PSX in February: Struggling for Footing

Nilam Bano | March 03, 2025 at 09:45 PM GMT+05:00

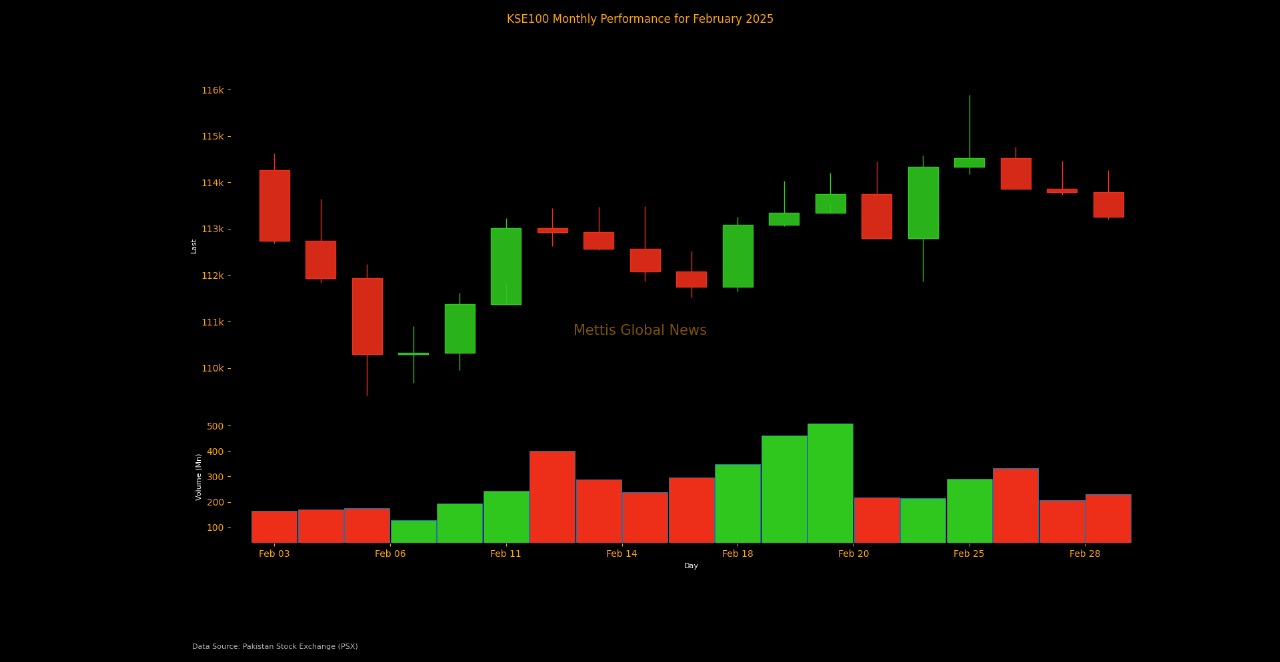

March 03, 2025 (MLN): February saw the bulls take a backseat as the benchmark KSE-100 index lost 1,004.06 points in a sluggish stretch to close the month at 113,251.66 compared to the previous month’s close of 114,255.72.

On the back of profit-taking, the index touched its lowest level of 109,405.53 (-3,846.13) during the first week of the month, while in the last week, it reached a monthly high of 115,889.6 (+2,637.94).

Market cap

The KSE-100 market capitalization stood at Rs3.48 trillion, down 1.18% from the previous month’s Rs3.52tr while compared to January 2024, the market cap has surged by 65.16%.

In USD terms, the market cap was recorded at $12.45 billion, compared to $12.63bn in the prior month, reflecting a decline of $181.4 million or -1.43%. While when compared to the previous year, the market capitalization witnessed a notable jump of 64.83%.

The index return in USD terms remained negative to -1.13%, compared to last month’s return of -0.89%.

On the economic front, Pakistan's inflation slowed to 1.5% in February 2025- lowest since September 2015 low, compared to 2.4% in the previous month and 23.1% in February 2024.

Further, the country’s trade deficit stood at $2.3bn in February 2025, reflecting a fall of 0.35% compared to January 2025.

The total cement dispatches stood at 3.895 million tons for January 2025, reflecting a 6% decline compared to 4.154 million tons in December 2024.

The sales volume of oil marketing companies (OMCs) in Pakistan increased by 8% month-on-month (MoM) in January 2025, reaching a total of 1.4 million tons, while the year-on-year (YoY) change remained flat.

During the month, a three-member mission from the International Monetary Fund (IMF) visited Pakistan to conduct a Governance and Corruption Diagnostic Assessment (GCDA) under the Extended Fund Facility (EFF) 2024 program.

In addition, MSCI Inc. (NYSE: MSCI) disclosed the results of its February 2025 Index Review for the MSCI Equity Indexes wherein Abbott Laboratories (Pakistan) Limited, Searle Pakistan Limited, BF Biosciences Limited, Biafo Industries Limited, and Power Cement Limited joined the Index.

Deletions include Air Link Communication Limited, Askari Bank Limited, and Attock Refinery Limited.

The sales of cars, including LCVs, vans, and jeeps, in Pakistan, increased by 61.4% in January 2025, clocking in at 17,010 units compared to 10,536 units recorded in the same month of last year,

On the external front, breaking a 3-month streak of posting surplus consecutively, the current account recorded deficit of $420m in January 2025.

The book-building process of Barkat Frisian Agro Limited’ Initial Public Offer (IPO) has concluded with an oversubscription of 16.25 times, the historic development at PSX.

In a notable development, Prime Minister Shehbaz Sharif met the Executive Directors of the World Bank, who arrived in Pakistan to review the implementation of $40 billion funding.

Moreover, the IMF staff team is scheduled to visit Pakistan in early to mid-March for discussions around the first review under Pakistan’s Extended Fund Facility-supported program.

Investor sentiments received a significant boost as a technical delegation from the IMF began discussions last week regarding Pakistan’s request for more than $1 billion in additional funding to enhance climate resilience.

Following the initial talks, a policy review is set to take place early next week to evaluate the government’s performance under the existing $7 billion Extended Fund Facility (EFF). The government is expecting to receive between $1 billion and $1.5 billion in additional funding.

In addition, Pakistan and Iran signed a Memorandum of Understanding (MoU) to boost bilateral trade, setting a target of $10 billion.

The total money supply circulating within the economy till January 2025 has been recorded at Rs40.13 trillion. The money circulating within the economy until December 2024 was Rs40.21tr whereas, in January of last year, the figure was Rs35.58tr.

Furthermore, The foreign exchange reserves held by the State Bank of Pakistan (SBP) increased by $20.9 million or 0.19% WoW to $11.22bn during the week ended on February 21, 2025.

Meanwhile, the Pakistani Rupee (PKR) depreciated marginally by 0.28% MoM, closing at 279.67 per USD.

A day earlier from PKR's monthly close, the currency marked the lowest level against the greenback, reflecting a 0.79% decline from its 52-week high of PKR 277.51, recorded on October 4, 2024.

The positive economic cues helped stabilize investor sentiment, pushing the KSE-100 index’s fiscal year-to-date returns to 43.37%. However, on CYTD return stood at -1.62%.

KSE-100 vs. Key Sector Indices

The KSE-100 index posted a 44.37% gain since July 2024, showing strong overall market performance. However, some sectors outpaced the index, indicating selective investor interest.

The Cement sector led with a 60.24% increase, likely driven by robust construction activity and favorable economic policies.

The Oil & Gas Exploration sector exhibited high volatility, peaking sharply before stabilizing at a 57.22% gain.

Meanwhile, the Fertilizer sector recorded a 37.8% increase, possibly benefiting from strong agricultural demand.

In contrast, Commercial Banks underperformed relative to other sectors, with a 26.66% gain, suggesting that factors such as interest rate changes and regulatory policies may have constrained growth.

Top Index Movers

During the month, Inv. Banks, Oil & Gas Exploration Companies, Technology & Communication, and Pharmaceuticals dragged the index down by -834.35, -582.66, -428.01, and -343.01, respectively.

On the flip side, Cement, Fertilizer, and Power Generation & Distribution contributed 1108.75, 186.95, and 110.54, respectively to the index.

Among individual stocks, ENGROH eroded -801.56 points from the index while HBL, MARI, SYS, and POL dented the index by -448.14, -342.32, -295.27 and -245.91, respectively.

Conversely, LUCK, BAHL, FFC, and NBP added 695.15, 211.12, 165.38, and 151.75, respectively.

FIPI/LIPI

This month, foreign investors emerged as net sellers, offloading the equities worth $28.13m.

Among them, foreign corporations led this activity by selling securities worth $25.79m while overseas Pakistanis sold securities worth $2.29m.

On the other hand, local investors were net buyers, purchasing equities worth $28.13m.

Among them, Insurance Companies and Mutual Funds bought securities worth $16.2m and $9.2m, respectively.

However, Individuals sold securities worth $9.71m, respectively.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpeg)

.jpeg)

.jpeg)

.jpeg)

Weekly Forex Reserves

Weekly Forex Reserves