August 24, 2023 (MLN): Amidst the increasing circular debt burden in the gas sector worth Rs1.6 trillion, the concept of Weighted Average Cost of Gas (WACOG) emerges as a glimmer of hope.

The government has shared a plan with the International Monetary Fund (IMF) which involves injecting Rs414 billion as grants into Sui Northern and Sui Southern gas companies with which they would clear outstanding liabilities to OGDCL, PPL, and GHPL, the gas producers.

In response, these gas-producing companies would give Rs475bn in dividends to the government which would help reduce the sector’s debt burden by approximately Rs543bn.

The depletion of gas reserves has resulted in the gas supply being reduced to 3,257mmcfd as compared to 3,936mmcfd in FY19.

However, demand for the commodity is in a growing phase creating a significant gap between consumption and supply.

In order to meet the rising demand, the government imports RLNG which creates a massive burden as it increases foreign exchange payments.

In addition to the import burden, there is a massive difference in the price of RLNG and system gas of around $9MMBtu.

To address this significant difference, the IMF has demanded the introduction of a uniform pricing structure based on the blended cost of RLNG and indigenous gas.

What is WACOG?

WACOG is computed while considering various factors such as the cost of purchasing and transporting natural gas from different sources or suppliers.

It is worth mentioning that the Senate passed the WACOG bill in March 2022, but its implementation has remained pending ever since.

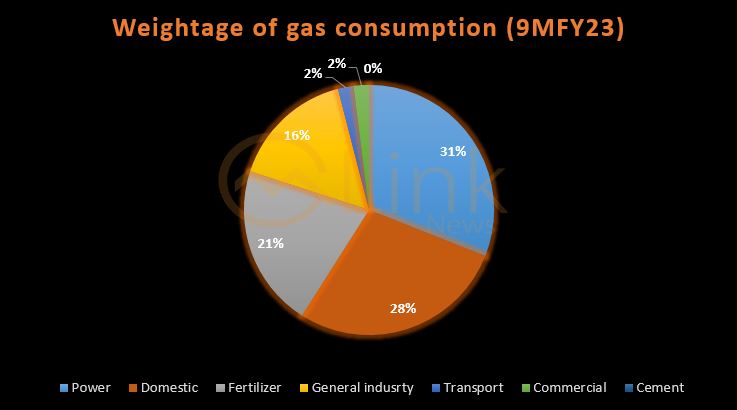

Implementation of the methodology comes as a challenge because of the large consumer base in different sectors which include; Power, Domestic, Fertilizer, General Industry, Transport (CNG), Commercial, and Cement.

In 9MFY23, the power sector remained the dominant consumer, accounting for 31%, followed by domestic consumers at 28%. The fertilizer sector, on the other hand, consumed approximately 31% of the total gas.

The general industry consumed 16% of the gas, while the transport and commercial sectors each held 2% of the total gas consumption.

Effective implementation of WACOG will benefit various sectors as it will reduce the flow of gas circular debt and lay out proper mechanisms to collect RLNG receivables.

Implementation of this price mechanism by the fertilizer sector might result in higher gas tariffs, which will be passed on by urea manufacturers.

After the gas price unification, players with efficient production facilities are poised to gain a competitive edge after the gas price unification.

Moreover, it will help improve the margins of the Construction and Allied Industries since RLNG is currently charged at OGRA-notified rates.

Textile and chemical players in the north are highly dependent on RLNG. However, due to substantial price differences between the northern and southern regions, they face increased costs. The implementation of WACOG will help reduce these costs and improve earnings.

Copyright Mettis Link News

Posted on: 2023-08-24T11:05:56+05:00