Moody's upgrades Pakistan banking sector outlook to 'Stable'

MG News | March 07, 2024 at 02:16 PM GMT+05:00

March 07, 2024 (MLN): In a noteworthy development, Moody's Investors Service (Moody's) changed the outlook on the banking sector of Pakistan (Caa3 stable) to stable from negative, the latest report issued by Moody's on Thursday revealed.

The banks' solid profitability and stable funding and liquidity provide an adequate buffer to withstand the country's macroeconomic challenges and political turmoil.

Economic and fiscal pressures are easing, thus Moody's expects that the Pakistani economy will return to modest growth of 2% in 2024 after subdued activity in 2023, and inflation to fall to around 23% from 29% last year, it added.

Pakistani banks remain highly exposed to the government via large holdings of government securities that amount to around half of total banking assets, which links their credit strength to that of the sovereign.

Persistent external pressures against a challenging operating backdrop will weigh slightly on the performance of Pakistani banks’ loan portfolios.

Profitability will remain strong because of wide net interest margins (NIMs), but decline from 2023 peaks because of subdued business growth, increased funding costs on the back of higher rates, and elevated taxes.

"We expect the banks' modest capital ratios to remain stable, as strong earnings offset high dividend payouts. Banks' stable deposit-based funding will continue to support financial stability," the report reads.

Moody's appreciated that Pakistani authorities have historically supported banks in difficulty, with no depositor losses recorded, and remain willing to do so given banks’ role as the main source of government financing.

However, the government’s capacity to provide support is constrained by the fiscal challenges that drive its Caa3 rating, which also constrains Pakistani banks’ deposit ratings at this level. However, deposit insurance of Rs500,000 per depositor covers about 94% of individual depositors and 15% of banks' total deposits.

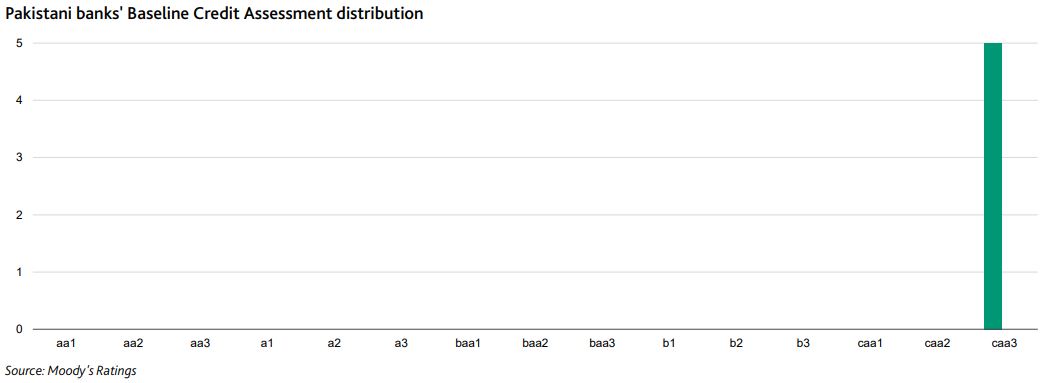

Moody's rate the five largest banks in Pakistan, which together account for 46% of system deposits, as of September 2023 and all have Baseline Credit Assessments of caa3.

Islamic banking is evident in Pakistan, with a market share of only 19% of total banking assets as of December 2023, the report further noted.

| Bank | Total Assets (Rs billions) | Domestic Mkt Share (Deposits, %) | Baseline Credit Assessment | Adjusted Baseline Credit Assessment | LT Deposit Ratings | LT Senior Unsecured Ratings /Issuer Ratings | Outlook |

|---|---|---|---|---|---|---|---|

| National Bank of Pakistan | 6,654.66 | 10.8% | caa3 | caa3 | Caa3 | - | Stable |

| Habib Bank Ltd. | 5,507.59 | 13.9% | caa3 | caa3 | Caa3 | - | Stable |

| Allied Bank Limited | 2,266.53 | 6.0% | caa3 | caa3 | Caa3 | - | Stable |

| United Bank Ltd. | 4,284.78 | 8.4% | caa3 | caa3 | Caa3 | - | Stable |

| MCB Bank Limited | 2,616.38 | 6.7% | caa3 | caa3 | Caa3 | - | Stable |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 184,409.67 393.48M | -0.61% -1133.34 |

| ALLSHR | 110,382.58 1,026.61M | -0.45% -501.36 |

| KSE30 | 56,593.88 158.22M | -0.71% -404.12 |

| KMI30 | 259,208.41 213.19M | -0.87% -2263.77 |

| KMIALLSHR | 70,710.78 493.25M | -0.60% -427.51 |

| BKTi | 53,774.72 51.55M | -0.55% -299.43 |

| OGTi | 36,045.04 14.71M | -0.59% -214.34 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 90,645.00 | 92,275.00 89,825.00 | -460.00 -0.50% |

| BRENT CRUDE | 63.06 | 63.92 61.83 | 1.07 1.73% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -1.25 -1.42% |

| ROTTERDAM COAL MONTHLY | 95.30 | 98.65 95.30 | -2.90 -2.95% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 58.78 | 59.77 57.61 | 1.02 1.77% |

| SUGAR #11 WORLD | 14.89 | 14.99 14.78 | -0.08 -0.53% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260109121026133_2151ce.jpg?width=280&height=140&format=Webp)

_20251003092603298_af0c50_20251010094012153_327c07.webp?width=280&height=140&format=Webp)

Workers' Remittances

Workers' Remittances