PSX in March: No Mountain High Enough

Nilam Bano | April 03, 2025 at 02:40 PM GMT+05:00

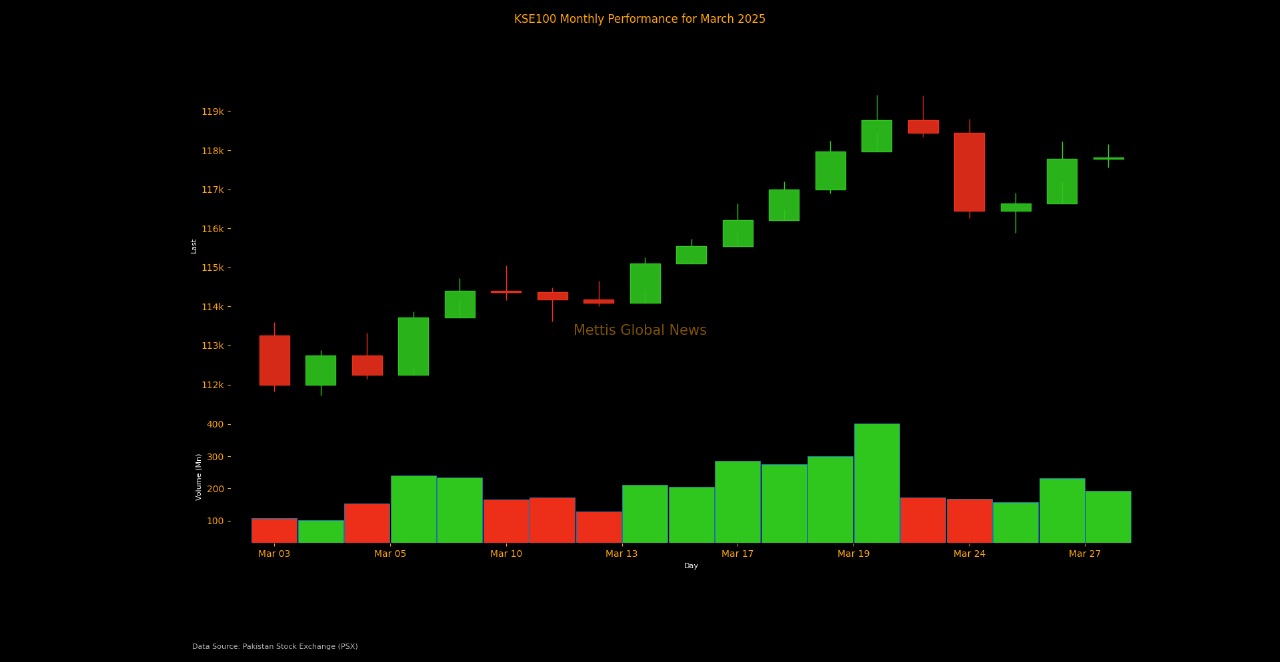

April 03, 2025 (MLN): Bulls made their way to the local bourse in March 2025 as the benchmark KSE 100 index touched all time high of 119,421.81 mainly due to $1 billion IMF staff-level agreement under the Extended Fund Facility (EFF).

Investor confidence was further bolstered by the $1.3bn Resilience and Sustainability Facility (RSF) arrangement. Furthermore, expectations of progress on circular debt resolution kept investor interest intact.

The month also saw investors booking profits amid concerns over cement royalties in KPK and IMF-related news flows which led the index to touch the low of 115,883.22.

Accordingly, the index closed the month at 117,806.74, up by 4,555 points or 4% compared to the previous month’s close of 113,251.66.

Market cap

The KSE-100 market capitalization stood at Rs3.55 trillion, up by 2% from the previous month’s Rs3.48tr while compared to March 2024, the market cap has surged by 65.61%.

In USD terms, the market cap was recorded at $12.67bn, compared to $12.45bn in the prior month, reflecting an increase of 1.8%. While when compared to the previous year, the market capitalization witnessed a notable jump of 64.30%.

The index return in USD terms turned positive to 3.83%, compared to last month’s return of -1.13%.

On the economic front, CPI in March slowed to 0.7% in March 2025, compared to 1.5% in the previous month and 20.68% in March 2024,

Trade deficit in February 2025 increased by 33.43% YoY, standing at $2.3bn compared to $1.72bn in February 2024.

Cotton arrivals in Pakistan fell 34% to 5.5m bales as of February 28, 2025, compared to 8.4m bales in the same period last year.

The Central Bank maintained the policy rate at 12% on the economic front. On the same day, Governor Jameel Ahmed revealed that the State Bank of Pakistan (SBP) has successfully met the IMF's Net International Reserves (NIR) target for December 2024 by a wide margin and remains on track to achieve the June 2025 target.

Workers’ remittances reached $3.1bn in February 2025. This represents a 38.6% YoY increase compared to February 2024 and a 3.8% rise from the previous month.

The sales of cars, including LCVs, vans, and jeeps, in Pakistan, increased by 24.5% in February 2025, clocking in at 12,084 units compared to 9,709 units recorded in the same month of last year.

The country’s overall nutrient offtake in February 2025 stood at 231 thousand tonnes, reflecting a 41.8% decrease compared to February 2024.

The current account posted a deficit of $12 million in February 2025. Last month, the country recorded a current account deficit of $399m.

Pakistan recorded a Foreign Direct Investment (FDI) of $94.7m in February 2025, compared to $172m in the Same Period Last Year (SPLY).

Pak Rupee's Real Effective Exchange Rate Index (REER) decreased by 1.71% in February 2025 to a provisional value of 102.27 from 104.06 in January 2025.

Pakistan’s Gross Domestic Product (GDP) posted a growth of 1.73% in the second quarter of FY25 despite contraction in industry of -0.18%. This growth was bolstered by due to positive growth in agriculture (1.10%) and services (2.57%), according to the National Accounts Committee (NAC).

The total money supply circulating within the economy till February 2025 has been recorded at Rs40.57 trillion.

In addition, the foreign exchange reserves held by the Central Bank decreased by $540m or 4.84% WoW, to $10.61bn during the week ending on March 21, 2025.

The positive economic cues helped stabilize investor sentiment, pushing the KSE-100 index’s fiscal year-to-date returns to 50.17%, while the CYTD return stood at 2.32%.

Top Index Movers

During the month, Oil & Gas Exploration Companies, Oil & Gas Marketing Companies, Commercial Banks, and Power Generation & Distribution contributed 2,048.44, 762.57, 631.29, and 614.47 points to the index, respectively.

On the flip side, Fertilizer, Leather & Tanneries and Inv. Banks dented the index by 319.82, 160.66, and 151.16 points, respectively.

Among individual stocks, MARI remained the star performer as it added 1,072.44 points, while HUBC, PSO, and OGDC contributed 643.56, 590.87, and 512.84 points, respectively.

Conversely, FFC, SRVI, and ENGROH lost 189.05, 160.66, and 154.1, respectively.

FIPI/LIPI

This month, foreign investors emerged as net sellers, offloading the equities worth $11.97m.

Among them, foreign corporations led this activity by selling securities worth $14.09m while foreign individuals sold securities worth $56.93 thousand.

On the other hand, overseas Pakistanis bought equities worth $2.17m.

The local investors remained net buyers, purchasing equities worth $11.97m.

Among them, BANKS/DFI bought securities worth $325.17m. However, Insurance Companies sold securities worth $11.9m, respectively.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

Weekly Forex Reserves

Weekly Forex Reserves