Pakistan posts strong external gains in FY25 amid tensions: Economic Survey

MG News | June 09, 2025 at 06:08 PM GMT+05:00

June 09, 2025 (MLN): Despite global trade disruptions and rising geopolitical tensions, Pakistan’s external sector showed marked resilience during July–April FY2025, achieving a historic current account surplus of $1.9 billion, a significant turnaround from a deficit of $1.3bn in the same period last year.

Exports recorded a growth of 6.8%, led by textiles, which maintained a 53% share in total exports.

Imports rose by 11.8%, but prudent management kept the overall trade deficit in check.

Remittances played a pivotal role in strengthening the external position, reaching $31.2bn, with a record monthly inflow of $4.1bn in March 2025.

This marked a 30.9% year-on-year growth, driven by robust labor markets and improved formal remittance channels.

Foreign exchange reserves stood at $16.64bn as of May 27, 2025 $11.5bn held by SBP and $5.14bn with commercial banks.

The average exchange rate for July–April FY2025 was Rs278.72 per US dollar.

The financial account showed a net outflow of $1.6bn, reflecting higher debt repayments and reduced external borrowing.

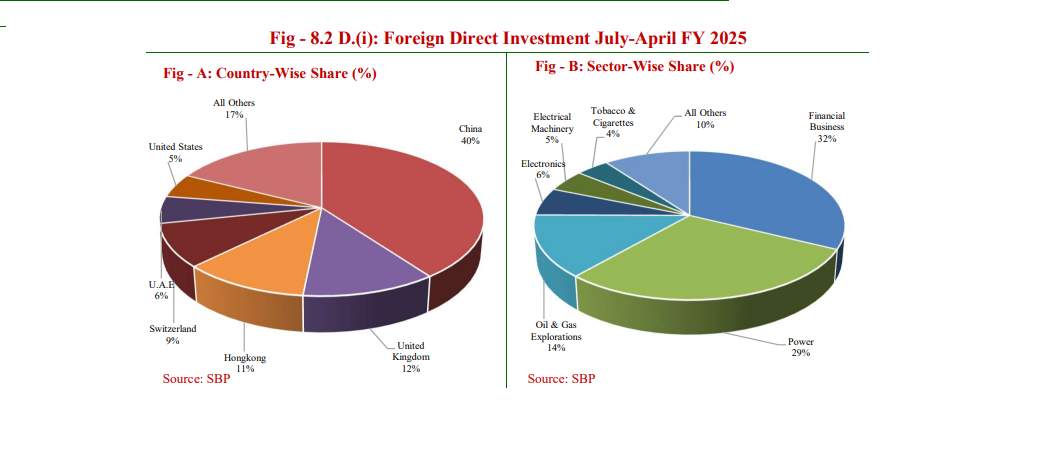

FDI stood at $1.8bn, with major contributions from China, Hong Kong, and the UK, concentrated in energy and financial sectors.

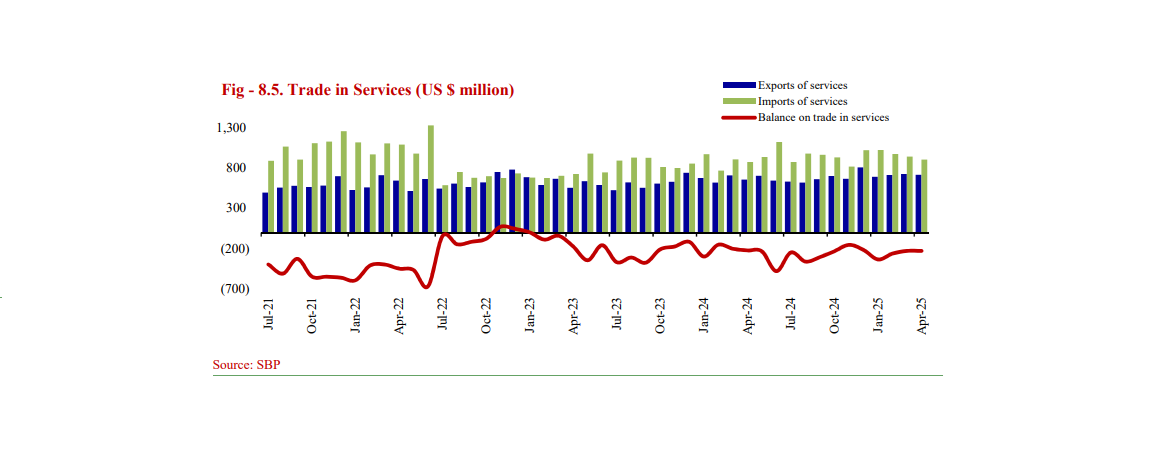

The trade deficit in services widened to $2.5bn, as service imports outpaced exports.

Exports of services grew by 9.3% to $6.9bn, while imports rose to $9.4bn.

The primary income account posted a deficit of $7.1bn, up by $803 million over the previous year, largely due to outflows on investment income.

Despite a $1.6bn net outflow in the financial account, exchange rate stability, IMF support, and growing remittances underpinned a positive balance of payments outlook, reinforcing macroeconomic confidence.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 173,169.71 245.48M | 0.58% 999.42 |

| ALLSHR | 103,952.96 533.68M | 0.46% 476.31 |

| KSE30 | 53,042.90 95.92M | 0.73% 384.11 |

| KMI30 | 242,931.39 83.21M | 1.01% 2420.10 |

| KMIALLSHR | 66,507.09 270.16M | 0.79% 519.06 |

| BKTi | 51,058.55 42.50M | 0.09% 45.65 |

| OGTi | 34,159.98 10.77M | 1.77% 594.51 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,925.00 | 68,450.00 66,565.00 | 720.00 1.07% |

| BRENT CRUDE | 71.68 | 72.34 71.06 | 0.02 0.03% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.45 -1.36% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.31 | 67.03 65.81 | -0.09 -0.14% |

| SUGAR #11 WORLD | 13.86 | 14.02 13.61 | 0.16 1.17% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account