PSX in May: Charts New Highs

Sara Ateeq | June 02, 2025 at 03:25 PM GMT+05:00

June 02, 2025 (MLN): May 2025 started on a bullish trend, with the benchmark KSE-100 index rising by 8,364.51 points to close the month at 119,691.09, compared to 111,326.58 at the end of April.

Amid profit-taking, the index dipped to its monthly low of 103,527 in the second week. However, it later rebounded to hit a monthly high of 119,962 in mid-May.

Market cap

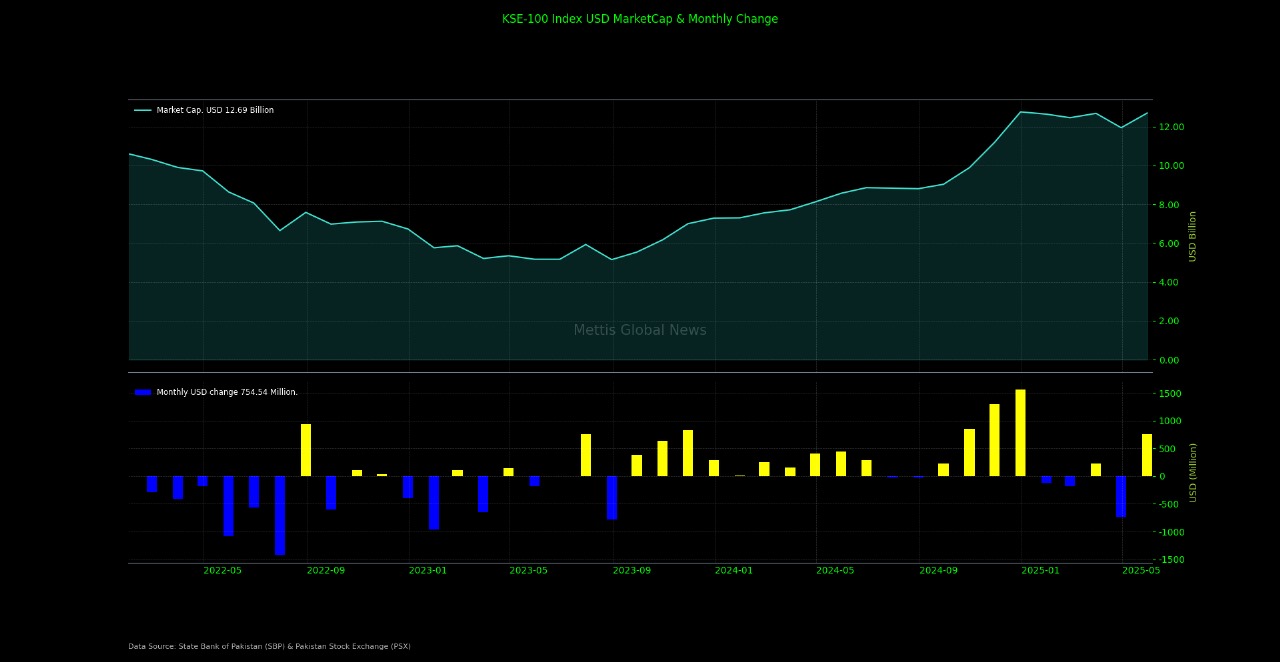

The KSE-100 market capitalization stood at Rs3.58 trillion, up 6.71% from the previous month’s Rs3.35tr while compared to May 2024, the market cap has surged by 50.14%.

In USD terms, the market cap was recorded at $12.69 billion, compared to $11.93bn in the prior month, reflecting an increase of $754 million or 6.3%. When compared to the previous year, the market capitalization witnessed a notable jump of 48.17%.

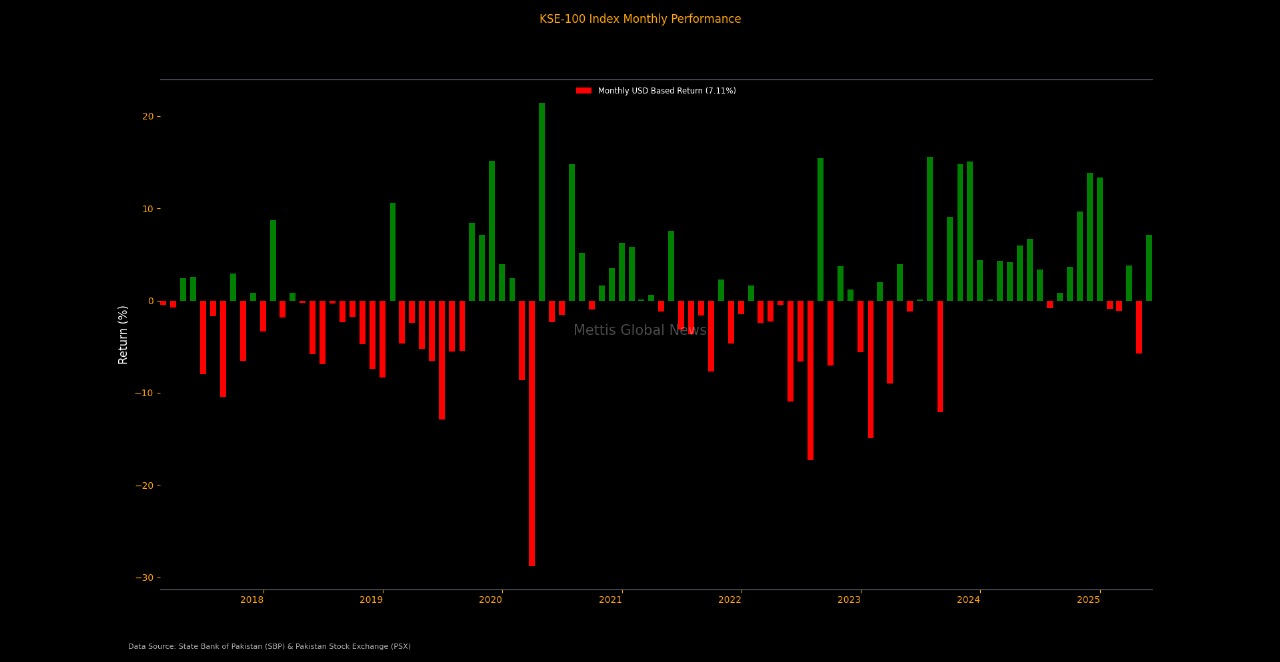

The index return in USD terms remained positive to 7.11%, compared to last month’s return of -5.7%.

On the economic front, the Consumer Price Index (CPI) in May rose to 3.5%, compared to 0.3% in the previous month and 11.8% in the same period last year (SPLY).

Pakistan has recorded a current account surplus of $12m, Last month, the country recorded a current account surplus of $1.2bn, while in April 2024, the current account surplus stood at $315m.

Workers’ remittances reached around $3.2bn in April 2025. This represents a 30.9% YoY increase compared to April 2024 and a 27.3% fall from the previous month.

The country recorded a Foreign Direct Investment (FDI) of $140.76m in April, compared to a FDI worth $394.49m in SPLY.

Further, the Pak Rupee’s Real Effective Exchange Rate Index (REER) decreased by 2.09% in April 2025 to a provisional value of 99.42 from the revised value of 101.55 in March 2025.

The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) surprised many by cutting the policy rate by 100 basis points to 11%, signaling a dovish stance.

Following the SBP’s decision, the Karachi Interbank Offered Rate (KIBOR) across major tenors declined sharply by 64 to 91 basis points, reflecting a swift market realignment.

Business sentiment also improved, with overall confidence rising by 16% points, from -5% to +11%, according to the Foreign Investors' Business Confidence Survey by the Overseas Investors Chamber of Commerce and Industry (OICCI).

The large-scale manufacturing (LSM) sector of Pakistan recorded an increase of 1.79% in March 2025 to 117.20 compared to last year. On a monthly basis, it plummeted by 4.64% compared to February's 122.91 points.

Trade deficit in April 2025 increased by 35.79% YoY, standing at $3.39bn compared to $2.49bn in April 2024.

The sales of cars, including LCVs, vans, and jeeps, in Pakistan, recorded a 4.5% MoM decline during April 2025, falling to 10,596 from 11,098 in March,

Moreover, the sales volume of oil marketing companies (OMCs) in Pakistan saw a significant increase of 5% MoM in May 2025, reaching a total of 1.53m tons, while YoY growth stood at 10%.

Following a deadly attack in Kashmir, intensified hostilities, India requested the International Monetary Fund (IMF) to review loans disbursed to Pakistan,

However, the IMF declined India’s request, maintaining its support for Pakistan.

In retaliation, India launched strikes on nine locations in Pakistan and Pakistan-administered Kashmir, claiming “precision strikes” under Operation Sindoor.

As a result, PSX experienced extreme volatility, with the benchmark KSE-100 index plunging by as much as 6,560 points during intraday trade—one of the steepest falls in recent history.

This sharp decline was triggered by panic selling amid reports of Indian aggression.

Regional trade flows were also disrupted, as global shipping lines suspended operations to Karachi and rerouted cargo.

Despite these challenges, the IMF Executive Board approved $2.3bn in funding for Pakistan, including a $1bn tranche under the ongoing Extended Fund Facility (EFF) and a new $1.4bn Resilience and Sustainability Facility (RSF).

In response, Pakistan and China launched Operation Bunyan-e-Marsous, a joint display of strength featuring China’s cutting-edge weaponry, tested and showcased with surgical precision.

Furthermore, the federal government pushed forward with reforms by introducing the “Tax Laws (Amendment) Ordinance, 2025,” aimed at accelerating tax recovery.

The government also achieved a milestone in sustainable finance by launching its first Green Sukuk.

To support fiscal needs, the government set a target to raise Rs5.75tr from May to July 2025 through auctions of Market Treasury Bills (MTBs) and Pakistan Investment Bonds (PIBs) with fixed and floating rates.

Looking ahead, the government plans to present the federal budget for fiscal year 2025–26 on June 10, 2025.

In a groundbreaking move to position Pakistan as a leader in digital innovation, the government announced an allocation of 2,000 megawatts (MW) of electricity in the first phase of a national initiative.

This initiative aims to power Bitcoin mining and Artificial Intelligence (AI) data centers.

The positive economic cues helped stabilize investor sentiment, pushing the KSE-100 index’s fiscal year-to-date returns to 53.67%. However, on CYTD return stood at 57.74%.

Top Index Movers

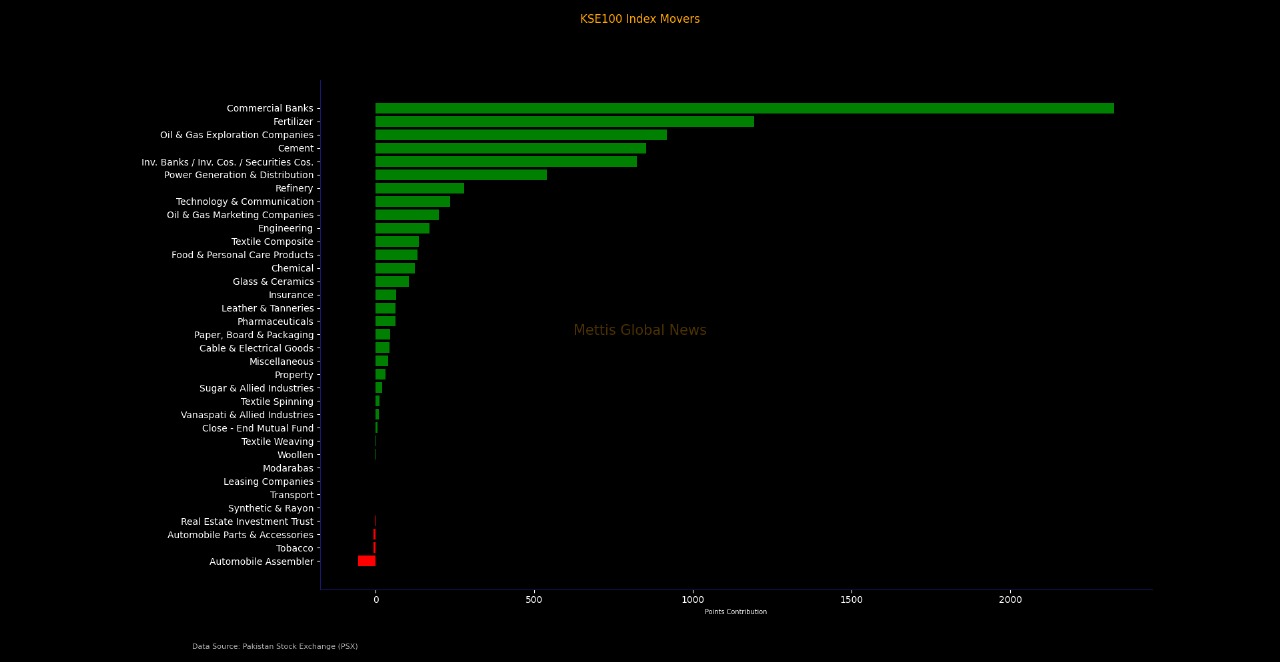

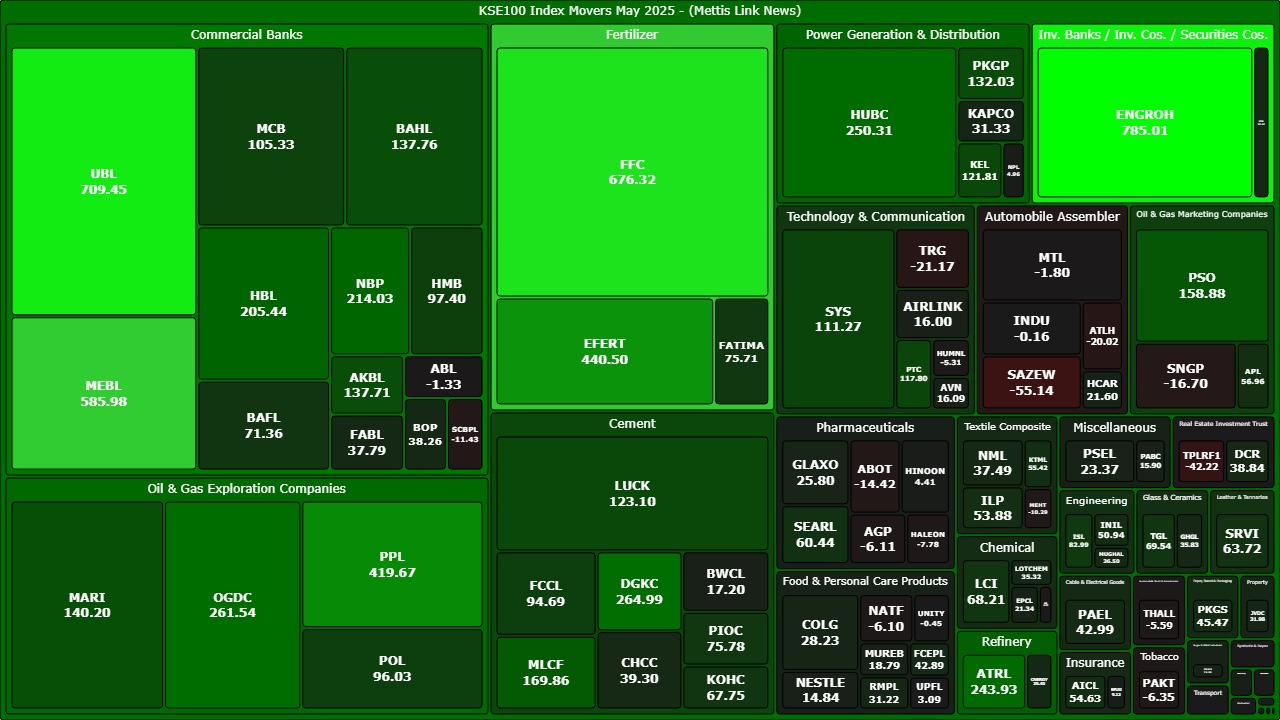

During the month, Automobile Assembler, Tobacco, Automobile Parts & Accessories and Real Estate Investment Trust dragged the index down by -55.5, -6.34, -5.58, and -3.38, respectively.

On the flip side, Commercial Banks, Fertilizer, and Oil & Gas Exploration Companies, Cement contributed 2327.74, 1192.52, 917.43, and 852.67 respectively to the index.

Among individual stocks, SAZEW eroded -55.13 points from the index while TPLRF1, TRG, ATLH, and SNGP dented the index by -42.22, -21.16, -20.01, and -16.7, respectively.

Conversely, ENGROH, UBL, FFC, and MEBL added 785.01, 709.44, 676.32, and 585.97, respectively.

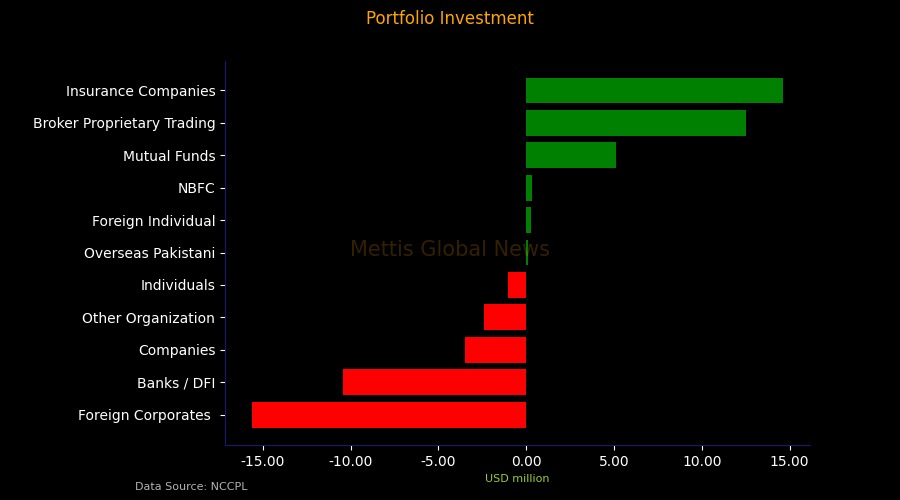

FIPI/LIPI

This month, foreign investors emerged as net sellers, offloading the equities worth $15.24m.

Among them, foreign corporations led this activity by selling securities worth $15.63m while overseas Pakistanis sold securities worth $0.103m.

On the other hand, local investors were net buyers, purchasing equities worth $15.24m.

Among them, Insurance Companies and Mutual Funds bought securities worth $14.65m and $5.12m, respectively.

However, Individuals sold securities worth $1.02m, respectively.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 178,805.41 412.52M | 3.27% 5654.99 |

| ALLSHR | 107,306.27 671.78M | 2.82% 2942.71 |

| KSE30 | 54,663.07 204.80M | 3.50% 1846.79 |

| KMI30 | 250,693.28 135.11M | 2.17% 5329.63 |

| KMIALLSHR | 68,644.33 386.38M | 1.89% 1270.94 |

| BKTi | 52,628.84 104.28M | 6.80% 3350.17 |

| OGTi | 35,081.33 33.78M | 0.93% 323.46 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,180.00 | 68,570.00 66,910.00 | 315.00 0.46% |

| BRENT CRUDE | 67.88 | 67.89 67.36 | 0.46 0.68% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.00 -3.03% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -0.10 -0.09% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 62.67 | 62.69 62.04 | 0.41 0.66% |

| SUGAR #11 WORLD | 13.66 | 13.66 13.47 | 0.18 1.34% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account