PSX in April: A Volatile Affair

Nilam Bano | May 02, 2025 at 03:45 PM GMT+05:00

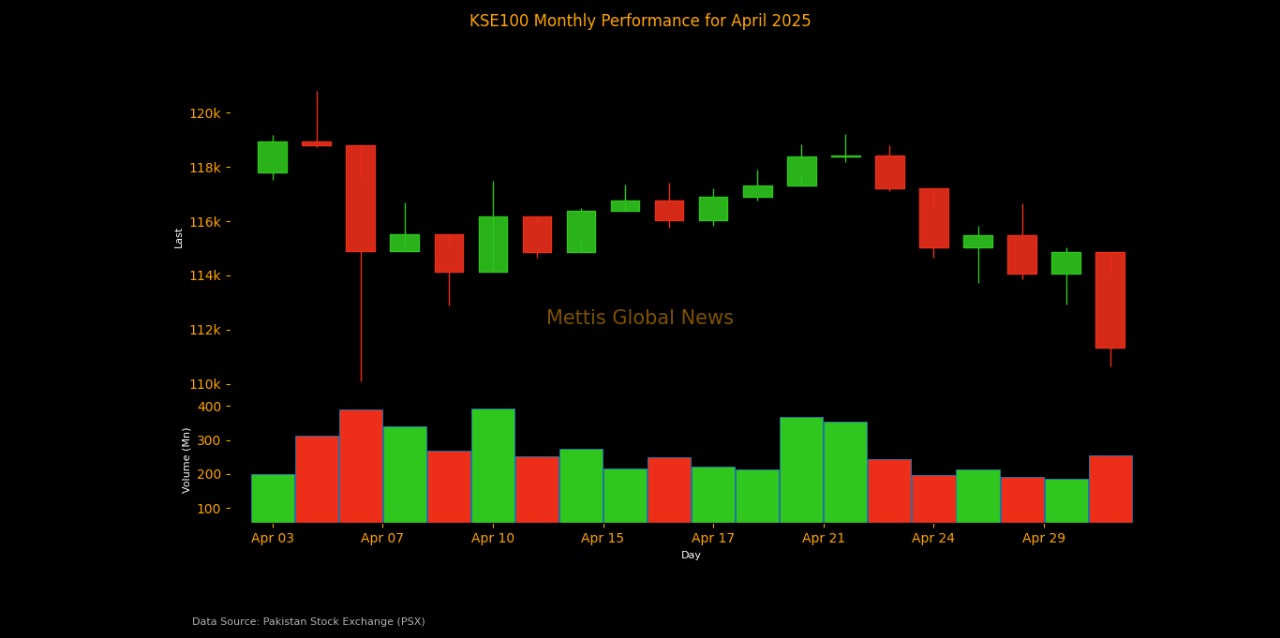

May 02, 2025 (MLN): The local bourse remained highly volatile in April 2025, mainly due to Trump’s reckless decision to impose tariffs on 60 countries, including Pakistan and cross-border tension.

The market melted down significantly on April 07, 2025, and at one point, the benchmark KSE-100 Index lost 8,687 points or -7.3%. This was the biggest one-day decline in PSX history, and trading was briefly halted. Though some ground was clawed back in the final hour, the damage was done that resulting in the index losing 3,882.18 points or -3.27%.

Although a 90-day pause on tariffs above 10% for most countries provided some relief, investor sentiment remained cautious.

Later, the release of economic indicators, including record remittances and current account surplus, improved market sentiments. However, regional tensions between India and Pakistan weighed on the market, which again created uncertainty.

As a result, the benchmark KSE-100 index closed April at 111,325.57 points, down -6,480.17 or- 5.5% MoM compared to the previous month’s close of 117,806.74.

Market cap

The KSE-100 market capitalization stood at Rs3.35 trillion, down by -5.56% from the previous month’s Rs3.55tr while compared to April 2024, the market cap has surged by 48.39%.

In USD terms, the market cap was recorded at $11.93bn, compared to $12.67bn in the prior month, reflecting a drop of 5.83%. While when compared to the previous year, the market capitalization witnessed a notable jump of 47%.

The index return in USD terms turned negative to 5.77%, compared to last month’s return of 3.83%.

On the economic front, Pakistan's inflation slowed to 0.3% in April 2025, compared to 0.7% in the previous month and 17.3% in April 2024.

During the month, remittances reached a record high of $4.05bn in March 2025, marking a notable 37% YoY increase.

As a result, the country has recorded a current account surplus of $1.2bn.

Following the surge in remittances, the central bank has revised its full-year remittance forecast for FY25 to $38bn, up from the earlier estimate of $36bn.

Additionally, Pakistan is expected to receive $4–5bn from multilateral lenders and other external sources before the close of the fiscal year, according to State Bank of Pakistan (SBP) Governor Jameel Ahmad.

Also, Pakistan has recorded a Foreign Direct Investment (FDI) of $25.75m in March, compared to a FDI worth $294.17m in the Same Period Last Year (SPLY).

Further, Pak Rupee's Real Effective Exchange Rate Index (REER) decreased by 0.61% in March 2025 to a provisional value of 101.618 from the revised value of 102.246 in February 2025.

Fitch Ratings upgraded Pakistan's Long-Term Foreign-Currency Issuer Default Rating (IDR) to 'B-' from 'CCC+', with a Stable Outlook.

The large-scale manufacturing (LSM) sector of Pakistan recorded a decline of 3.51% in February 2025 to 122.56 compared to last year,

SBP’s foreign exchange reserves, currently under pressure due to recent debt repayments, are projected to climb to $14bn by the end of June. This compares with a previous target of $13bn.

The Governor reaffirmed Pakistan’s improving macroeconomic stability and outlook during high-level meetings with senior executives from global financial and investment institutions, including JP Morgan, Standard Chartered, Deutsche, Jefferies, and major credit rating agencies.

The foreign exchange reserves held by the SBP decreased by $366.5 million or 3.47% WoW to $10.21bn during the week ended on April 18, 2025.

The positive economic cues helped stabilize investor sentiment, pushing the KSE-100 index’s fiscal year-to-date returns to 41.91%, while the CYTD return stood at -3.3%.

Top Index Movers

During the month, Oil & Gas Exploration Companies, Fertilizer, Inv. Banks, and Power Generation & Distribution eroded -2,518.23, -1,425.18, -998.25, and -531.99 points from the index, respectively.

On the flip side, Commercial Banks, Cement, and Automobile Assembler added 1,071.27, 253.107, and 58.85 to the index, respectively.

Among individual stocks, ENGROH remained the worst performer as it lost -984.06 points, while PPL, EFERT, and OGDC dented the index by -946, -865.70, and -688.17 points, respectively.

Conversely, UBL, LUCK, and MEBL added 993.88, 400.96, and 352.52, respectively.

FIPI/LIPI

Foreign investors remained as net sellers, offloading the equities worth $9.51m.

Among them, foreign corporations led this activity by selling securities worth $23.52m while foreign individuals bought securities worth $13.86m.

The local investors remained net buyers, purchasing equities worth $9.51m.

Among them, Companies and Other Organization bought securities worth $26.39m and $22.17m, respectively. However, Insurance Companies sold securities worth $44.9m, respectively.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 136,502.54 259.91M |

1.64% 2202.77 |

| ALLSHR | 85,079.90 838.35M |

1.26% 1061.74 |

| KSE30 | 41,552.62 97.27M |

1.81% 738.33 |

| KMI30 | 193,330.76 84.69M |

0.39% 741.60 |

| KMIALLSHR | 56,315.31 366.02M |

0.43% 243.06 |

| BKTi | 38,498.08 37.91M |

4.13% 1526.33 |

| OGTi | 28,138.38 5.66M |

-0.36% -101.89 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 120,155.00 | 123,615.00 118,675.00 |

1625.00 1.37% |

| BRENT CRUDE | 69.18 | 71.53 69.08 |

-1.18 -1.68% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.25 0.26% |

| ROTTERDAM COAL MONTHLY | 106.50 | 106.60 106.50 |

-2.20 -2.02% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.96 | 69.65 66.84 |

-1.49 -2.18% |

| SUGAR #11 WORLD | 16.31 | 16.67 16.27 |

-0.26 -1.57% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.png)