November 13, 2023 (MLN): Global oil prices started the week with a significant drop as the market grappled with an uncertain demand outlook driven by waning demand in the world's top oil consumers, the United States and China.

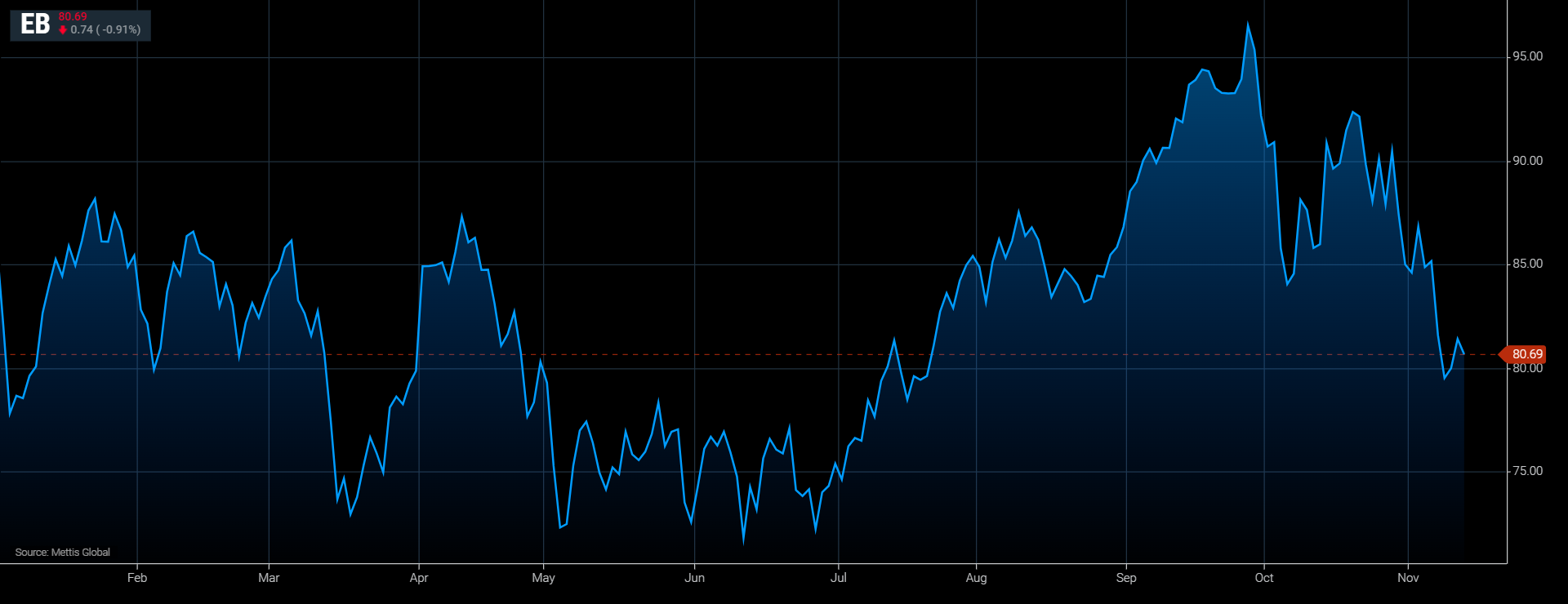

Brent crude is currently trading at $80.52 per barrel, down by 1.1% on the day.

While West Texas Intermediate crude (WTI) is trading at $76.43 per barrel, down by 1.12% on the day.

It is pertinent to note that both benchmarks plunged by over 4% last week and marked their third consecutive weekly loss as concerns about demand overweighed the supply disruptions caused by the Israel-Hamas conflict.

Both benchmarks were well below the 100-day moving average of $86.61 a barrel for WTI and $82.31 a barrel for Brent, as Reuters reported.

Prices gained nearly 2% last Friday as Iraq voiced support for oil cuts by OPEC+, but lost about 4% for the week, notching their third weekly losses for the first time since May.

"Investors are more focused on slow demand in the United States and China while worries over the potential supply disruptions from the Israel-Hamas conflict have somewhat receded," said Hiroyuki Kikukawa, president of NS Trading, a unit of Nissan Securities.

The U.S. Energy Information Administration (EIA) said last week crude oil production in the United States this year will rise by slightly less than previously expected while demand will fall.

Next year, per capita U.S. gasoline consumption could fall to the lowest level in two decades, it said.

Weak economic data last week from China, the world's biggest crude oil importer, also increased fears of faltering demand.

China's consumer prices fell to pandemic-era lows in October, casting doubts on the strength of the country's economic recovery.

Additionally, refiners in China asked for less supply from Saudi Arabia, the world's largest exporter, for December.

Still, Kikukawa said oil prices would be supported if WTI approaches $75 a barrel.

"If the market falls further, we will likely see support buying on expectations that Saudi Arabia and Russia would decide to continue their voluntary supply cuts after December," Kikukawa said.

Top oil exporters Saudi Arabia and Russia confirmed last week they would continue with their additional voluntary oil output cuts until the end of the year as concerns over demand and economic growth continue to drag on crude markets.

OPEC+, the Organization of the Petroleum Exporting Countries and allies including Russia, will meet on November 26.

On the supply side, U.S. energy firms cut the number of oil rigs operating for a second week in a row to their lowest since January 2022, energy services firm Baker Hughes said. The rig count points to future output.

Copyright Mettis Link News

Posted on: 2023-11-13T10:35:28+05:00