Pakistan’s debt rises 6.7% by Jul–Mar FY25: Economic Survey

MG News | June 10, 2025 at 11:28 AM GMT+05:00

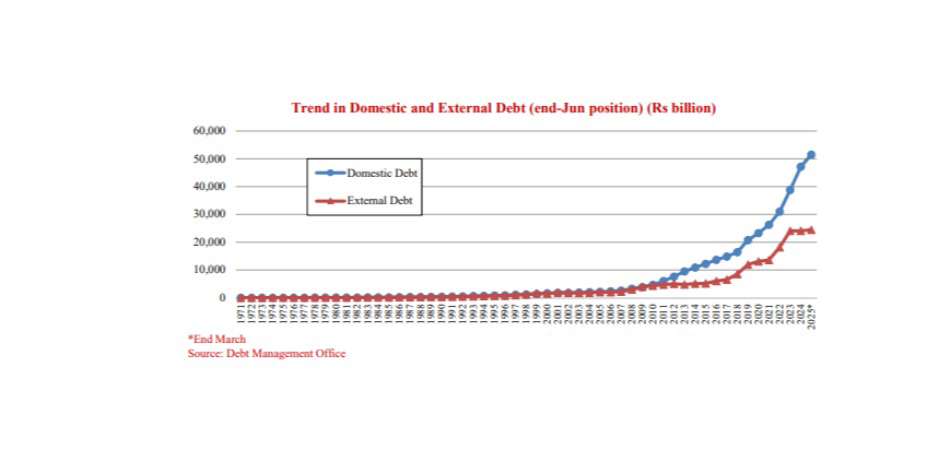

June 10, 2025 (MLN): Pakistan’s total public debt stood at Rs76.01 trillion by the end of March 2025, reflecting a 6.7% growth in the first nine months of FY25, a slower pace compared to the 7.4% increase recorded during the same period last year.

According to the Pakistan Economic Survey 2024–25, domestic debt accounted for Rs51.52tr, while external public debt remained at Rs24.49tr.

The fiscal deficit was financed entirely through domestic borrowing, marking a shift from the previous year when 12% of the deficit was covered by external sources.

The government retired Rs2.4tr worth of Treasury Bills (T-bills), opting for long-term instruments such as Pakistan Investment Bonds (PIBs) and Sukuk to strengthen debt maturity.

The newly introduced 2-year zero-coupon PIB helped raise Rs610 billion, while Shariah-compliant Sukuk issuances generated Rs1.6tr, including a new 10-year Sukuk.

On the external front, budgetary disbursements totaled $5.1bn, with $2.8bn sourced from multilateral partners, $0.3 billion from bilateral development partners, $1.5bn via Naya Pakistan Certificates, and $0.56 billion from commercial banks.

Additionally, Pakistan received $1.03bn from the IMF’s Extended Fund Facility (EFF).

A significant milestone was achieved through Pakistan’s first-ever Buyback and Exchange Programme, which successfully repurchased Rs1tr worth of government debt securities, lowering debt servicing costs.

Public debt as a percentage of GDP saw a decline compared to previous years, reflecting a strategic shift in debt management, with external debt’s share decreasing to 32.2% by March 2025.

The average time to maturity (ATM) of domestic debt improved to 3.5 years, while external debt ATM remained stable at 6.2 years.

Total markup expenditure for the first nine months of FY25 stood at Rs6.44tr, 66% of the full-year budget estimate of Rs9.78tr, demonstrating effective cash flow planning.

Pakistan’s debt servicing discipline, coupled with a shift toward long-term domestic instruments, is gradually easing short-term repayment pressures.

However, persistent exchange rate vulnerabilities and interest rate risks underscore the need for continued fiscal discipline.

The government remains committed to debt sustainability, reinforcing efforts through prudent borrowing, active portfolio management, and diversification of financing sources, ensuring that public debt remains manageable in the medium to long term.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 173,169.71 245.48M | 0.58% 999.42 |

| ALLSHR | 103,952.96 533.68M | 0.46% 476.31 |

| KSE30 | 53,042.90 95.92M | 0.73% 384.11 |

| KMI30 | 242,931.39 83.21M | 1.01% 2420.10 |

| KMIALLSHR | 66,507.09 270.16M | 0.79% 519.06 |

| BKTi | 51,058.55 42.50M | 0.09% 45.65 |

| OGTi | 34,159.98 10.77M | 1.77% 594.51 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,925.00 | 68,450.00 66,565.00 | 720.00 1.07% |

| BRENT CRUDE | 71.68 | 72.34 71.06 | 0.02 0.03% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.45 -1.36% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.31 | 67.03 65.81 | -0.09 -0.14% |

| SUGAR #11 WORLD | 13.86 | 14.02 13.61 | 0.16 1.17% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20251223102454789_a58e54.webp?width=280&height=140&format=Webp)

Roshan Digital Account

Roshan Digital Account