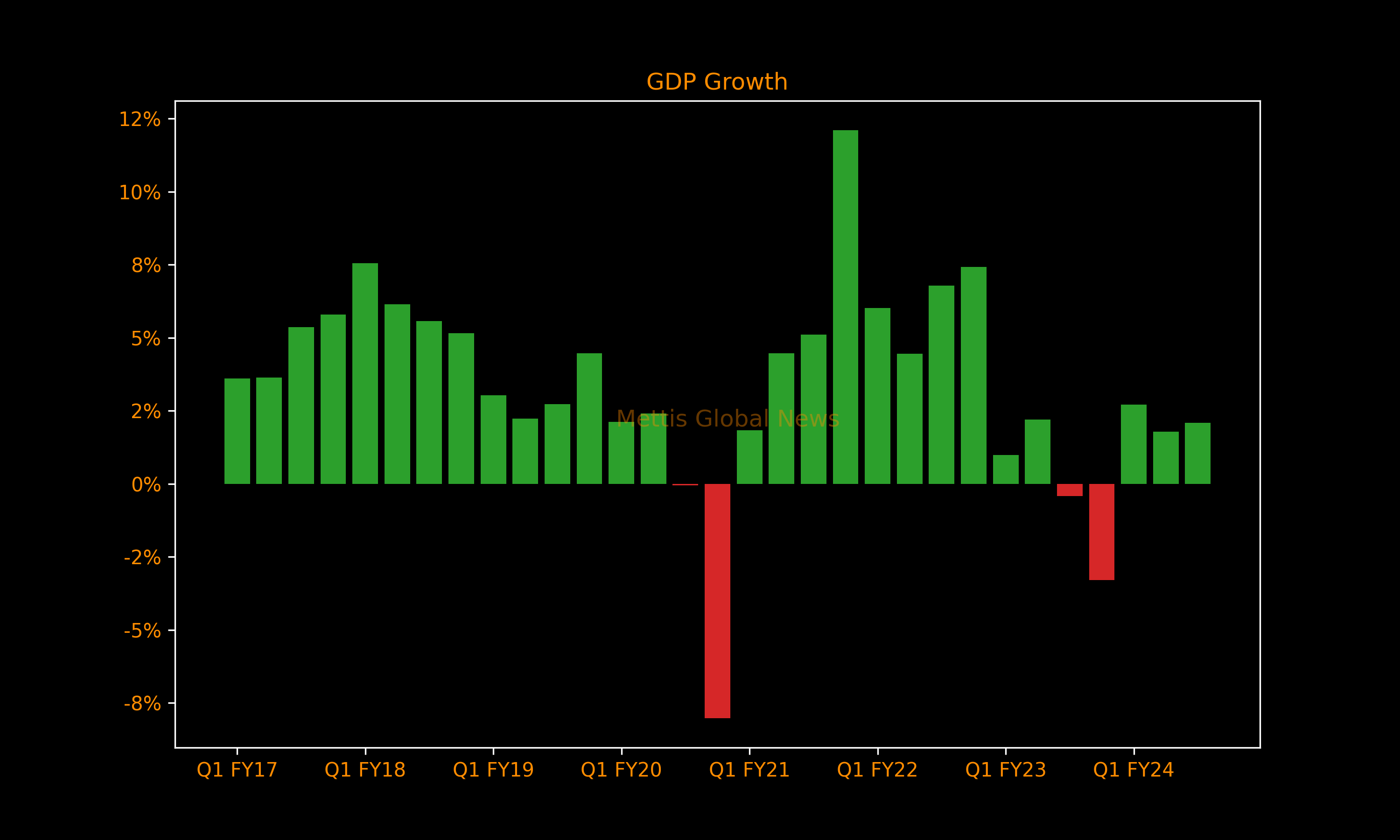

Pakistan's GDP grows 2.09% in Q3 FY24

MG News | May 21, 2024 at 12:11 PM GMT+05:00

May 21, 2024 (MLN): Pakistan’s Gross Domestic Product (GDP) has shown a growth of 2.09% in Q3 FY24 as compared to the revised growth of 1.79% in the previous quarter, estimates released by the Pakistan Bureau of Statistics (PBS) showed on Tuesday.

Moreover, the growth rate for Q1 has also been revised upwards to 2.71% as compared to 2.50% presented in 108th meeting of the NAC.

The NAC also approved a provisional growth rate of GDP for FY 2023-24 at 2.38%.

These estimates were approved in the 109th National Accounts Committee (NAC) meeting held on the same day.

The growth in agriculture, industry, and services stands at 3.94%, 3.84%, and 0.83% respectively.

During Q3, all the constituents of agriculture have contributed positively e.g. important crops (2.89% due to wheat), other crops (1.14%), cotton ginning (61.75%), and livestock (4.20%).

Despite negative growth of construction industry (-15.75%), the industrial growth of 3.84% is attributable to mining & quarrying (0.63), large-scale manufacturing (1.47%), and electricity, gas, and water supply (37.3%).

The overall growth in services is positive (0.83%) during Q3 2023-24 albeit having mixed trends in its constituents i.e. wholesale & retail trade (0.38%), transport& storage (0.91%), information and communication (-5.92%), finance & insurance activities (-7.11%), public administration and social security (-6.38%) and education (10.38%).

Cumulative Growth FY24

The committee approved the provisional growth of GDP at 2.38% during on-going FY 2023-24.

The provisional growth in agriculture is 6.25%, whereas it is 1.21% for both industry as well as services.

Agriculture

The healthy growth of agriculture is mainly due to double-digit growth in important crops i.e. 16.82% on back of bumper crops of wheat (11.64% from 28.16 to 31.44 MT), cotton (108.22% from 4.91 to 10.22 million bales) and rice (34.78% from 7.32 to 9.87m tons).

Two important crops i.e. sugarcane (-0.39% from 87.98 to 87.64m tons) and maize (-10.35% from 10.99 to 9.85m tons) have posted negative growth.

Further, provisional growth in other crops is 0.90%, cotton ginning & miscellaneous component 47.23%, livestock 3.89% and forestry 3.05%.

Industry

Industry in FY24 has shown a growth of 1.21% provisionally.

Mining & quarrying industry has witnessed a growth of 4.85% because of increase in production of crude oil (1.51%), coal (37.72%), other minerals (7.57%) e.g. limestone (7.95%), marble (23.22%).

Large scale manufacturing, which is based on Quantum Index of Manufacturing (QIM), has witnessed a nominal growth of 0.07% with mixed trend in the production of various groups e.g. Food (+1.69%), Beverages (-3.43%), Textile (-8.27%), Tobacco (-33.59%), Non-metallic mineral products (-3.89%), Wood (+12.09%), Coke & Petroleum (+4.85%), and Pharmaceuticals (+23.19%).

Electricity, gas and water supply industry has shown a negative growth of 10.55% because of decrease in subsidies in real terms due to high deflator.

Construction industry increased by 5.86% due to increase in construction-related expenditures by private and public sector enterprise.

Services

Services industry has also shown a growth of 1.21% in FY24.

Detailed analysis of the industry reflects a mixed trend.

Wholesale and retail trade has witnessed a growth of 0.32% because of positive growth in agriculture output.

Transport and storage industry has increased by 1.19% because of increase in output of railways, water transport, and road transport.

Due to high inflation, real growth in Information & Communication, Finance & Insurance and Public Administration and Social Security industries has become negative at 3.02%, 9.64% and 5.25% respectively.

Further, both Education and Human health and Social Work industries have posted positive growth at 10.30% and 6.80% respectively.

Other private services have been estimated at 3.58% on the basis of indicators received from the sources.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 170,326.92 61.20M | -1.07% -1843.37 |

| ALLSHR | 102,231.32 131.52M | -1.20% -1245.33 |

| KSE30 | 52,165.78 21.24M | -0.94% -493.01 |

| KMI30 | 237,814.12 18.29M | -1.12% -2697.17 |

| KMIALLSHR | 65,233.84 66.28M | -1.14% -754.20 |

| BKTi | 50,496.47 8.66M | -1.01% -516.43 |

| OGTi | 33,507.40 3.39M | -0.17% -58.07 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,205.00 | 67,665.00 66,880.00 | 0.00 0.00% |

| BRENT CRUDE | 71.91 | 72.16 71.59 | 0.25 0.35% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.10 -3.13% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.75 -1.63% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.65 | 66.86 66.31 | 0.25 0.38% |

| SUGAR #11 WORLD | 13.72 | 13.85 13.62 | -0.04 -0.29% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account