Weekly Market Roundup

Abdur Rahman | May 24, 2024 at 07:17 PM GMT+05:00

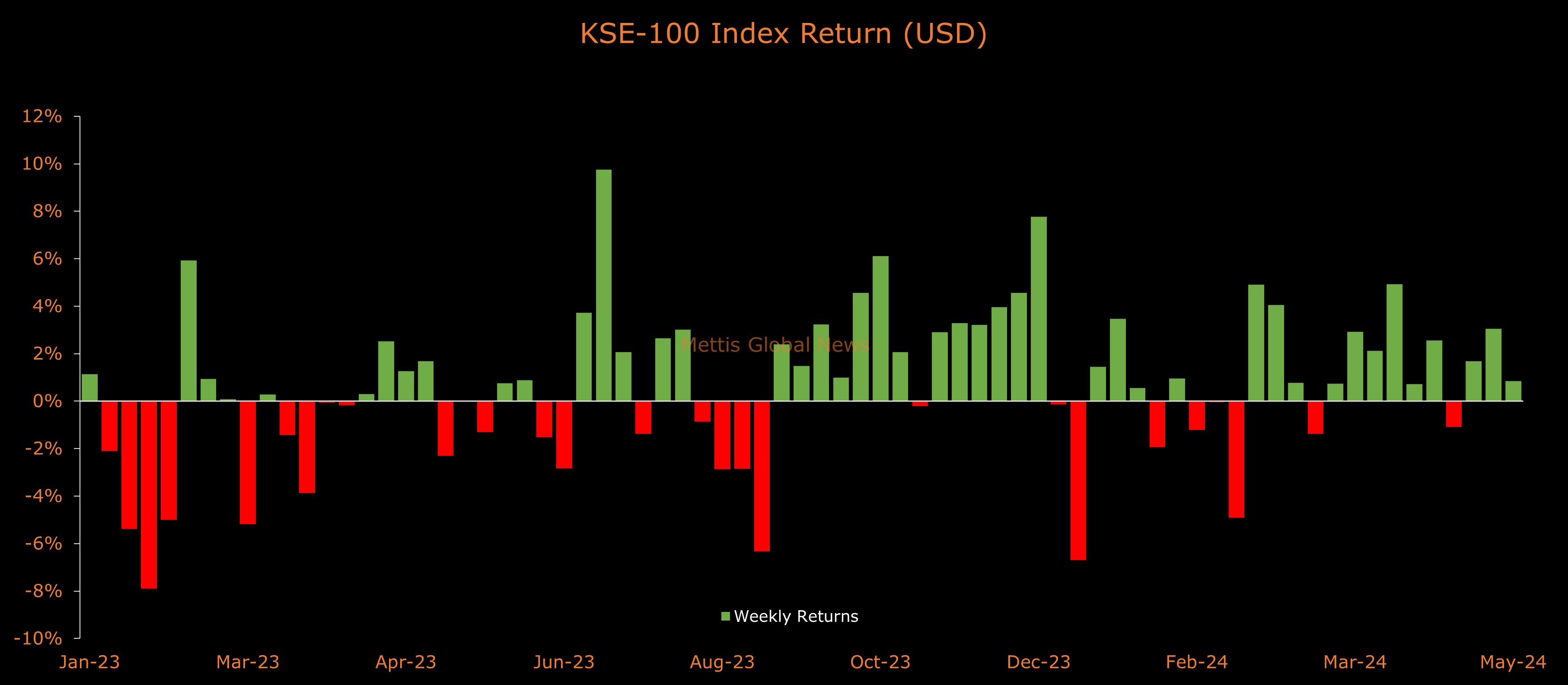

May 24, 2024 (MLN): The benchmark KSE-100 index closed this week at another record high of 75,983, a gain of 641 points or 0.9%.

The 100-index also gained 0.9% in USD terms as PKR remained stable this week.

Throughout the week, KSE-100 traded in a range of 1,523 points, between a high of 76,249 (+906) and a low of 74,726 (-616) points.

PSX average traded volume was recorded at 558.19 million shares worth Rs18.04 billion, marking an increase of 0.7% WoW in the number of shares while a fall of 17.7% WoW in traded value.

The marginal increase in numbers of shares traded was largely on the back of K-Electric Limited (PSX: KEL).

In a recent development, National Electric Power Regulatory Authority (NEPRA) approved KEL’s Power Acquisition Program (PAP) for the period FY 2024 to 2028.

The key objective of KEL’s PAP is to develop a long-term capacity expansion plan to meet the energy demand in a reliable, sustainable, and cost-effective manner as the Supplier of Last Resort (SoLR) for its licensed service territory.

Meanwhile, the PSX market capitalization increased by $411.82m or 1.1% to $36.84bn over the week. In PKR terms, market capitalization stood at Rs10.25 trillion.

Key Developments

The positivity comes as investors cheered developments on the International Monetary Fund (IMF) and United Arab Emirates (UAE) front.

Pakistani authorities and IMF have made significant progress toward reaching a Staff Level Agreement (SLA) on a comprehensive economic policy and reform program that can be supported under an Extended Fund Facility (EFF).

The IMF said it will continue policy discussions over the coming days aiming to finalize discussions.

Moreover, the UAE president on Thursday pledged to allocate $10 billion for investment in promising economic sectors in Pakistan.

On the economic front, the National Accounts Committee (NAC) approved provisional growth of gross domestic product (GDP) at 2.38% for the ongoing fiscal year 2023-24 against the budgetary projection of 3.5%.

Meanwhile, in Q3 FY24, Pakistan’s GDP showed a growth of 2.09% as compared to the revised growth of 1.79% in the previous quarter.

The SPI-based inflation fell for the sixth consecutive week. Accordingly, CPI inflation for May is expected to fall to below 14% YoY, pushing real interest rates above 8%.

The government conducted two auctions during the week, picking up Rs97bn through PIBs, and Rs117bn through GIS auction.

The cut-off yields for the PIBs edged lower for the 3-year, 5-year, and 10-year tenures.

Top Index Movers

Sector-wise, top positive contributors were Commercial Banks (419pts), Power Generation & Distribution (313pts), Technology & Communication (142pts), Leather & Tanneries (54pts), and Fertilizer (41pts).

Contrary to that, negative contributions came from Cement (111pts), Inv. Banks / Inv. Cos. / Securities Cos. (89pts), Automobile Parts & Accessories, (46pts), Pharmaceuticals (30pts), and Oil & Gas Marketing Companies (27pts).

The best-performing stocks during the week were MEBL (251pts), SYS (153pts), PKGP (127pts), UBL (121pts), and HUBC (91pts).

Whereas, ENGRO, DAWH, MCB, THALL, and POL collectively took away 364 points from the index.

FIPI/LIPI

Foreign investors turned to net sellers after a 15-week long streak, dumping $12.08m worth of equities.

Flow-wise, Banks / Dfi were the dominant buyers, with a net investment of $10.44m.

They allocated the majority of their capital, $16.55m, to Debt Market, while divesting from the Commercial Banks sector, amounting to $6.57m in sales.

On the other hand, the leading sellers were Foreign Corporates, with a net sale of $10.65m.

Their most substantial sales activity was in Debt Market, amounting to $16.55m, while they acquired $2.98m of equities in the Commercial Banks.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|