CPI edges higher to 12.6% in June 2024

MG News | July 01, 2024 at 01:02 PM GMT+05:00

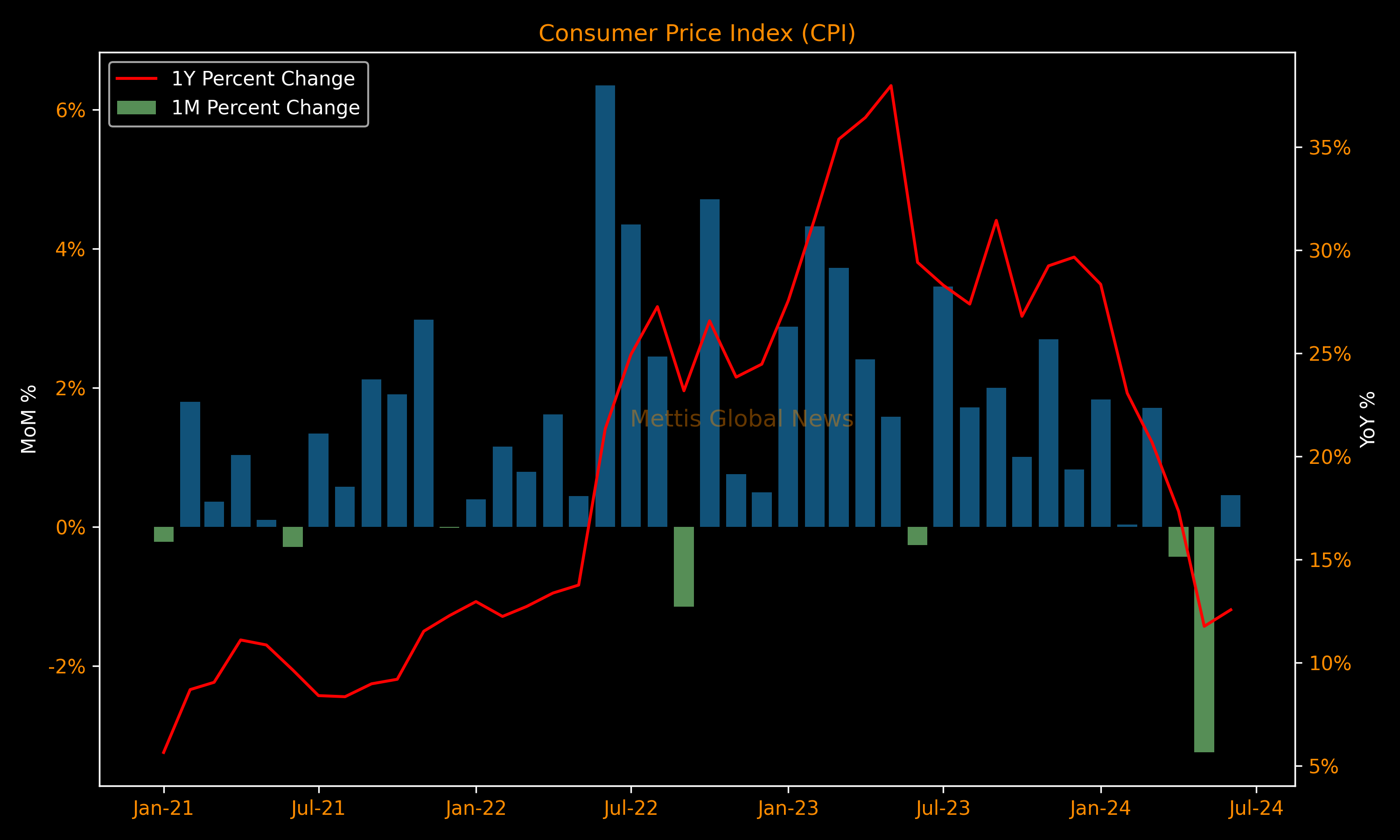

July 01, 2024 (MLN): The consumer price index (CPI) for June 2024 clocked in at 12.6% YoY, compared to 11.8% YoY in the last month and 29.4% YoY in June 2023, the latest data issued by the Pakistan Bureau of Statistics (PBS) on Monday showed.

On a monthly basis, CPI rose 0.5% in June 2024 as compared to a decrease of 3.2% in the previous month and a decrease of 0.3% in June 2023.

Accordingly, this takes the average yearly inflation of FY24 to 23.4% YoY compared to 29.2% YoY in FY23.

The average core inflation, measured by non-food non-energy, rose 14.1% YoY in June 2024 as compared to an increase of 14.2% YoY in the previous month and an increase of 21.2% YoY in June 2023.

On a monthly basis, average core CPI increased 0.7% in June 2024 as compared to an increase of 0.4% in the previous month and an increase of 0.8% in June 2023.

The inflation reading came in slightly higher than MG Research's expectations but in line with the government's projections.

On Friday, the Ministry of Finance, in its monthly economic update and outlook report had projected a slightly increased inflation outlook for June 2024 compared to the previous month but said that it remains well below the levels of the same month last year.

“This rise is primarily due to higher prices of perishable items driven by Eid ul Adha,” it said.

In response, the government is implementing various administrative, policy, and relief measures to control inflationary pressures, it added.

| Metric | Jun-24 | May-24 | Jun-23 | FY24 | FY23 |

|---|---|---|---|---|---|

| CPI MoM | 0.5% | -3.2% | -0.3% | 1.0% | 2.2% |

| CPI YoY | 12.6% | 11.8% | 29.4% | 23.4% | 29.2% |

| Core CPI MoM | 0.7% | 0.4% | 0.8% | 1.1% | 1.6% |

| Core CPI YoY | 14.1% | 14.2% | 21.2% | 18.9% | 17.8% |

The food index rose 0.97% compared to a year ago. Housing index surged 35.29% primarily attributable to the FCA adjustment in electricity costs.

Transport costs fell 1.63% compared to June last year amid deflated fuel prices.

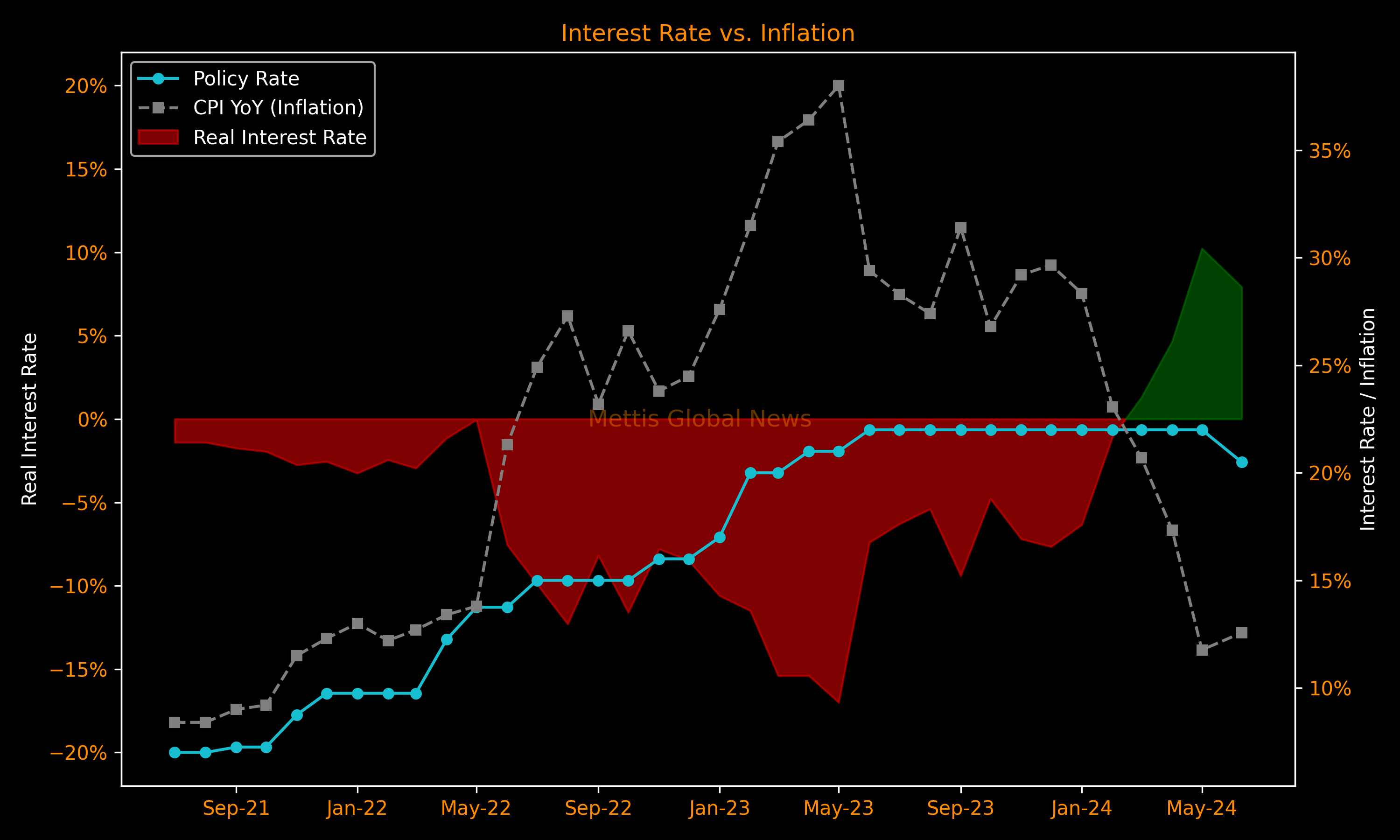

Earlier this month, the State Bank of Pakistan (SBP) lowered its key policy rate by 150 basis points to 20.5% citing a better than anticipated decline in May's inflation.

The reduction was the first in almost four years.

With the CPI-based inflation rate at 12.6% and the policy rate at 20.5%, the real interest now stands at 7.9%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 170,984.40 63.82M | -0.69% -1185.89 |

| ALLSHR | 102,584.89 136.89M | -0.86% -891.75 |

| KSE30 | 52,402.63 22.07M | -0.49% -256.16 |

| KMI30 | 239,040.17 18.98M | -0.61% -1471.11 |

| KMIALLSHR | 65,512.03 69.25M | -0.72% -476.01 |

| BKTi | 50,717.72 8.98M | -0.58% -295.19 |

| OGTi | 33,734.90 3.54M | 0.50% 169.43 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,280.00 | 67,665.00 66,880.00 | 75.00 0.11% |

| BRENT CRUDE | 71.91 | 72.16 71.59 | 0.25 0.35% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.10 -3.13% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.75 -1.63% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.65 | 66.86 66.31 | 0.25 0.38% |

| SUGAR #11 WORLD | 13.72 | 13.85 13.62 | -0.04 -0.29% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account