CPI drops to 6.9% in Sep

MG News | October 01, 2024 at 02:23 PM GMT+05:00

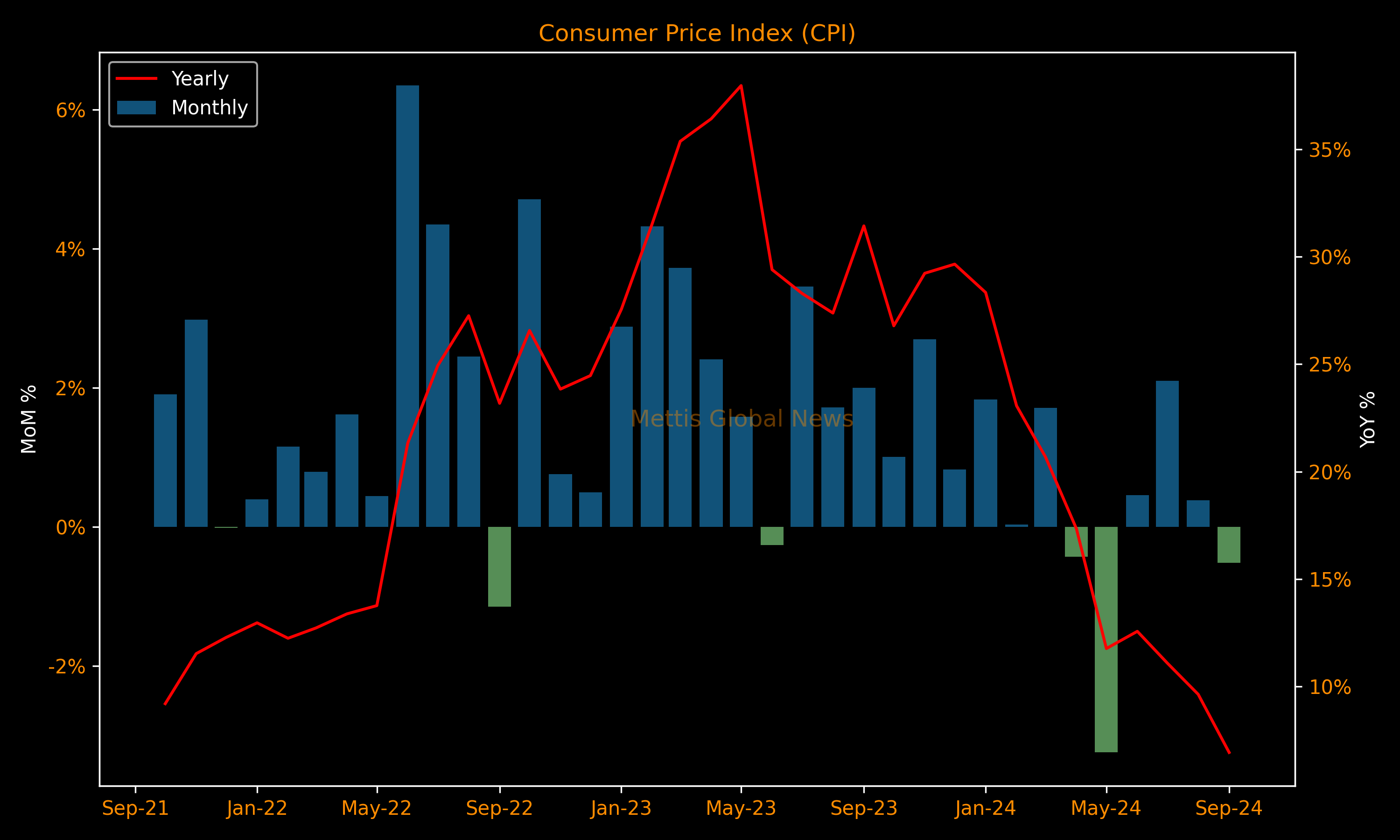

October 01, 2024 (MLN): Pakistan inflation slowed to the lowest in almost four years, with consumer prices rising by 6.9% in September over the prior year. That is within the central bank's target range of 5-7%.

The inflation pace was significantly lower than the market expectations of 7.5% and was the lowest reading since January 2021.

It compares to a price gain of 9.6% last month and 31.4% in September 2023, Pakistan Bureau of Statistics (PBS) reported on Tuesday.

Accordingly, this takes the average yearly inflation of 3MFY25 to 9.2% compared to 29.0% in 3MFY24.

On a monthly basis, CPI fell 0.5% in September 2024 as compared to an increase of 0.4% in the previous month and an increase of 2.0% in September 2023.

The average core inflation, measured by non-food non-energy, rose 10.4% YoY in September 2024 as compared to an increase of 11.9% YoY in the previous month and an increase of 22.1% YoY in September 2023.

On a monthly basis, average core CPI increased 0.3% in September 2024 as compared to an increase of 0.5% in the previous month and an increase of 1.6% in September 2023.

The inflation pace slowed notably in September amid a fall in fuel and food costs.

Transport costs fell 7.3% over the prior year amid a significant fall in international oil prices. While food prices also declined 0.6% from last year.

| Metric | Sep-24 | Aug-24 | Sep-23 | 3MFY25 | 3MFY24 |

|---|---|---|---|---|---|

| CPI MoM | -0.5% | 0.4% | 2.0% | 0.7% | 2.4% |

| CPI YoY | 6.9% | 9.6% | 31.4% | 9.2% | 29.0% |

| Core CPI MoM | 0.3% | 0.5% | 1.6% | 0.6% | 1.7% |

| Core CPI YoY | 10.4% | 11.9% | 22.1% | 12.0% | 21.4% |

Pakistan last week secured a $7 billion loan package from the International Monetary Fund Executive Board. The global lender also lowered the inflation forecasts for Pakistan, projecting consumer price gains to average 9.5% in FY25 from the earlier projection of 12.7%.

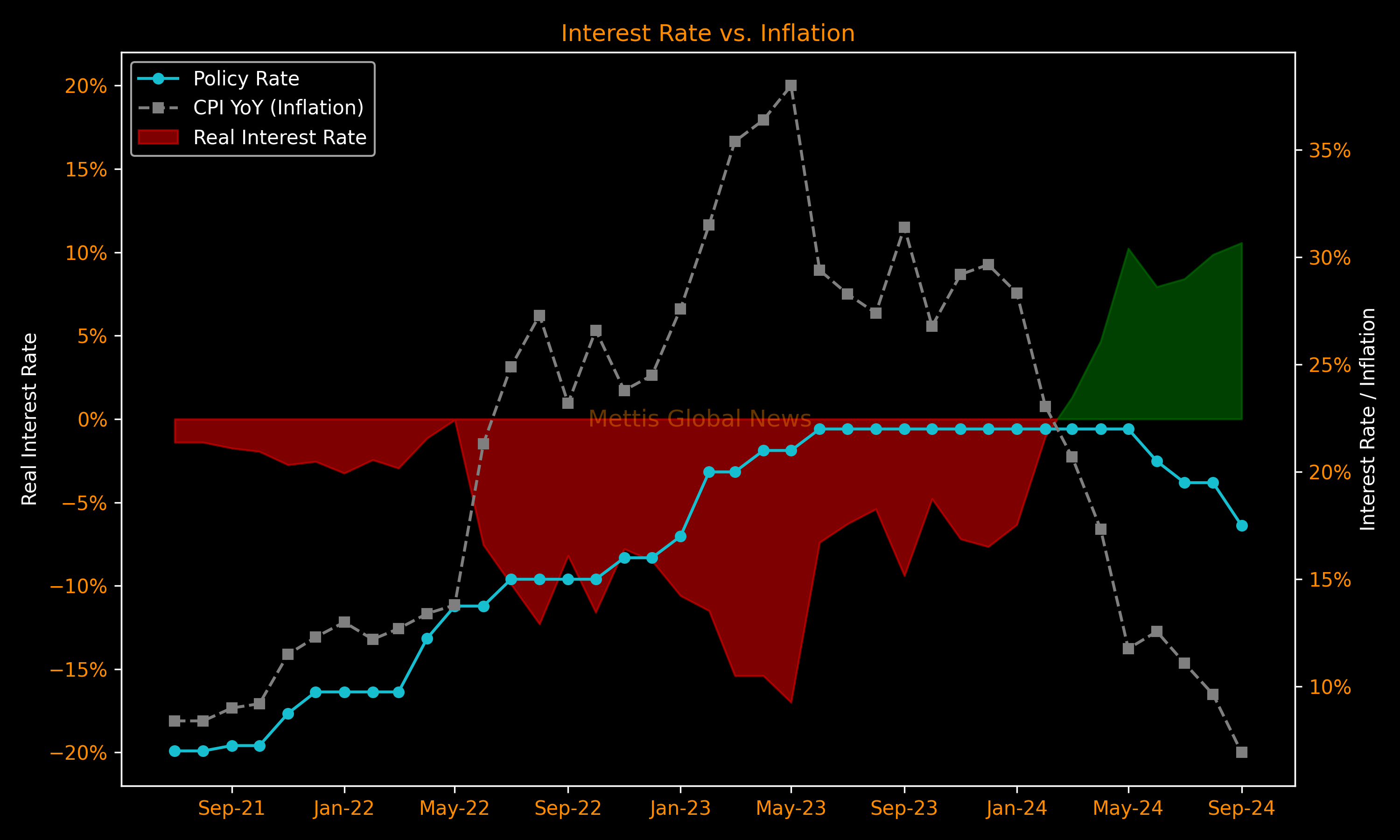

With the CPI-based inflation rate at 6.9% and the policy rate at 17.5%, the real interest rate now stands at 10.6%.

The State Bank of Pakistan (SBP) has slashed interest rates by a cumulative 450 basis points since June.

The significant slowdown in price gains will give policymakers additional room to continue monetary easing in a bid to spur growth.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 146,480.15 378.01M | -6.99% -11015.95 |

| ALLSHR | 88,401.15 613.63M | -6.18% -5825.86 |

| KSE30 | 44,996.51 162.61M | -6.90% -3333.70 |

| KMI30 | 210,039.41 136.40M | -6.52% -14647.92 |

| KMIALLSHR | 57,315.72 369.31M | -5.79% -3523.37 |

| BKTi | 42,364.50 67.24M | -6.87% -3125.46 |

| OGTi | 31,480.49 21.12M | -1.88% -602.98 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 69,175.00 | 69,750.00 65,685.00 | 880.00 1.29% |

| BRENT CRUDE | 90.06 | 119.50 83.66 | -2.63 -2.84% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -13.60 -12.04% |

| ROTTERDAM COAL MONTHLY | 132.00 | 134.20 132.00 | 5.05 3.98% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 85.08 | 119.48 81.19 | -5.82 -6.40% |

| SUGAR #11 WORLD | 14.62 | 14.64 14.25 | 0.52 3.69% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Business Confidence Survey

Business Confidence Survey