Pakistan’s stock rally leads in Asia with more gains seen: Bloomberg

MG News | June 25, 2024 at 10:22 AM GMT+05:00

June 25, 2024 (MLN): The bull run in Pakistani stocks looks to have more legs as signs of improving economic conditions bolster the outlook for Asia’s best-performing market this year, reported Bloomberg.

The case for more gains is strengthening on the back of one of the cheapest valuations in Asia and the budget laying the groundwork to secure a new loan from the International Monetary Fund, according to strategists.

A stable rupee and easing inflation boosting the prospect for rate cuts are other positives.

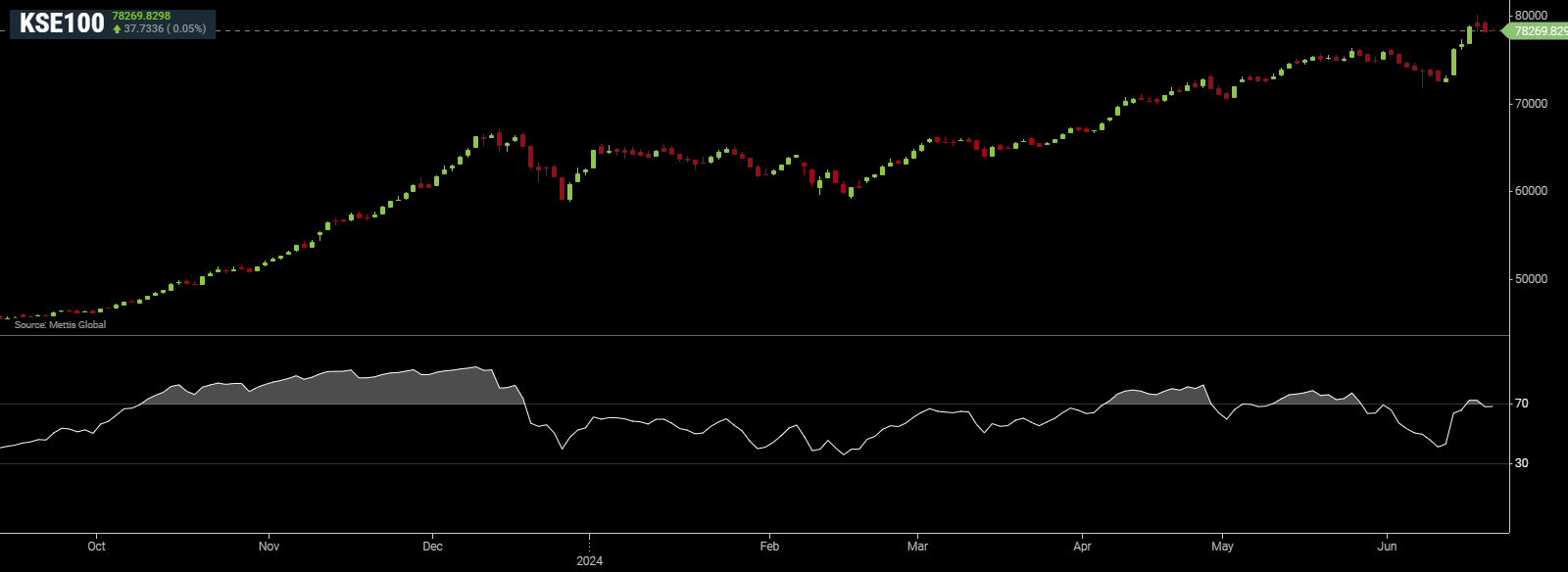

The KSE 100 Index, which has outperformed Asian peers with a 27% surge in dollar terms this year, is likely to further extend gains by 10% by year-end, according to brokerages Topline Securities Ltd. and Arif Habib Ltd.

“There’s a lot of juice left in this rally,” said Ali Hussain, head of research at Dubai-based Frontier Investment Management Partners Ltd. “Cheap valuations, high positive real rates and a fairly valued currency make a very attractive case right now,” he said.

Even while the stocks tested new record highs in recent days, the index remains quite cheap, with a one-year forward earnings-based valuation of 3.8 times, a 50% discount to its lifetime average.

Pakistan earlier this month raised taxes on several industries including cement, automobile, and steel to support the government’s finances as it looks to comply with the IMF guidelines.

The IMF program is critical for the country to help meet its debt payments of about $24 billion in the next fiscal year.

Still, the beleaguered nation remains exposed to political instability given the split mandate in February this year.

The main coalition partner — Pakistan Peoples Party — could easily walk away in the event of a public backlash to austerity measures taken to fulfill the IMF’s conditions for loans, according to Bloomberg Economics.

That may even topple the government, BE said.

The KSE 100’s 14-day relative strength index surpassed the 70 level on Thursday. That is typically seen as representing overbought levels, raising the prospect of a correction.

Meanwhile, investors remain bullish. The market momentum over the next two to three years is likely to be driven by foreign buying, earnings growth and robust local liquidity, according to Karachi-based securities firm Arif Habib.

“With the new IMF program spanning the next three years, we anticipate a favorable external position, supporting continued bullish market sentiment,” said Bilal Khan, head of institutional equity sales at Arif Habib.

(Header image generated with AI)

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 170,741.35 410.45M | 0.52% 876.82 |

| ALLSHR | 103,176.20 904.54M | 0.44% 451.08 |

| KSE30 | 51,932.10 160.24M | 0.51% 261.68 |

| KMI30 | 245,585.80 136.41M | 0.55% 1354.98 |

| KMIALLSHR | 67,531.86 525.58M | 0.58% 390.03 |

| BKTi | 45,672.13 42.39M | 0.35% 160.88 |

| OGTi | 34,337.06 26.90M | 1.63% 550.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 87,480.00 | 90,250.00 86,760.00 | -2960.00 -3.27% |

| BRENT CRUDE | 60.63 | 61.50 60.51 | -0.49 -0.80% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 1.15 1.28% |

| ROTTERDAM COAL MONTHLY | 96.50 | 96.50 96.50 | -0.20 -0.21% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 56.89 | 57.80 56.77 | -0.55 -0.96% |

| SUGAR #11 WORLD | 14.87 | 15.13 14.78 | -0.23 -1.52% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MPC Meeting

MPC Meeting