MLCF on firm footing to Rs193

%20(1)_20251204094045711_daef16%20(1)_20251216120107641_a52b61.webp?width=950&height=450&format=Webp)

MG News | December 16, 2025 at 05:08 PM GMT+05:00

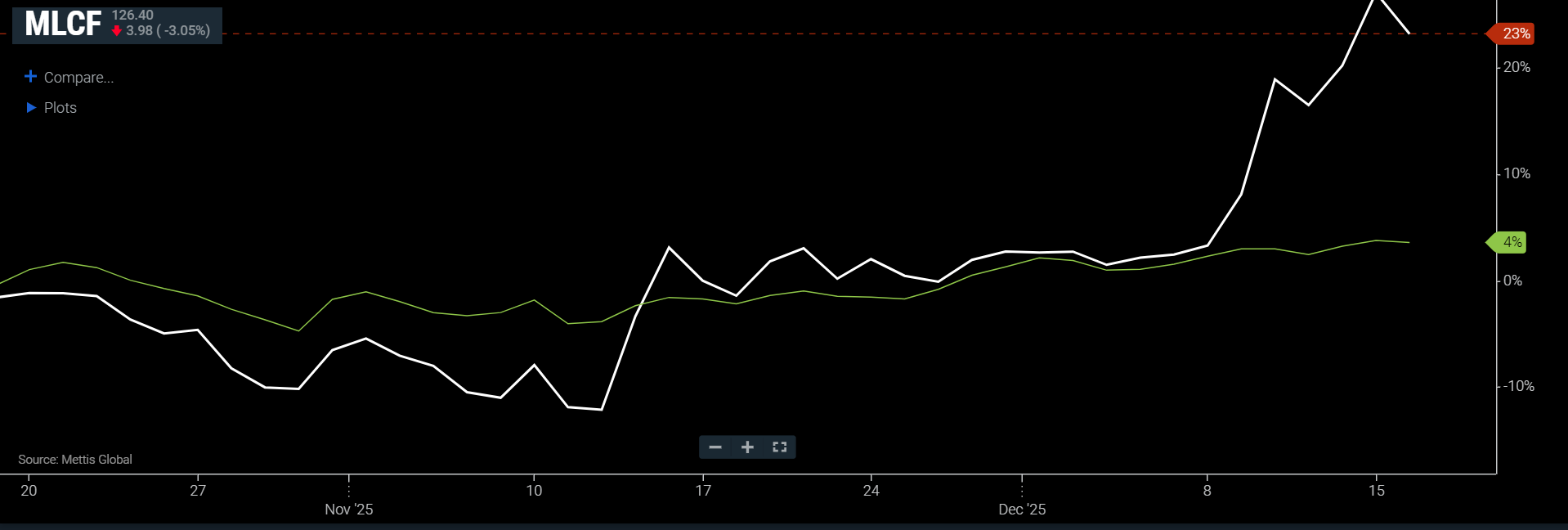

December 16, 2025 (MLN): Maple Leaf Cement Factory Limited’s (PSX: MLCF)

share price is projected to reach Rs193.4 by June 2026, a potential upside of

around 53%, from current level of Rs126.

The projection reflects the expected consolidated

performance of the combined entity, which is anticipated to benefit from scale

efficiencies, stronger regional positioning, and enhanced long-term value

creation,

Spectrum Securities Limited has initiated coverage on Maple

Leaf Cement Factory Limited with a BUY recommendation, a strong

fundamental and an attractive post-merger outlook.

The brokerage expects the combined entity to increase its

market share to around 20% in the northern region, supported by the strategic

proximity of MLCF’s and Pioneer Cement’s plants within a 120-kilometer radius

and the acquisition being executed at a compelling valuation.

Spectrum Securities highlights MLCF’s consistent historical

performance, underlined by a five-year revenue CAGR of 21% and net income CAGR

of 36%, driven by disciplined pricing, operating leverage, and effective cost

management.

Looking ahead, earnings are expected to maintain an upward

trajectory, with growth of 11% in FY26E and 29% in FY27F, supported by a

recovery in domestic cement demand, pricing resilience aided by the white

cement portfolio, rising dividend and other income due to strong cash

generation, and easing finance costs amid expected monetary relaxation.

From FY28 onwards, earnings growth is expected to accelerate

further with the operationalization of the NOVA Care Hospital project by

end-2026.

With approximately 70–80% of civil works already completed,

the project is expected to begin contributing recurring cash flows from FY28,

enhancing earnings diversification and improving cash flow stability.

The brokerage also anticipates a strengthening balance

sheet, with book value per share projected to rise to Rs93 in FY26E from Rs66

in FY25A.

This increase is largely driven by unrealized gains

recognized through other comprehensive income, which enhance shareholders’

equity and provide incremental valuation support.

Operationally, EBITDA per ton is forecast at Rs2,863 in

FY26, supported by higher capacity utilization, an efficient energy mix, and

sustained cost discipline, while assets per share are expected to reach Rs138, a continued balance sheet accretion.

The brokerage further notes that operational efficiencies,

particularly in energy optimization and power cost management, are likely to

support margins.

The company’s high utilization of pet-coke and alternative

fuels, alongside coal-fired power, waste heat recovery, and solar generation,

is expected to keep energy and power costs competitive.

On the acquisition front, Spectrum values the Pioneer Cement

transaction at around US$69–70 per ton, below estimated replacement cost, with

the deal assumed to be financed through a 60:40 debt-to-equity mix.

While higher leverage may temporarily weigh on near-term profitability due to increased finance costs, Tabish Abbas, Research Analyst at Spectrum Securities Limited believes these pressures are manageable and likely to be offset over time by operational and logistical synergies, improved capacity utilization, and lower fixed costs.

Key risks to the outlook include execution timelines, financing structure, and the pace at which post-acquisition efficiencies are realized.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 172,342.86 176.39M | -3.64% -6510.24 |

| ALLSHR | 103,665.66 433.77M | -3.42% -3670.20 |

| KSE30 | 52,679.03 82.49M | -3.65% -1997.67 |

| KMI30 | 240,780.64 55.10M | -3.93% -9840.30 |

| KMIALLSHR | 66,117.58 183.18M | -3.69% -2529.72 |

| BKTi | 50,976.18 42.50M | -3.41% -1796.92 |

| OGTi | 33,648.65 9.28M | -3.95% -1383.77 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,300.00 | 67,400.00 66,300.00 | 970.00 1.46% |

| BRENT CRUDE | 70.91 | 70.92 70.19 | 0.56 0.80% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.00 -3.03% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.75 -1.63% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 65.61 | 65.62 64.77 | 0.56 0.86% |

| SUGAR #11 WORLD | 13.77 | 13.78 13.47 | 0.29 2.15% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

%20(1)_20251204094045711_daef16%20(1)_20251216120107641_a52b61.webp?width=280&height=140&format=Webp)

Roshan Digital Account

Roshan Digital Account