MPS Preview: SBP to reduce policy rate by 100bps

Nilam Bano | January 27, 2025 at 01:22 PM GMT+05:00

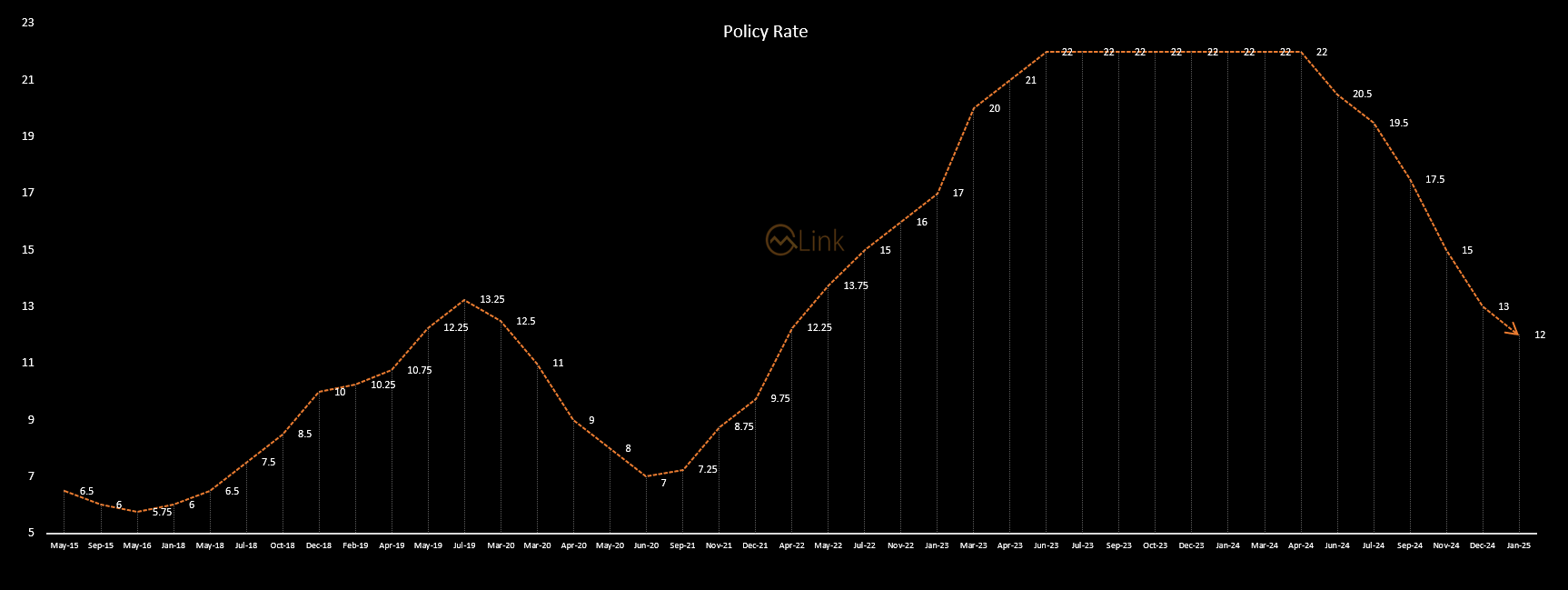

January 27, 2025 (MLN): Continuing its streak of monetary easing, the Monetary Policy Committee of the State Bank of Pakistan (SBP) is expected to lower the policy rate by another 100 basis points to 12% in today's meeting, marking the sixth consecutive reduction.

This would bring the total rate cuts to 1,000bps since June 2024, bringing the policy rate down to 12%- closer to a level last seen in December 2022, when it was 9.75%.

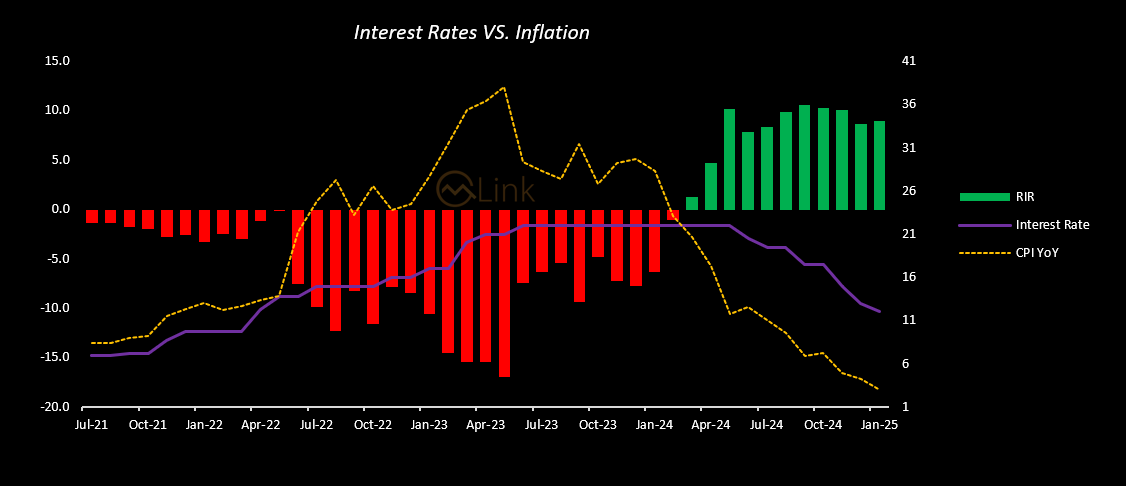

The reduction in policy rate is mainly attributed to the significant decline in inflation which has dropped to 4.1% in December 2024—the lowest since May 2023 where it stood at 38%.

On the external front, Pakistan recorded a current account surplus of $582 million in December 2024, taking the 6MFY25 surplus to $1.21 billion.

Meanwhile, workers' remittances increased by 29.3% in December to $3.08bn. In 6MFY25, the total remittances stood at $17.84bn, providing much-needed support to the external sector.

Since, the large-scale manufacturing (LSM) sector of Pakistan recorded a decline of 3.8% in November 2024 compared to last year, the expected interest rate cut will likely to provide relief to businesses by lowering borrowing costs, potentially boosting investment and consumer spending.

Additionally, the SBP’s reserves climbed to $11.45bn in January 2025, up from $9.4bn in June 2024.

Not to forget, the country’s foreign exchange reserves got stimulation on the back of IMF’s first tranche of $1bn under the 37-month Extended Fund Facility (EFF) received during the first seven months of FY25.

Moreover, in a much-needed boost to the country's financial stability, Pakistan managed to secure a $1bn loan from two Middle Eastern banks.

Last time, the MPC reduced the policy rate by 200 basis points to 13% which took the real interest rate to 8.7% which is still providing the room to SBP for further reduction.

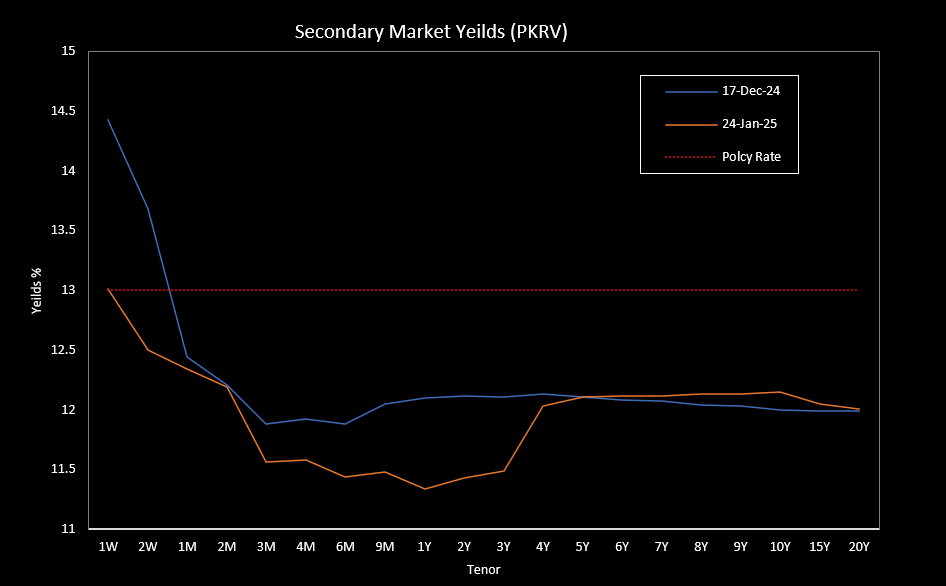

Money Market Yields

Since the last monetary policy meeting, the secondary market has seen a decrease in yields across 6M, 1Y, 2Y and 3Y by 44bps, 76bps, 69bps and 62bps, respectively.

However, yields for the longer-term bonds have increased, with the 9-year 10bps, 10-year 15bps, and 15-year 6bps.

Market Treasury bills (MTBs) yields in the primary market have also witnessed a fall across all tenors.

Since the last MPC meeting, T-bill yields have fallen to 11.5887% (-41bps) for 3 months, 11.4048% (-59bps) for 6 months, and 11.3898% (-91bps) for 12 months.

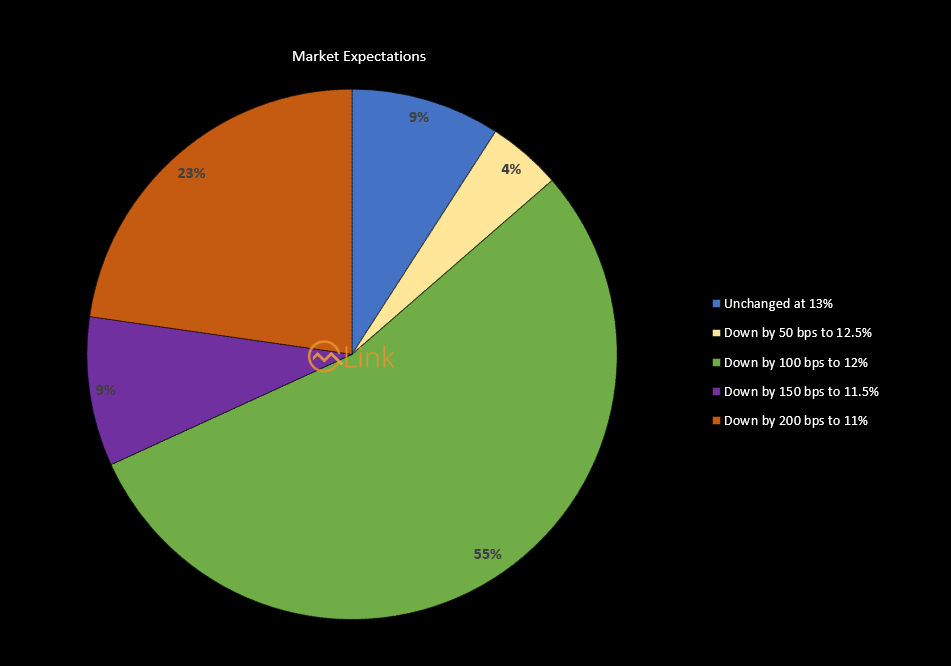

Survey Result

To estimate market expectations for the upcoming monetary policy meeting scheduled for today, Mettis Global surveyed various sectors.

Our survey reveals a strong expectation for a rate cut in the upcoming monetary policy statement.

A majority, 55% of respondents, expect a 100bps reduction, while 23% foresee a more significant 200bps cut. Additionally, 9% predict a 150bps reduction, 4% expect a smaller 50bps cut, and 9% believe the policy rate will remain unchanged at 13%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves