Oil prices drop amid U.S. tariff concerns, rising OPEC+ output

MG News | March 10, 2025 at 11:41 AM GMT+05:00

March 10, 2025 (MLN): Oil prices fell on Monday as concern about the impact of U.S. import tariffs on global economic growth and fuel demand, as well as rising output from OPEC+ producers, cooled investor appetite for riskier assets.

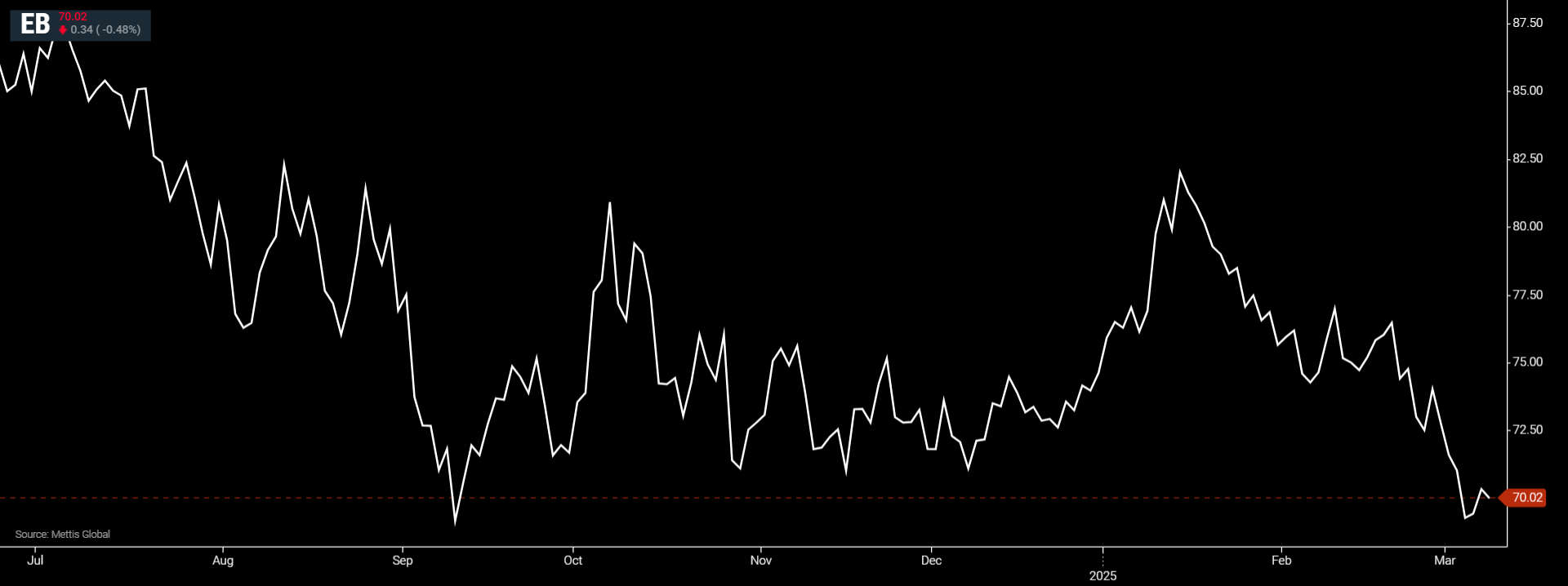

Brent crude futures decreased by $0.34, or 0.48%, to $70.02 per barrel.

West Texas Intermediate (WTI) crude futures fell by $0.37, or 0.55%, to $66.67 per barrel by [11:35 am] PST.

WTI declined for a seventh successive week, marking its longest losing streak since November 2023.

Meanwhile, Brent was down for a third consecutive week after U.S. President Donald Trump imposed, then delayed, tariffs on key oil suppliers Canada and Mexico while increasing taxes on Chinese goods.

China retaliated against the U.S. and Canada with tariffs on agricultural products, as Reuters reported.

"Tariff uncertainty is a key driver behind the weakness," ING analysts said in a note, adding that oil price cuts from Saudi Arabia and deflationary signals from China also hurt sentiment.

IG analyst Tony Sycamore said other factors weighing on oil prices include concerns about U.S. growth, the potential lifting of U.S. sanctions on Russia, and OPEC+ opting to increase output.

"Nonetheless, with much of the bad news likely factored in, we expect weekly support around $65/$62 to hold firm before a recovery back to $72.00," he said in a client note in reference to the WTI price.

Oil prices clawed back some loss on Friday after Trump said the U.S. would increase sanctions on Russia if the latter fails to reach a ceasefire with Ukraine.

The U.S. is also studying ways to ease sanctions on Russia's energy sector if Russia agrees to end its war with Ukraine, two people familiar with the matter told Reuters.

Meanwhile, the Organization of the Petroleum Exporting Countries and allies including Russia, collectively known as OPEC+, said it will proceed with oil output hikes from April.

Russia's Deputy Prime Minister Alexander Novak on Friday said OPEC+ could reverse the decision in the event of market imbalance.

Adding to supply concerns, Saudi Arabia cut prices for crude grades it sells to Asia for the first time in three months in April.

Last week, Trump said he wanted to negotiate a deal with OPEC member Iran to prevent the latter seeking nuclear weapons though Iran has said it is not seeking such weapons.

Trump is pursuing a "maximum pressure" campaign against Iran under which the U.S. on Saturday rescinded a waiver that allowed Iraq to pay Iran for electricity, a State Department spokesperson said.

Iran's Supreme Leader Ayatollah Ali Khamenei on Saturday said his country will not be bullied into negotiations.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 156,177.12 289.65M | 6.62% 9696.97 |

| ALLSHR | 93,623.09 484.05M | 5.91% 5221.94 |

| KSE30 | 48,043.06 141.71M | 6.77% 3046.55 |

| KMI30 | 225,069.58 124.56M | 7.16% 15030.17 |

| KMIALLSHR | 60,866.01 284.12M | 6.19% 3550.28 |

| BKTi | 45,102.26 59.40M | 6.46% 2737.76 |

| OGTi | 33,122.47 17.00M | 5.22% 1641.98 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 70,220.00 | 70,280.00 69,620.00 | 25.00 0.04% |

| BRENT CRUDE | 87.19 | 91.05 86.77 | -0.61 -0.69% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -17.60 -15.04% |

| ROTTERDAM COAL MONTHLY | 121.00 | 129.25 118.95 | -11.50 -8.68% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 82.68 | 88.59 81.79 | -0.77 -0.92% |

| SUGAR #11 WORLD | 14.32 | 14.57 14.17 | -0.27 -1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Business Confidence Survey

Business Confidence Survey