OGDC's profit collapse sinks Oil & Gas sector in Q4FY24

Rafay Malik | October 04, 2024 at 04:09 PM GMT+05:00

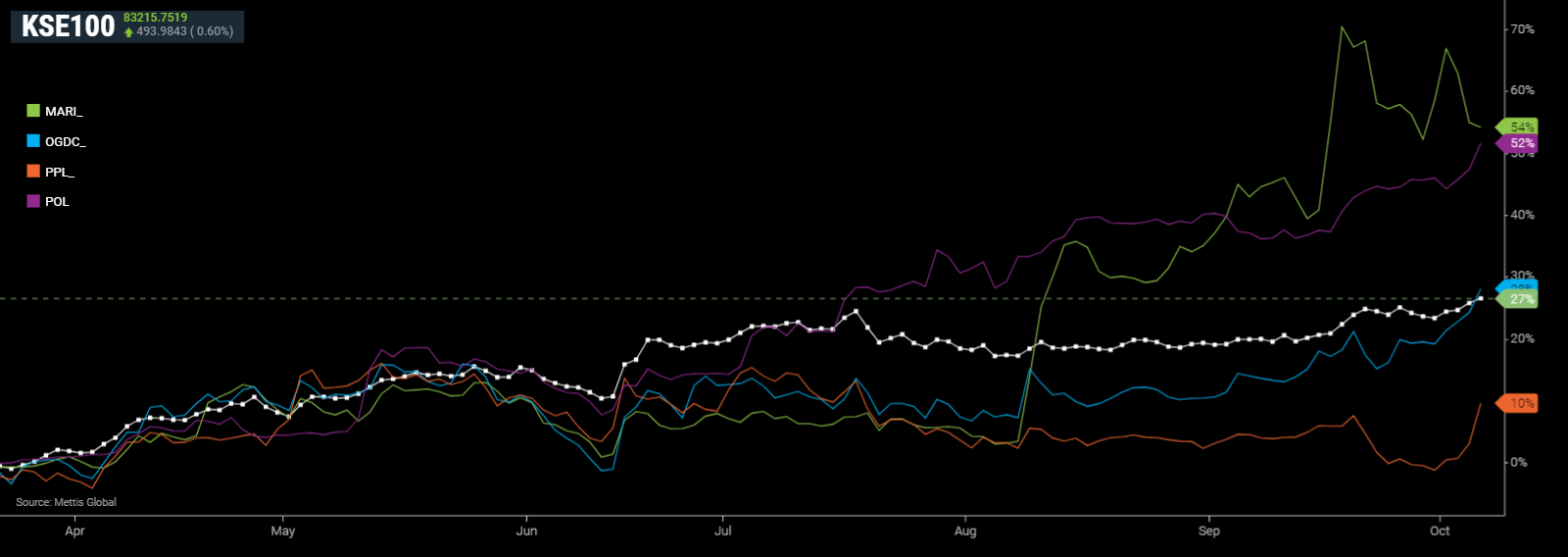

October 04, 2024 (MLN): Oil & Gas Development Company Limited (PSX: OGDC), the leading Force in Pakistan's Oil and Gas Exploration sector, posted a substantial drop in its quarterly profit, which dragged the bottom line of the sector as a whole down, despite other players reporting remarkable earnings growth.

The KSE-100 listed sector comprising four members, recorded a bottom line of Rs90.64 billion for the quarter ended June 30, 2024, down by 11.81% or over Rs12.14bn compared to the windfall reported in the same quarter last year.

As this quarter marked the close of the financial year 2024, it is important to mention that a growth of 5.92% was observed in profits, with these companies earning a total of Rs439.72bn, retaining its status as the most profitable sector in the country after commercial banks.

OGDC, once again emerged as the lead contributor to the sector’s earnings, arriving at a fourth-quarter profit of Rs37.87bn.

However, the giant missed analysts' estimates by a significant margin as its bottom line plummeted near 42% YoY due to a reversal of its finance and other income, which fell from a positive Rs89.51bn to a negative Rs3.2bn in the reviewed quarter.

Apart from OGDC, all remaining members, namely MARI, PPL and POL strived strong and demonstrated resilience with pumped quarterly performances.

MARI’s profit surged the most with a growth of 62%, earning Rs25.66bn in Q4FY24 and record-breaking Rs77.29bn in FY24.

PPL and POL followed in its footsteps as both booked earnings of Rs17.9bn and Rs9.21bn, up by 11.2% and 57.1% YoY, respectively.

With respect to returns in the form of dividends to shareholders, all four members announced strong dividends, in contrast to the previous quarter wherein POL and MARI did not announce any dividends.

OGDC paid Rs4 per share, POL paid Rs70 per share, MARI paid Rs134 per share, and PPL delivered Rs2.5 per share.

MARI once again stood out by issuing bonus shares for the year June 30, 2024, of 800% (eight shares for every one share held) from the Capital Redemption Reserve Fund and the balance from Revenue Reserves.

The issuance of bonus shares is a reflection of the increasingly strong ability of the company to grow and diversify further.

A broad assessment of the joint profit and loss statement of the sector shows the dropping profits were initially caused by a drop in sales. However, the situation worsened over time as the finance and other sector income experienced a drastic decline.

The sector posted a topline of Rs234.46bn, down by Rs4.3bn or 1.8% from the same quarter last year.

Notably, this decline was associated with all companies except OGDC, which achieved a 10.62% YoY increase in sales this quarter amid a leap in oil production and prices.

Overall, the drop in revenue is attributed to a negative price variance that stems from a significant appreciation of the Pakistan Rupee against the US dollar. The average exchange rate during Q4FY24 dropped to 278.3 compared to 286.04 during the corresponding period, reflecting a 2.78% YoY improvement.

For reference, appreciation in the value of the Pak rupee against the US dollar has a negative bearing on the earnings of the sector.

Oil prices helped offset this negative impact, as tensions in the Middle East pushed Brent Crude, the key benchmark, to an average rate of $85 in Q4 FY24, up from $77.75 in Q4 FY23.

However, with gas production plummeting across members, the overall impact was adverse, leading to a decline in revenue.

Concerning costs to sell, the sector made royalty payments worth Rs30.45bn, while the operating expenses spiked to Rs66.96bn.

PPL, being the primary driver of the increase in operating charges attributed the rise to higher salaries, wages, welfare, depreciation and well services.

The rise in costs to sell widened the harsh impact of the drop in sales and eventually, the gross profit dropped 7.38% YoY to Rs137.06bn in Q4FY24.

(Gross margins arrived at 58.45% in Q4FY24 vs 61.97% in Q4FY23)

Exploration charge was one of the key highlights of the sector’s financial statement as it dwindled by a substantial 76.78%, down from Rs23.68bn to just Rs5.5bn during the review period.

The cost of dry and abandoned wells fell substantially due to lower maintenance costs, improved efficiency in managing these wells, or possibly a decrease in associated fees or taxes.

MARI saw a turnaround here with an impairment reversal - which along with the lower cost of dry wells - turned it to a positive value of Rs5.86bn versus an expense of Rs6.48bn in Q4FY23.

On similar terms, administrative charges also dropped to Rs4.25bn, reflecting a 7.01% YoY change in Q4FY24.

Other charges of all four companies dragged down, generating a cumulative decline of 30.18% YoY.

Now, as we continue in the statement, our focus shifts to finance and other income which can be seen as the primary driver leading the sector to negative growth in profits.

A massive 90% reduction was seen, resulting in a Rs88.18bn drag in profits as other income slumped to Rs10.17bn from Rs98.36bn in the same quarter last year.

OGDC was the only company that contributed to this decline, as the results were impacted by an exchange loss and a substantial one-time adjustment related to overdue markup receivables from TFCs.

Return from associates and subsidiaries maintained a strong trend across competitors, arriving at Rs3.8bn from Rs3.3bn in Q4FY23.

Accordingly, the profit before taxation clocked in at Rs127.48bn in Q4FY24 for the sector, declining by 37.87% YoY.

On the taxation front, oil and gas exploration companies barred a cumulative burden of Rs36.84bn in Q4FY24, which is 64.03% YoY lower compared to the Rs102.42bn paid in the same quarter last year.

OGDC, MARI, PPL, and POL all contributed to this drop due to the realization of deferred tax assets in 4QFY24.

Mainly, the tax expenditure was reduced this quarter on account of the reversal of prior years’ tax provisions under a favorable decision of the Honorable Supreme Court of Pakistan (SCP) in respect of the calculation of depletion allowance on well-head value.

In the judgment, the SCP decided that royalty paid by a taxpayer is a separate component and not to be deducted while calculating the well-head value for depletion allowance, said PPL.

(Effective tax rate clocked in at 28.9% in Q4FY24 vs 49.91% in Q4FY23)

To sum up, the fall in other income along with sales must have hit the sector but the substantial drop in exploration expenses and tax reversals somewhat mitigated these effects, with members apart from OGDC securing higher profit ranks this quarter.

(Net profit margins arrived at 38.66% in Q4FY24 vs 43.05% in Q4FY23)

| Profit and loss account for the quarter ended June 30, 2024 (Rupees in '000) | |||

|---|---|---|---|

| Jun-24 | Jun-23 | % Change | |

| Sales - net | 234,463,694 | 238,761,769 | -1.80% |

| Royalty | (30,445,815) | (30,929,180) | -1.56% |

| Operating expenses | (66,962,478) | (59,863,838) | 11.86% |

| Gross profit | 137,055,401 | 147,968,751 | -7.38% |

| Exploration and prospecting expenditure | (5,498,426) | (23,676,047) | -76.78% |

| General and administration expenses | (4,251,919) | (4,572,653) | -7.01% |

| Finance cost | (4,085,491) | (3,948,356) | 3.47% |

| Finance and other income | 10,168,194 | 98,358,580 | -89.66% |

| Other charges | (8,836,304) | (12,656,020) | -30.18% |

| Share of profit in associate - net of taxation | 3,798,522 | 3,328,544 | 14.12% |

| Other balances (doubtful debts, other inflows) | (865,463) | 396,111 | -318.49% |

| Profit before taxation | 127,484,514 | 205,198,910 | -37.87% |

| Taxation | (36,843,038) | (102,415,931) | -64.03% |

| Profit after taxation | 90,641,476 | 102,782,979 | -11.81% |

Future Outlook

PPL said that it is focusing on consolidating its core upstream assets, both domestically and internationally, while exploring new frontiers through joint ventures and strategic partnerships.

The company is also expanding its footprint into value-added segments of the energy value chain and diversifying into the minerals and energy value chain to ensure a stable revenue stream and resilience to market fluctuations.

POL also shared its plan to extend its seismic acquisition efforts to the Langrial, North Dhurnal, Pariwali, Ikhlas, and Turkwal blocks to enhance our prospect generation.

Looking ahead to fiscal year 2024-25, POL said that it plans to drill both development and exploratory wells, with a significant investment aimed at expanding our reserve base.

MARI, in FY25, will focus on several exploratory and appraisal wells that are planned in various operated and JV blocks.

Additionally, various 2D and 3D seismic data acquisition projects are also planned to evaluate the hydrocarbon potential that will lead to prospect maturation.

In addition, many activities for further evaluation of explored and producing fields/blocks are underway to enhance the production and recoverability of reserves and resources along with plateau extension.

As far as OGDC is concerned, the industry leader has planned to drill 16 new wells including 10 exploratory/appraisal wells, 6 development wells in FY25.

Net Capital expenditure is estimated at Rs106.35 billion; Rs38.59 billion on exploratory/appraisal and development wells net of dry hole cost of Rs5.64 billion and Rs67.76 billion on development projects and property, plant and equipment.

With such development plans, the sector is expected to strive further, however, certain challenges remain, such as the gas sector's circular debt, fluctuations in the exchange rate, and oil prices, which impact its income and have been the main slide in its performance.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 161,210.68 402.54M | 3.49% 5433.46 |

| ALLSHR | 96,097.29 718.60M | 3.34% 3102.77 |

| KSE30 | 49,781.74 146.66M | 3.95% 1890.99 |

| KMI30 | 230,597.11 158.11M | 4.81% 10582.05 |

| KMIALLSHR | 62,183.27 382.16M | 3.79% 2272.55 |

| BKTi | 46,523.21 43.62M | 2.50% 1134.61 |

| OGTi | 32,678.22 24.62M | 6.68% 2046.87 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 71,685.00 | 73,825.00 70,845.00 | -1760.00 -2.40% |

| BRENT CRUDE | 83.75 | 86.28 81.50 | 2.35 2.89% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -9.60 -8.81% |

| ROTTERDAM COAL MONTHLY | 125.00 | 125.00 125.00 | 3.50 2.88% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 78.94 | 82.16 74.97 | 4.28 5.73% |

| SUGAR #11 WORLD | 13.71 | 13.82 13.61 | -0.02 -0.15% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction