KSE-100 rallies 4,554pts in 1Q2024, fourth straight win

Abdur Rahman | March 30, 2024 at 01:07 PM GMT+05:00

March 30, 2024 (MLN): Pakistan stock market extended its record rally, with its key benchmark KSE-100 Index achieving a record quarterly closing of 67,005.

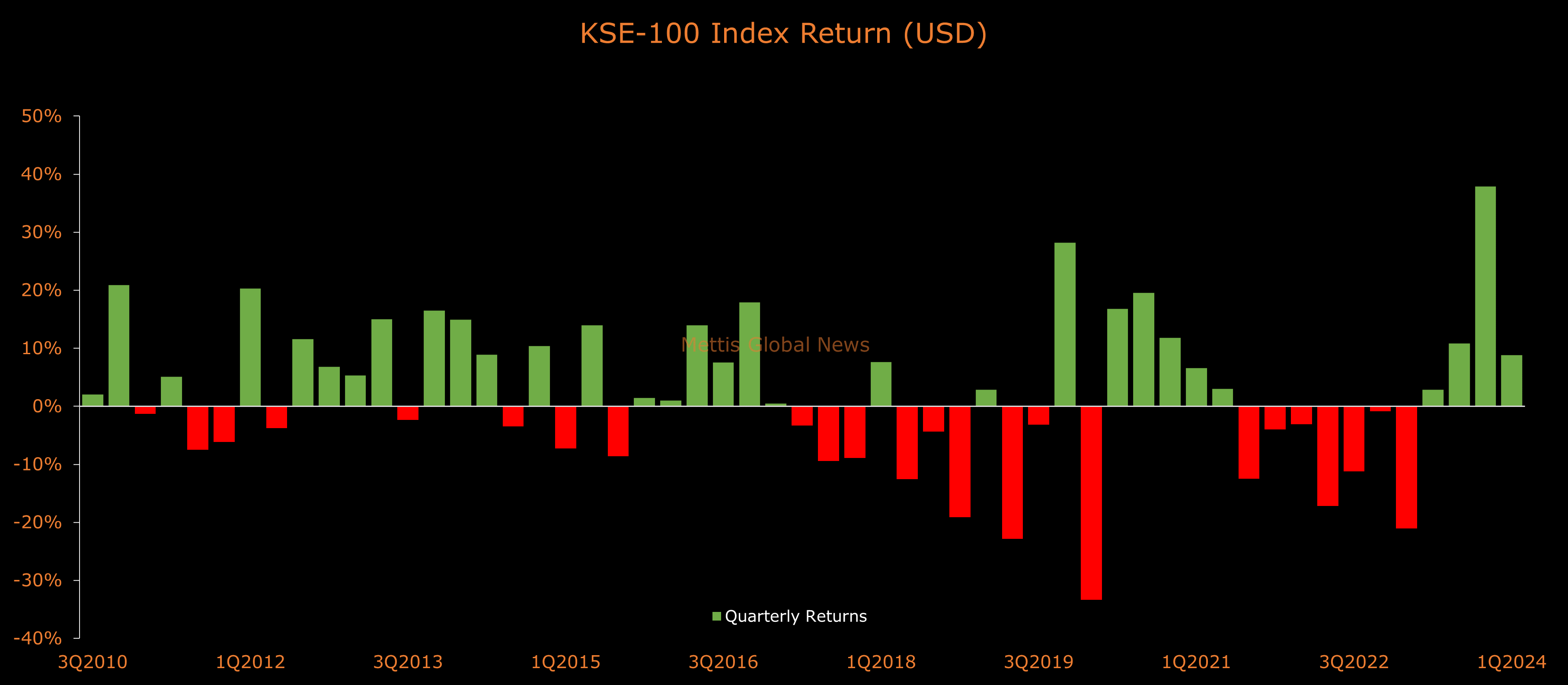

PSX's main gauge surged 4,554 points or 7.3% in 1Q2024, marking its fourth consecutive quarterly win. In USD terms, the 100-index gained 8.8%.

The relentless rally, which began last year after the country avoided default with the assistance of International Monetary Fund (IMF), was further boosted by better-than-expected conclusion of general elections, anticipation of interest rate cuts, and fresh inflows from the IMF.

This was further complemented by the government’s efforts to restructure and privatize Pakistan International Airlines Corp (PSX: PIAA).

Notably, insurance companies were extremely aggressive in accumulating debt-laden nation's stocks, as they poured in a net total of $60.6 million this quarter.

This was the highest quarterly net inflow from Insurance Companies since 4Q2020, according to NCCPL data compiled by Mettis Global.

Commercial Banks attracted the lion's share of these investments, as insurance companies purchased $21.4m worth of stocks on net basis.

This was followed by the Fertilizer sector, with a solid $21.3m in net buying.

In Jan-Mar 2024 period, Insurance companies led among other foreign and local investors (FIPI / LIPI), with Foreign Corporates coming in second with a net investment of $7.7m.

On the other hand, companies were the leading sellers, as they dumped $21.9m worth of stocks during the quarter.

Their most substantial sales activity was in Commercial Banks, amounting to $23.9m, while they acquired $7.5m of equities in the Oil and Gas Exploration Companies.

Top Index Movers

From the sector-specific lens, Commercial Banks was the best performing sector, as it added 2,215 points to the index.

This was followed by Fertilizer with 1,680, Oil & Gas Exploration Companies with 676, Inv. Banks / Inv. Cos. / Securities Cos. with 332, and Automobile Assembler with 246 points, respectively.

Contrary to that, Technology & Communication, Cement, Chemical, Oil & Gas Marketing Companies, and Food & Personal Care Products remained red, as they took away 230, 196, 178, 113, and 76 points from the index.

Scrip-wise, MEBL, EFERT, ENGRO, MCB, and MARI were the best-performing stocks during the quarter as they added 833, 781, 531, 506, and 440 points to the index respectively.

Whereas, SYS, COLG, PPL, TRG, and SNGP collectively took away 700 points from the index.

The market turnover fell on a QoQ basis, with PSX daily average traded volume (All-Share) of 400m shares worth Rs14.44bn, marking a decrease of 40.3% QoQ in the number of shares and 24.7% QoQ in traded value.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 139,390.42 291.21M | 0.71% 978.17 |

| ALLSHR | 86,260.96 576.29M | 0.65% 558.00 |

| KSE30 | 42,618.60 119.41M | 0.86% 363.76 |

| KMI30 | 196,907.86 123.77M | 1.44% 2798.27 |

| KMIALLSHR | 57,276.87 259.26M | 0.99% 563.20 |

| BKTi | 37,820.27 20.77M | -0.03% -11.06 |

| OGTi | 28,214.64 47.07M | 2.82% 774.00 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,135.00 | 119,785.00 117,095.00 | -485.00 -0.41% |

| BRENT CRUDE | 71.82 | 72.82 71.00 | -0.65 -0.90% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.38 | 70.41 68.56 | -0.62 -0.89% |

| SUGAR #11 WORLD | 16.35 | 16.61 16.28 | -0.10 -0.61% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Consumer Confidence Survey

Consumer Confidence Survey