August 25, 2023 (MLN): Oil prices rose on Friday but are on the path to a second consecutive week of decline as the dollar continues to strengthen and concerns over tight supply have eased.

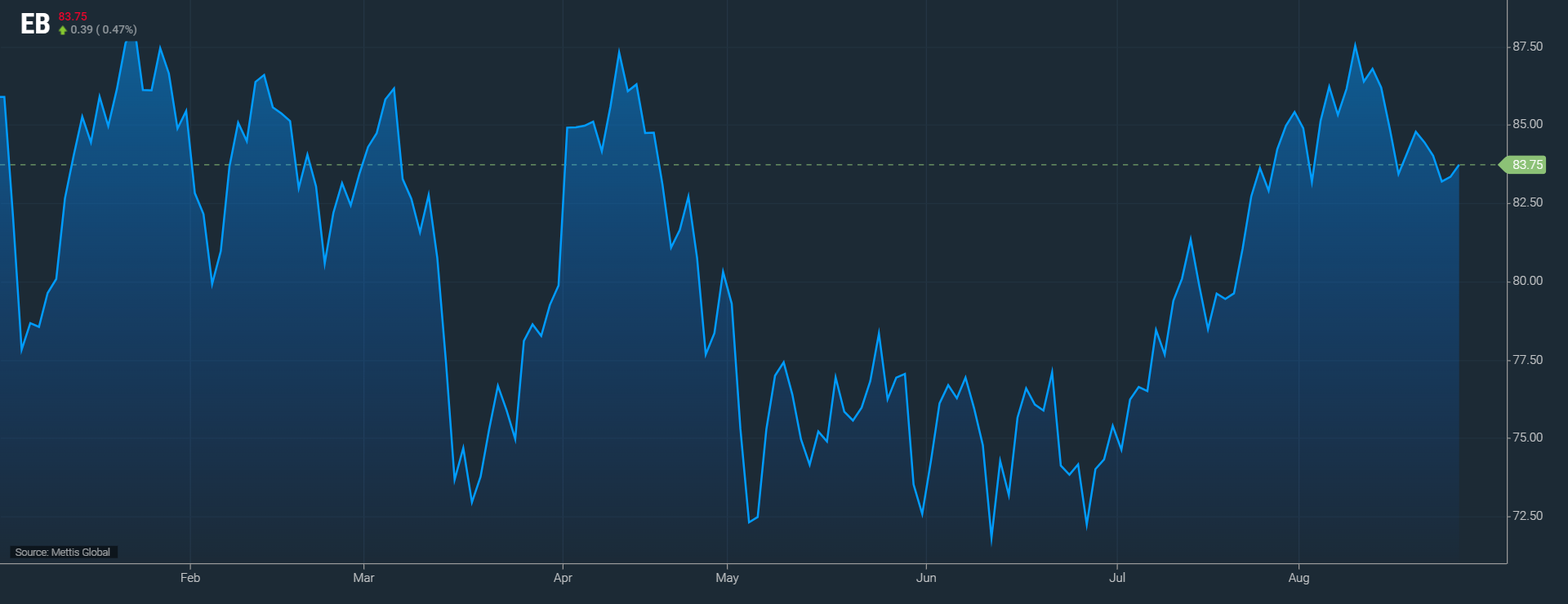

Brent crude is currently trading at $83.29 per barrel, up by 0.76% on the day.

While West Texas Intermediate crude (WTI) is trading at $79.28 per barrel, up by 0.71% on the day.

Crude prices are nearly down 1.50% this week and are headed towards their second consecutive week of decline.

The greenback rallied toward a three-month high as market participants expected the FED to keep interest rates at higher levels for an extended period.

Federal Reserve Chair Jerome Powell is set to deliver a speech at the Jackson Hole symposium on Friday.

Investor caution ahead of Powell's remarks at the Jackson Hole Symposium lifted the safe-haven dollar to a 10-week high, its biggest rise in a month, as markets waited for word on how long rates would stay elevated, as Reuters reported.

A strong dollar makes oil more expensive for holders of other currencies, denting demand.

On the supply side, talks between Turkey and Iraq's semi-autonomous Kurdistan regional government on northern Iraqi crude oil exports are still going on after officials failed to reach an agreement to restart oil exports earlier this week.

Turkey stopped Iraqi oil flows via Ceyhan port on March 25 after losing a long-standing arbitration case brought by Iraq.

The market is closely monitoring the flows of Iranian oil as the country's crude oil output will reach 3.4 million bpd by the end of September, Iran's oil minister was quoted as saying by state media, even though U.S. sanctions remain in place.

Further weighing on market sentiment, U.S. officials are drafting a proposal that would ease sanctions on Venezuela's oil sector, allowing more companies and countries to import its crude oil.

"The support to oil prices from previous production cuts has ebbed. The market is looking for Saudi Arabia to continue extending its voluntary output reductions," said analysts from Haitong Futures.

Analysts estimated that the top oil exporter will likely roll over a voluntary oil cut of 1 million barrels per day for a third consecutive month into October, amid uncertainty about supplies and as the kingdom targets drawing down global inventories further.

Copyright Mettis Link News

Posted on: 2023-08-25T11:46:45+05:00