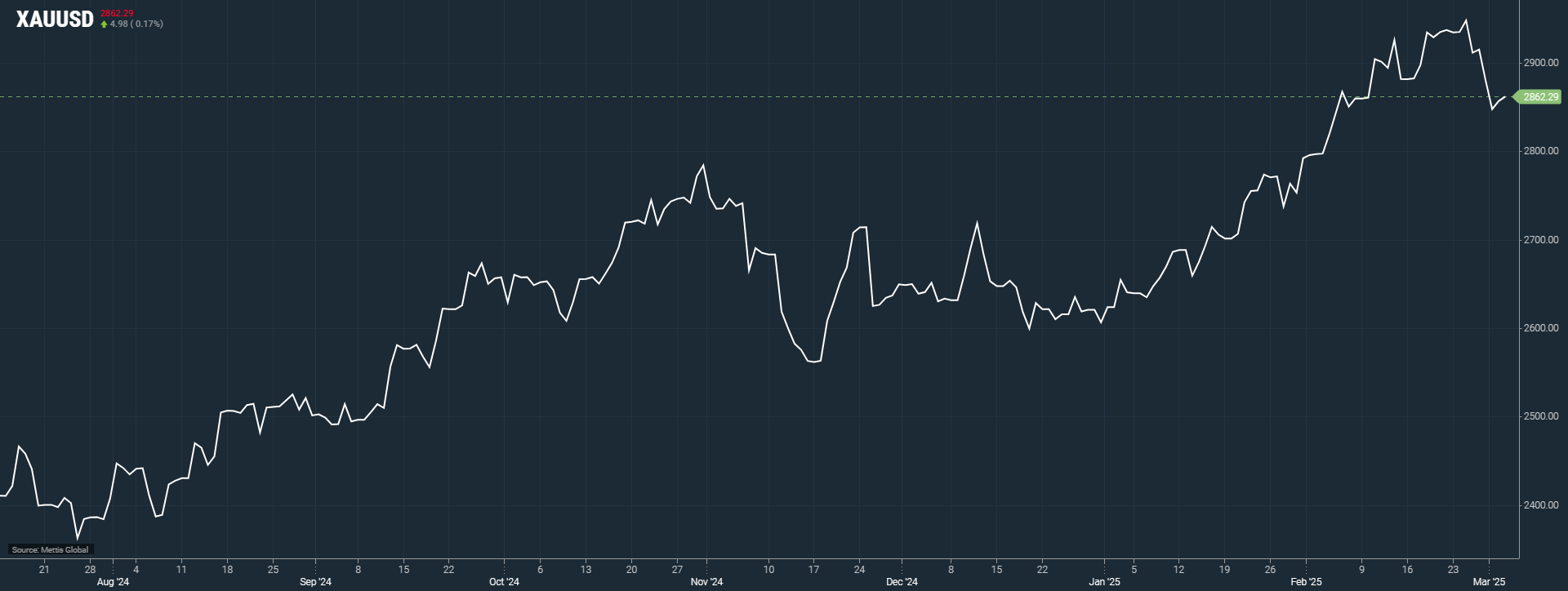

Spot gold prices climb amid weaker dollar, geopolitical tensions

By MG News | March 03, 2025 at 12:21 PM GMT+05:00

March 03, 2025 (MLN): Gold prices rose on Monday, helped by a weaker dollar, while a delay in finding peace in Ukraine and concerns over the U.S. tariff policy fuelled safe-haven demand for the metal.

Spot gold climbed 0.17% to $2,862.29 an ounce by [12:16 pm]. U.S. gold futures rose 1.1% to $2,880.5.

The dollar index fell 0.4% from a more than two-week high hit in the previous session, making bullion less expensive for other currency holders.

"Today's early Asian bullish tone in gold is likely to be driven by geopolitical risk factors due to the pushback of the anticipated peace deal between Ukraine and Russia," said Kelvin Wong, senior market analyst, Asia Pacific, at OANDA.

Ukrainian President Volodymyr Zelenskiy's meeting with U.S. President Donald Trump ended in disaster on Friday, adding uncertainty to financial markets already jittery due to weakening economic data and volatility around U.S. trade policies.

U.S. Commerce Secretary Howard Lutnick said on Sunday that tariffs on Canada and Mexico would come into effect on Tuesday, but Trump would determine whether to stick with the planned 25% level.

Trump said he would add another 10% tariff on Chinese goods on Tuesday, effectively doubling 10% duties imposed on February 4, according to Reuters.

Data released on Friday showed that U.S. consumer spending unexpectedly fell in January, but a pickup in inflation could provide cover for the Federal Reserve to delay cutting interest rates for some time.

Although bullion is considered a hedge against geopolitical uncertainty, it loses its allure in a high interest rate environment.

Among other metals, spot platinum shed 0.2% to $945.45 an ounce and palladium added 1% to $928.54.

Demand for industrial precious metals platinum and palladium will likely fall if tariffs proposed by the Trump administration on U.S. auto imports dampen vehicle sales, analysts said.

Spot silver was up 0.5% at $31.30, Reuters further added.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI