SBP Governor links 16% import surge to economic growth

Nilam Bano | January 28, 2025 at 08:40 AM GMT+05:00

January 28, 2025 (MLN): Pakistan's imports have shown a natural uptick mainly due to increasing economic activity, removal of restrictions, and absence of any undue pressure, State Bank of Pakistan (SBP) Governor Jameel Ahmed said during the post-MPC analyst briefing today.

Note that imports in December 2024 soared by 16.38% to $5.39 billion compared to $4.63bn in the previous month.

While appreciating this uptick in imports, he said that the central bank has not placed any undue pressure or barriers on trade activities rather the absence of restrictions has enabled smoother trade flows.

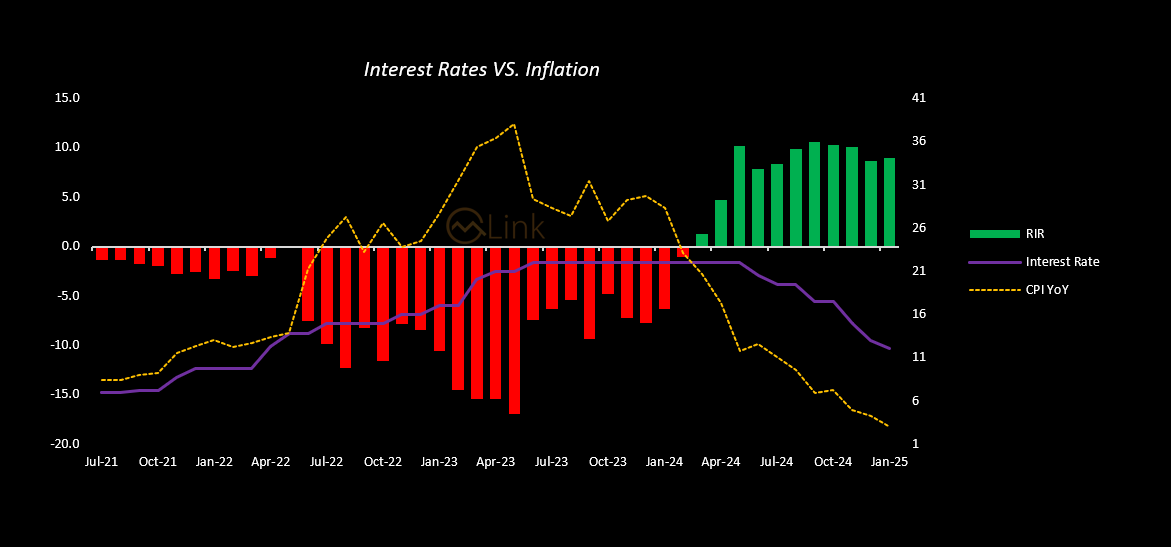

The Governor also noted that successive policy adjustments, including a 10% reduction in interest rates since June 2024, have nurtured stability in key economic indicators, such as external inflows and the currency market.

Disclosing broader economic projections, Jameel Ahmed revealed a GDP growth target of 2.5-3.5% for FY25 and revised inflation forecasts downward to 5.5-7.5%, compared to the earlier range of 11.5-13.5%.

"The external outlook has been revised due to increasing inflows, and we are confident in achieving our medium-term targets," he added.

The Governor elaborated on upcoming inflows from commercial banks and multilateral institutions, which will aid in bolstering foreign reserves, expected to stay above $13bn by June 2025.

The total debt repayment requirement for FY25 stood at $26.1bn. Of this, $16bn is expected to be rolled over.

From the remaining $10.1bn, $6.4bn has already been settled, with $3.7bn slated for repayment in the remaining months of the fiscal year.

With regards to remittances, he stated that with Eid and Hajj seasons ahead, remittances are also anticipated to rise which will further provide support to the external sector.

Reiterating its commitment to achieving the medium-term target as agreed with the International Monetary Fund (IMF), SBP reaffirmed its cautious stance on inflation management.

The headline inflation for FY25 is expected to average between 5.5% and 7.5%. However, this outlook is subject to several risks, including volatility in global commodity prices and protectionist policies in major economies, which could disrupt trade dynamics.

Additionally, the timing and magnitude of administered energy tariff adjustments, fluctuations in perishable food prices, and any additional revenue-generating measures could further impact the inflation trajectory, adding to economic uncertainty.

The next policy review is due in March, where updates on fiscal and monetary adjustments are expected.

In response to a query regarding the new currency notes, Ahmed stated that work is in full swing, with printing expected to commence in the next fiscal year subject to cabinet approval.

To note, the Monetary Policy Committee (MPC) of the SBP has reduced the policy rate by 100 basis points to 12%, effective January 28, 2024, in line with market expectations.

The reduction was the sixth in a row, bringing the total decrease since June 2024 to 1,000bps as a slowdown in inflation gives policymakers room to continue monetary easing to spur growth.

The reduction in policy rate is mainly attributed to the significant decline in inflation which has dropped to 4.1% in December 2024—the lowest since May 2023 where it stood at 38%.

The SBP Chief attributed the policy rate reduction to an improved economic outlook. On the external front, Pakistan recorded a current account surplus of $582m in December 2024, taking the 6MFY25 surplus to $1.21bn.

The Committee noted the following key developments since its last meeting.

- First, real GDP growth in Q1-FY25 turned out slightly lower than the MPC’s earlier expectations.

- Second, the current account remained in surplus in December 2024, though the SBP’s FX reserves declined amidst low financial inflows and high debt repayments.

- Third, despite a substantial increase in December, tax revenues remained below target in H1-FY25.

- Fourth, global oil prices have exhibited heightened volatility over the past few weeks.

- And lastly, the global economic policy environment has become more uncertain, prompting central banks to adopt a cautious approach.

Considering these developments and evolving risks, the Committee viewed that a cautious monetary policy stance is needed to ensure price stability, which is essential for sustainable economic growth.

In this regard, the MPC assessed that the real policy rate needs to remain adequately positive on a forward-looking basis to stabilize inflation in the target range.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 164,626.29 351.26M | -0.98% -1632.25 |

| ALLSHR | 98,999.23 613.73M | -0.76% -757.44 |

| KSE30 | 50,342.54 122.55M | -1.13% -575.33 |

| KMI30 | 229,014.43 138.56M | -1.61% -3757.33 |

| KMIALLSHR | 63,057.91 362.66M | -1.13% -722.77 |

| BKTi | 49,028.54 65.39M | -0.01% -2.61 |

| OGTi | 32,109.94 7.71M | -1.79% -583.79 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20251230120446451_06c077.png?width=280&height=140&format=Webp)

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile