PSX set to extend bullish run due to low multiples, rate cuts

By MG News | April 15, 2024 at 01:19 PM GMT+05:00

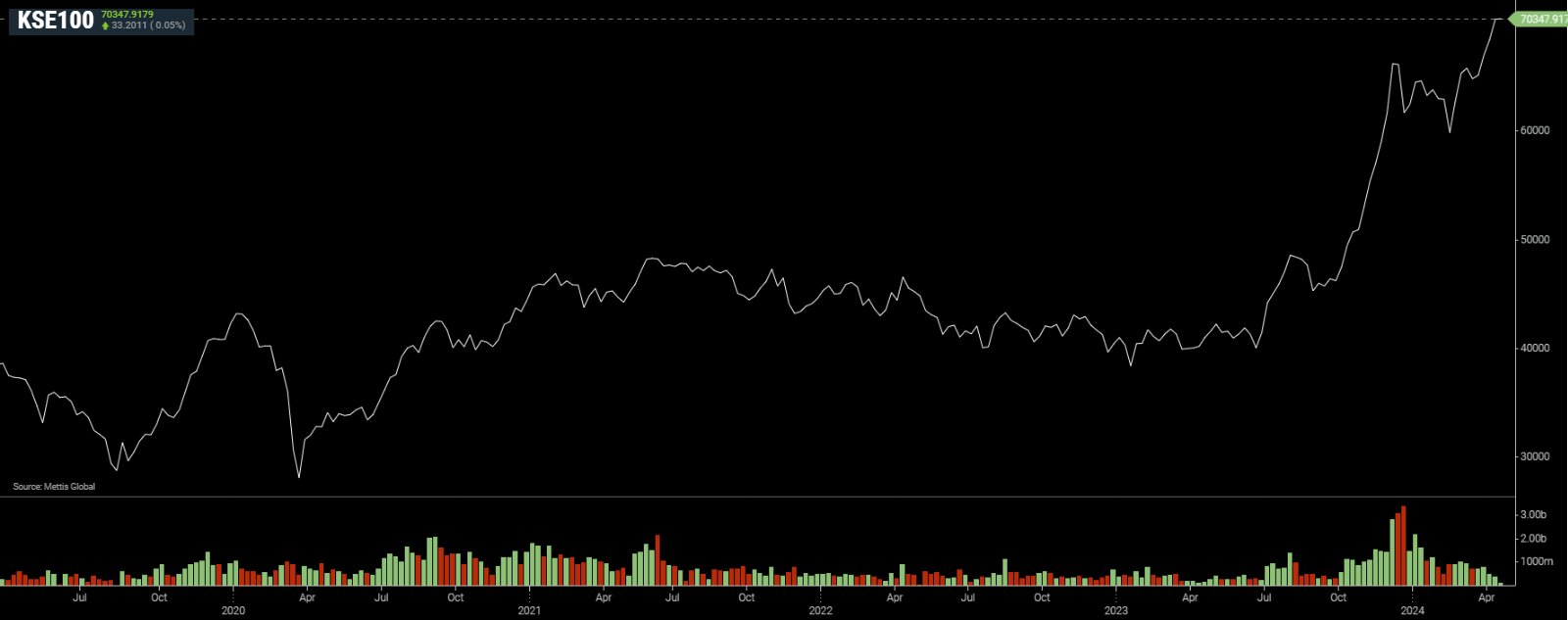

April 15, 2024 (MLN): The Pakistan Stock Exchange (PSX) is poised to sustain its bullish rally, potentially reaching new record levels due to the current low multiples and valuations, alongside anticipated drop in interest rate.

This insight was highlighted by CEO of JS Global, Imtiaz Gadar, and MD of PSX, Farrukh Khan during an interview with a private news channel discussing the outlook on the domestic equity exchange.

During the interview, the primary question revolved around the sustainability of the renewed investor confidence and how it has evolved in comparison to the preceding four years.

Answering to this, Farrukh Khan stated that the significant steps taken by the newly established government in terms of State Owned Enterprises (SOEs), especially the privatization of Pakistan International Airlines is encouraging investors and strengthening their mindset for a potential solution to the country’s structural problems.

He further highlighted the positive developments with Saudi Arabia and China, through which the nation will attract a substantial sum of foreign investment that would further uplift the country’s stock market.

However, he emphasized the significant role that the government would need to play in addressing structural and economic issues, which remain major concerns for investors and continue to constrain them.

While analyzing the performance of the KSE-100 index, the interviewer raised concerns that this rally is largely driven by the commercial banks, which are posting record profits due to high interest rates, while the key economic driving sectors are showing limited positivity.

In response, Imtiaz Gadar, CEO of JS Global, highlighted that beyond banks, the fertilizer sector also demonstrated a stellar performance despite strict measures introduced by the government, citing increase in gas tariffs.

He further added that the cement sector has also shown improvement in recent times, as the market anticipates and readies itself for a decrease in interest rates.

Highlighting a crucial point regarding the upward momentum, Farrukh Khan gave his remarks that the market was already on low levels based on valuation multiples, and it continues to remain lower, indicating potential for further growth.

Regarding textile sector, MD of PSX said that the slowdown is not only limited to the local environment, but also in foreign countries, despite of which they are still holding their position strong.

The KSE-100 index has surged 70% since the Staff Level Agreement (SLA) with the International Monetary Fund (IMF) in June, placing it among one of the best performing markets in the world, despite peak interest rates which prompted investors to fixed income instruments.

Earlier this period, the market was filled with doubts over default, which plunged the market to all-time lows. Therefore, this rally reflects a recovery from that mindset, with a major boom anticipated soon as the central bank transits toward monetary easing, according to Imtiaz Gadar.

Going forward, the transition to a shorter settlement cycle (T+1) expected by May will boost volumes further as it would increase efficiency, says Farrukh Khan.

It is crucial to mention here that the National Clearing Company of Pakistan Limited (NCCPL) has recently announced that the pilot run of the T+1 settlement cycle, has commenced from April 15.

Moreover, after thorough deliberation and coordination with the concerned stakeholders, the final road map and date for the pilot run for the implementation of the T+1 settlement will be finalized by April 25, 2024, and shall be accordingly notified.

Imtiaz Gadar further shared that foreign investors perceive local companies to possess immense potential, with a favorable ecosystem, but the main concerns revolve around macroeconomic factors, especially the depreciating Rupee, which limits their confidence.

Concerning the outlook for the Pakistani Rupee (PKR), he mentioned that with the successful agreement with the IMF and improved bilateral ties with Saudi Arabia, the future of domestic unit appears promising.

Farrukh Khan said that a certain devaluation is also priced in by investors due to interest rate and inflation differentials between US and Pakistan, this can be reduced if government takes measures to control interest rates.

He also raised concerns about the market size being low in dollar terms, which is not much appealing to large institutional investors. To increase this size, he called for listing SOEs to expand depth and size of the overall market.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 130,344.03 345.79M |

1.67% 2144.61 |

| ALLSHR | 81,023.99 1,021.87M |

1.55% 1236.37 |

| KSE30 | 39,908.26 141.62M |

2.05% 803.27 |

| KMI30 | 189,535.00 150.29M |

1.40% 2619.39 |

| KMIALLSHR | 54,783.66 508.76M |

1.07% 581.78 |

| BKTi | 34,940.73 55.86M |

4.37% 1464.05 |

| OGTi | 28,296.06 16.02M |

1.19% 333.47 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,710.00 | 110,105.00 109,405.00 |

-575.00 -0.52% |

| BRENT CRUDE | 68.62 | 69.00 68.58 |

-0.49 -0.71% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 109.20 | 110.00 108.25 |

1.70 1.58% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.99 | 67.50 66.98 |

-0.46 -0.68% |

| SUGAR #11 WORLD | 15.56 | 15.97 15.44 |

-0.14 -0.89% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpeg)

Trade Balance

Trade Balance

CPI

CPI