Pakistan’s monetary growth slows in FY25 amid policy easing: Economic Survey

MG News | June 10, 2025 at 10:48 AM GMT+05:00

June 10, 2025 (MLN): Pakistan’s monetary landscape during FY25 shifted toward easing, driven by improved macroeconomic indicators and reduced inflationary pressures.

According to the Economic Survey 2024–25, broad money (M2) expanded by Rs1.6 trillion during July–March FY25, reflecting a 4.5% growth, which was lower compared to 7.2% in the same period last year.

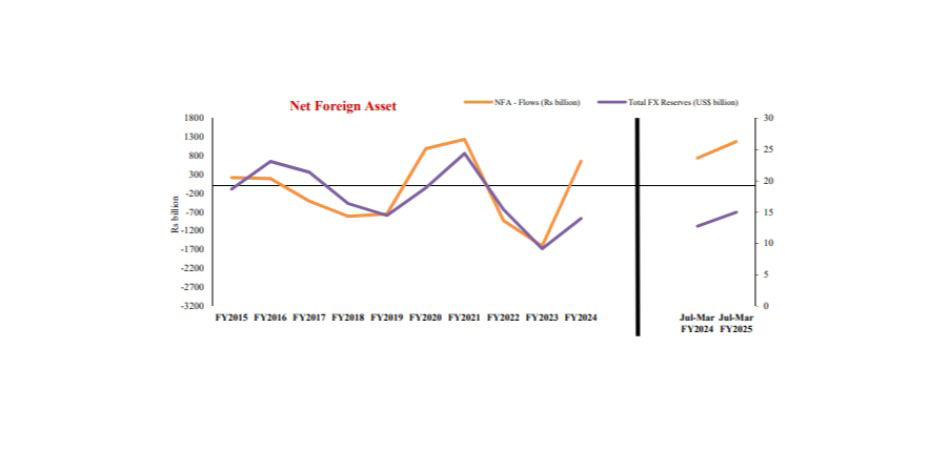

The increase was primarily supported by a sharp rise in Net Foreign Assets (NFA), which grew by Rs1.1tr, attributed to improved balance of payments and higher foreign exchange reserves.

In contrast, Net Domestic Assets (NDA) saw subdued growth of Rs441.4 billion, compared to Rs1.56tr last year, reflecting lower government borrowing.

The State Bank of Pakistan reduced its policy rate by a cumulative 1,100 basis points from June 2024 to May 2025, driven by easing inflation, a stable exchange rate, and improved external and fiscal conditions.

Private sector credit nearly tripled to Rs767.6bn during July–March FY25, up from Rs265.2bn in the previous year, signaling a revival in investment activity.

Within this, loans to businesses surged to Rs830.9bn from Rs307.8bn.

The manufacturing sector remained a key contributor with Rs573.1bn, followed by textiles at Rs255.1bn, and significant increases in construction, accommodation, food services, and information and communication.

Consumer finance also recorded a turnaround, posting a net increase of Rs71.4bn, compared to a net retirement of Rs52.6bn last year.

Auto loans rebounded with an 11.7% growth, personal loans rose by 12.2%, and credit card borrowing grew 15%. However, housing finance continued to decline with a net repayment of Rs4.1bn.

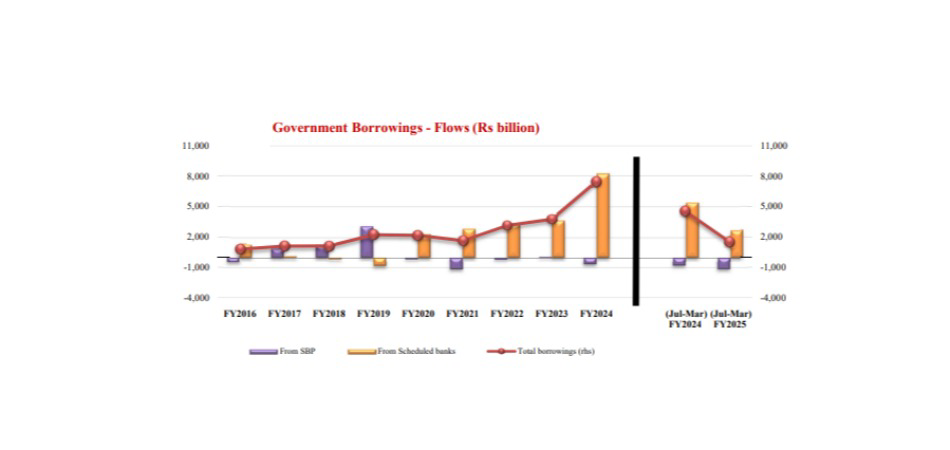

Government borrowing for budgetary support decreased significantly to Rs1.3tr from Rs4.2tr last year.

Borrowing from scheduled banks fell to Rs1.6tr, and there was a net retirement of Rs287.4bn to the SBP.

Commodity financing also showed a net retirement of Rs303.4bn, driven by a policy shift in wheat procurement.

Currency in circulation increased by Rs1.1tr (12.1%), while total deposits grew modestly by Rs490bn (1.8%), raising the currency-to-deposit ratio to 37.8%.

The banking sector showed resilience, with private sector credit growth supported by accommodative policy and improved business outlook.

Lower lending and deposit rates, alongside a narrowing banking spread from 10.4% to 7.4%, contributed to credit expansion and supported the economic recovery during FY25.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 173,169.71 245.48M | 0.58% 999.42 |

| ALLSHR | 103,952.96 533.68M | 0.46% 476.31 |

| KSE30 | 53,042.90 95.92M | 0.73% 384.11 |

| KMI30 | 242,931.39 83.21M | 1.01% 2420.10 |

| KMIALLSHR | 66,507.09 270.16M | 0.79% 519.06 |

| BKTi | 51,058.55 42.50M | 0.09% 45.65 |

| OGTi | 34,159.98 10.77M | 1.77% 594.51 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,925.00 | 68,450.00 66,565.00 | 720.00 1.07% |

| BRENT CRUDE | 71.68 | 72.34 71.06 | 0.02 0.03% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.45 -1.36% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.31 | 67.03 65.81 | -0.09 -0.14% |

| SUGAR #11 WORLD | 13.86 | 14.02 13.61 | 0.16 1.17% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account