No more tax, duty burden in FY24 budget: PAMA appeals

MG News | June 02, 2023 at 05:28 PM GMT+05:00

June 02, 2023 (MLN): The Pakistani auto-makers have requested the government to not impose any further tax and duty in the budget for the fiscal year 2023-24.

In a letter to Chairman FBR, DG Pakistan Automotive Manufacturers Association (PAMA) highlighted the concern that the basis of levy of withholding and other taxes/duties on the locally produced automobiles being proposed to be changed (in the budget 2023-24) that would badly impact the sales of the already tormented auto industry of the country.

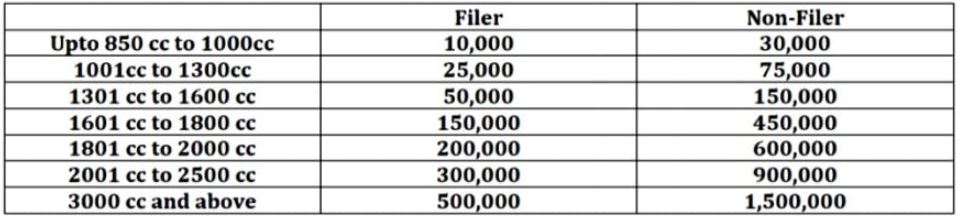

Presently, withholding tax is levied on the engine capacity basis of an automobile u/s 231B of income tax ordinance, whereby the amount of tax to be levied is known to each filer and non-filer buyer of an automobile.

The proposal reportedly under consideration for the forthcoming budget is to charge the WHT on an invoice price basis instead of an engine capacity basis.

"We are requesting not to go for this proposal as this would substantially increase the payment of the WHT amount and inevitably increase the sale price and badly impact the sales. Even we request to reduce the current engine-based WHT amount," the letter reads.

PAMA argued against the change of the age-old practice of levy of WHT on engine capacity basis to invoice price basis which would not only badly impact the sales but also against the simplicity and convenience of the levy of tax.

It is strongly recommended to maintain or to further reduce the existing withholding tax structure u/s 231B without changing the rates.

The letter further stated, "Barring decline during the Covid-19 years of 2019-20 and 2020-21, the industry started to revive during 2021-22 and then again nosedived massively in 2022-23 on account of import restrictions throughout 2022-23."

Now, due to such restrictions, skyrocketing inflation, and other macroeconomic maladies in the country the industry is suffering the worst times, our several members are in losses of billions of rupees.

It may, therefore be seen that any further increase in the amount of tax shall badly impact the industry which is already paying 40% plus per unit tax.

The current position of WHT is shown as under:

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 155,858.48 232.66M | -0.20% -318.64 |

| ALLSHR | 93,385.83 437.37M | -0.25% -237.26 |

| KSE30 | 47,851.52 125.11M | -0.40% -191.53 |

| KMI30 | 223,719.09 107.59M | -0.60% -1350.50 |

| KMIALLSHR | 60,541.53 227.24M | -0.53% -324.48 |

| BKTi | 45,022.52 54.66M | -0.18% -79.74 |

| OGTi | 32,464.35 8.69M | -1.99% -658.12 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 70,605.00 | 71,560.00 69,080.00 | 410.00 0.58% |

| BRENT CRUDE | 92.83 | 93.15 86.24 | 5.03 5.73% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -10.20 -9.31% |

| ROTTERDAM COAL MONTHLY | 121.50 | 121.50 120.50 | -0.35 -0.29% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 88.33 | 88.99 81.79 | 4.88 5.85% |

| SUGAR #11 WORLD | 14.22 | 14.53 14.18 | -0.16 -1.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Auto Numbers

Auto Numbers