PSX Closing Bell: Another One Bites the High

MG News | July 14, 2025 at 04:23 PM GMT+05:00

July 14, 2025 (MLN): The benchmark KSE-100 Index concluded Monday's trading session at 136,502.53, marking an all-time high closing, with a gain of 2,202.77 points or 1.64%.

The index remained positive throughout the day showing an intraday high of 136,841.49 (+2,541.73) and a low of 134,937.43 (+637.67) points.

The total volume of the KSE-100 Index was 259.91 million shares.

The bullish momentum in the stock market is being driven by improved investor confidence and positive economic indicators.

Prime Minister

Shehbaz Sharif praised the rally, citing it as proof of growing trust in the

government's economic policies and commitment to creating a business-friendly

environment.

The surge is supported by strong macroeconomic fundamentals, including record workers’ remittances of $38.3 billion in FY25, marking a 26.6% increase from $30.25bn in FY24.

Additionally, foreign exchange reserves climbed to a 39-month high of $14.5 billion.Local mutual fund activity

also played a key role in sustaining the rally.

Additionally, the auto sector’s performance boosted

sentiment, with June car sales up 64% year-on-year and FY25 sales rising 43%,

driven by pre-buying ahead of a proposed GST hike. These combined factors have

helped maintain market optimism and growth.

Of the 100 index companies 59 closed up, 39 closed down, while 2 were unchanged.

Top gainers during the day were POML (+10.00%), BNWM (+10.00%), ABL (+10.00%), MEHT (+10.00%), and JVDC (+9.99%).

On the other hand, top losers were GADT (-4.11%), NATF (-2.47%), IBFL (-2.43%), INIL (-2.02%), and NML (-1.98%).

In terms of index-point contributions, companies that propped up the index were UBL (+546.10pts), HBL (+373.23pts), FFC (+193.61pts), BAHL (+174.59pts), and MCB (+155.22pts).

Meanwhile, companies that dragged the index lower were PPL (-26.40pts), PSO (-24.80pts), NATF (-17.70pts), OGDC (-16.83pts), and NML (-14.92pts).

Sector-wise, KSE-100 Index was supported by Commercial Banks (+1555.83pts), Fertilizer (+249.68pts), Power Generation & Distribution (+132.52pts), Cement (+75.67pts), and Automobile Assembler (+66.82pts).

While the index was let down by Oil & Gas Exploration Companies (-42.12pts), Oil & Gas Marketing Companies (-37.08pts), Food & Personal Care Products (-16.02pts), Engineering (-15.01pts), and Textile Spinning (-5.91pts).

In the broader market, the All-Share Index closed at 85,079.90 with a net gain of 1,061.74 points or 1.26%.

Total market volume was 841.46 million shares compared to 765.08m from the previous session while traded value was recorded at Rs37.05 billion showing a decrease of Rs3.11bn.

There were 397,153 trades reported in 474 companies with 264 closing up, 194 closing down, and 16 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| CSIL | 4.34 | 28.78% | 47,209,653 |

| KEL | 5.33 | 5.13% | 42,841,396 |

| FDPL | 5.55 | 13.04% | 35,579,177 |

| BOP | 13.09 | 0.08% | 35,481,923 |

| WTL | 1.55 | 1.97% | 24,558,263 |

| AKBL | 66.15 | 7.21% | 19,938,829 |

| SSGC | 46.18 | 1.38% | 19,169,848 |

| ASL | 12.25 | 1.16% | 16,945,152 |

| PAEL | 43.25 | -0.48% | 15,372,669 |

| FNEL | 4.31 | 6.95% | 14,479,512 |

To note, the KSE-100 has gained 10,875 points or 8.66% during the fiscal year, whereas it has increased 21,376 points or 18.57% so far this calendar year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 148,617.78 624.60M | 0.86% 1274.27 |

| ALLSHR | 91,685.08 1,340.28M | 0.74% 669.39 |

| KSE30 | 45,247.79 197.43M | 0.83% 370.74 |

| KMI30 | 212,370.79 224.51M | 1.05% 2209.48 |

| KMIALLSHR | 61,227.89 711.87M | 1.18% 715.56 |

| BKTi | 41,264.02 160.39M | 0.54% 221.73 |

| OGTi | 30,019.10 23.63M | 0.64% 190.41 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,265.00 | 0.00 0.00 | -510.00 -0.47% |

| BRENT CRUDE | 67.46 | 67.94 67.29 | -0.52 -0.76% |

| RICHARDS BAY COAL MONTHLY | 88.70 | 88.70 88.70 | -0.75 -0.84% |

| ROTTERDAM COAL MONTHLY | 96.15 | 96.75 96.00 | -0.40 -0.41% |

| USD RBD PALM OLEIN | 1,106.50 | 1,106.50 1,106.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 64.01 | 0.00 0.00 | 0.00 0.00% |

| SUGAR #11 WORLD | 16.34 | 16.52 16.33 | -0.14 -0.85% |

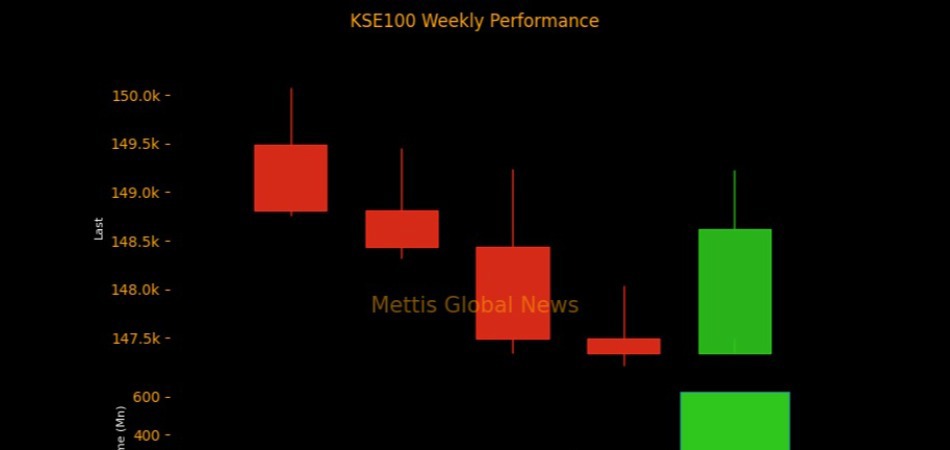

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

SPI

SPI