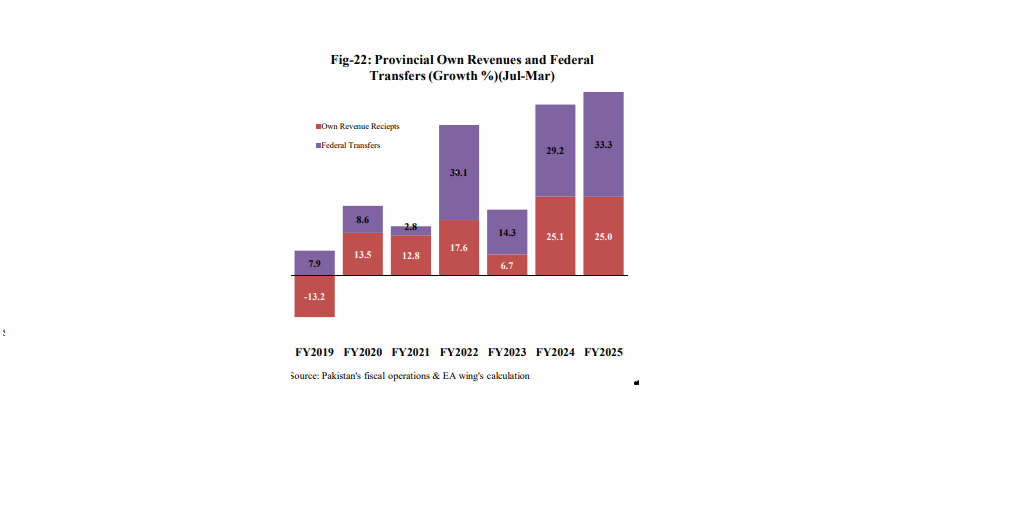

The provinces significantly supported fiscal consolidation, posting a cumulative surplus of Rs1.05tr during July–March FY2025 compared to Rs435.4 billion in the previous year.

Provincial revenues increased by 33.2% to Rs6.39tr, while expenditures grew by 22.3% to Rs5.34tr.

Provincial own source revenues grew by 25%, with tax and non-tax revenues increasing by 24.2% and 27.8%, respectively.

The current fiscal performance, amid a challenging economic environment, indicates effective fiscal management.

The government is continuing comprehensive fiscal reforms in coordination with provinces to enhance revenue mobilization, improve expenditure efficiency, and ensure long-term fiscal sustainability.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 166,258.55 345.39M | -0.85% -1432.54 |

| ALLSHR | 99,756.66 682.04M | -0.84% -849.13 |

| KSE30 | 50,917.87 169.66M | -0.80% -409.75 |

| KMI30 | 232,771.76 122.66M | -0.63% -1483.82 |

| KMIALLSHR | 63,780.68 324.88M | -0.84% -537.69 |

| BKTi | 49,031.15 76.99M | -1.23% -610.02 |

| OGTi | 32,693.73 16.75M | -1.13% -372.59 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile