Oil prices recover marginally following drop in U.S. inventories

By MG News | February 26, 2025 at 01:09 PM GMT+05:00

February 26, 2025 (MLN): Oil prices rose marginally on Wednesday, bouncing off two-month lows hit in the prior session after an industry group reported U.S. crude stockpiles fell last week.

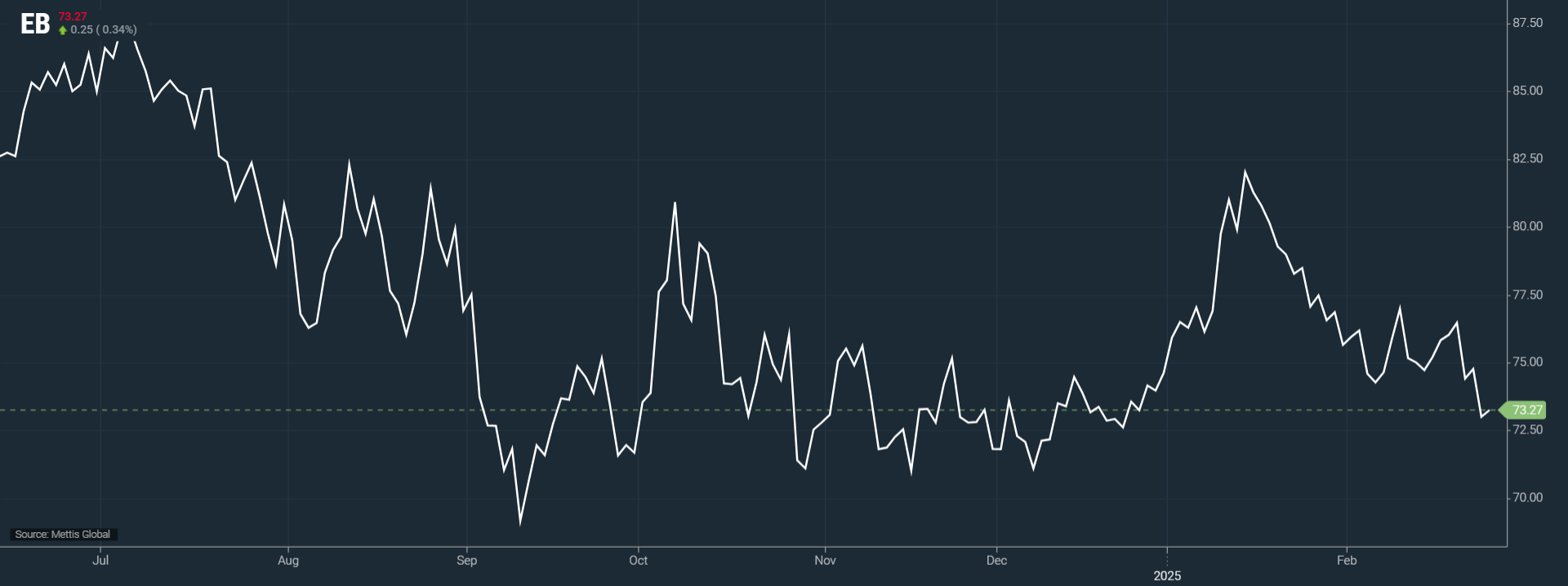

Brent crude futures increased by $0.25, or 0.34%, to $73.27 per barrel.

West Texas Intermediate (WTI) crude futures rose by $0.26, or 0.38%, to $69.19 per barrel by [1:05 pm] PST.

U.S. crude stocks fell 640,000 barrels in the week ended February 21, market sources said on Tuesday, citing American Petroleum Institute data. Official U.S. stockpile data is due later on Wednesday. [API/S] [EIA/S]

"If confirmed by the EIA later today, it would mark the first decline in U.S. crude oil inventories since mid-January," said ING commodities strategists in a note on Wednesday.

Analysts polled by Reuters estimated a 2.6-million-barrel increase in U.S. crude stocks last week, as Reuters reported.

On the supply side, prospects for a peace deal between Russian and Ukraine are improving, said ING, while the market also eyed the potential implications of a minerals deal between the U.S. and Ukraine.

"This would take us a step closer to Russian sanctions being lifted, removing much of the supply uncertainty hanging over the market," the ING strategists said.

The U.S. and Ukraine agreed terms of a draft minerals deal central to Trump's efforts to rapidly end the war in Ukraine, sources familiar with the matter told Reuters on Tuesday.

Meanwhile, dour economic reports from the U.S. and Germany capped price gains, after pulling oil prices more than 2% lower on Tuesday.

Brent crude closed at its lowest since December 23, while WTI recorded its lowest settlement since December 10.

U.S. data showed consumer confidence in February deteriorated at its sharpest pace in 3-1/2 years, with 12-month inflation expectations surging.

Meanwhile, the German economy shrank in the last three months of 2024 versus the prior quarter.

Oil prices have been buffeted by concerns that U.S. President Donald Trump's decisions about tariffs against China and other trading partners could add to pressure on the country's economy.

That has eased worries about tighter near-term oil supply despite fresh U.S. sanctions against Iran, ANZ Bank analysts wrote in a note to clients.

Even though U.S. policy measures could drive an up to 1mn barrel-per-day reduction in Iranian crude exports, any loss in supply from the Middle Eastern nation is countered by OPEC+ members hoping to bring more supply to the market in the months ahead, Commodity Context analyst Rory Johnston said.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI