Closing Bell: Runnin' with the Devil

MG News | October 20, 2020 at 05:46 PM GMT+05:00

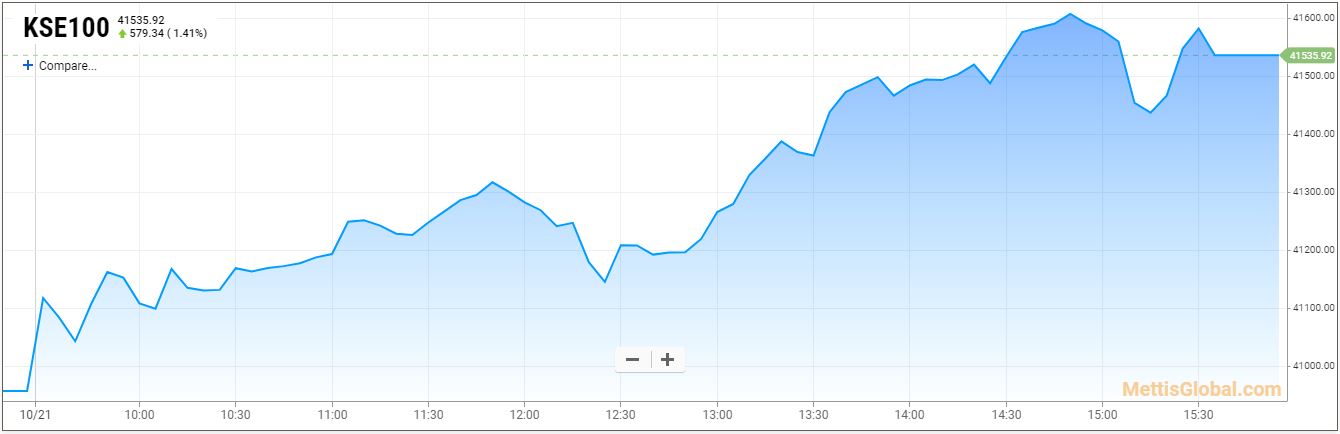

October 20, 2020 (MLN): Pakistan equities extended gains on Tuesday as KSE-100 Index rose by 616 points or a 1.53 percent gain to finish the trading day at 40,956 levels, marking its third straight increase.

The bullish spell was backed by assuaging political heat and the investors’ positive sentiments on FATF review, as per the closing note by Ismail Iqbal Securities.

Further, today’s market performance was also affected by the announcement of financial results made by several companies throughout the session which include:

- International Steel Limited (ISL) observed a substantial growth of 60.7% to stand at Rs 559 million (EPS: Rs 1.29) during 1QFY21 against net profits of Rs 347 million (EPS: Rs 0.80) of the same period last year.

- Attock Petroleum Limited witnessed a 21% YoY increase in net profits for 1QFY21 ended on September 30th, 2020, to Rs 1.485 billion against the net profits of Rs 1.225 billion reported in the same period last year.

- Lotte Chemical Pakistan (LOTCHEM) reported a massive decline of 78% YoY in profitability to Rs 1.037 billion (EPS: Rs 0.69) for the nine months ended September 30, 2020, against net profits of Rs 4.732 billion (EPS: Rs 3.13) of the corresponding period last year.

- Fauji Foods Limited incurred losses of Rs. 2.4 billion (LPS: 3.01) during the nine months ended September 20, 2020, i.e. around 27% lower than the losses witnessed in the same period of last year.

- National Refinery Limited (NRL) bore losses of Rs. 1.31 billion (LPS: 16.4) during the quarter ended September 30, 2020, i.e. nearly 93% higher as compared to the losses made in the same period of last year.

- Attock Refinery Limited (ATRL) suffered a loss after tax of Rs 555.3 million from refinery operations during 1QFY21, compared to the net profits of Rs 16.4 million earned in the same quarter of last year.

It is pertinent to mention that Pakistan Stock Exchange witnessed the highest all- share volume since Sept 23, 2020, as it increased by 173.11 Million to 492.67 Million Shares.

The Index remained positive throughout the session touching an intraday high of 41,056.95

Of the 95 traded companies in the KSE100 Index, 70 closed up 21 closed down, while 4 remained unchanged. The total volume traded for the index was 323.06 million shares.

Sectors propping up the index were Cement with 111 points, Power Generation & Distribution with 107 points, Commercial Banks with 91 points, Oil & Gas Exploration Companies with 72 points and Oil & Gas Marketing Companies with 50 points.

The most points added to the index was by HUBC which contributed 84 points followed by LUCK with 48 points, MEBL with 42 points, PPL with 37 points and HBL with 30 points.

Sector-wise, the index was let down by Close - End Mutual Fund with 4 points, Miscellaneous with 2 points, Food & Personal Care Products with 2 points, Automobile Parts & Accessories with 2 points and Textile Spinning with 1 points.

The most points taken off the index was by HMB which stripped the index of 7 points followed by UBL with 5 points, ABOT with 4 points, HGFA with 4 points and FML with 3 points.

Market Cap increased by Rs.82.97 Billion.

Total companies traded were 416 compared to 392 from the previous session. Of the scrips traded 305 closed up, 96 closed down while 15 remained unchanged.

Total trades increased by 58,625 to 155,626.

Value Traded increased by 8.44 Billion to Rs.16.41 Billion

| Company | Volume |

|---|---|

| Unity Foods | 77,967,500 |

| Hascol Petroleum | 50,716,941 |

| Fauji Foods | 35,143,500 |

| Pakistan International Bulk Terminal | 25,337,500 |

| K-Electric | 21,059,500 |

| TRG Pakistan | 19,239,500 |

| Pakistan Refinery | 17,298,000 |

| Byco Petroleum Pakistan | 16,292,000 |

| Pak Elektron | 14,654,500 |

| Lotte Chemical Pakistan | 12,794,000 |

| Sector | Volume |

|---|---|

| Vanaspati & Allied Industries | 77,969,000 |

| Oil & Gas Marketing Companies | 58,029,842 |

| Food & Personal Care Products | 50,963,770 |

| Refinery | 39,715,300 |

| Power Generation & Distribution | 32,966,043 |

| Cement | 32,554,950 |

| Technology & Communication | 30,501,500 |

| Transport | 25,835,900 |

| Chemical | 24,511,900 |

| Engineering | 16,281,600 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 139,390.42 291.21M | 0.71% 978.17 |

| ALLSHR | 86,260.96 576.29M | 0.65% 558.00 |

| KSE30 | 42,618.60 119.41M | 0.86% 363.76 |

| KMI30 | 196,907.86 123.77M | 1.44% 2798.27 |

| KMIALLSHR | 57,276.87 259.26M | 0.99% 563.20 |

| BKTi | 37,820.27 20.77M | -0.03% -11.06 |

| OGTi | 28,214.64 47.07M | 2.82% 774.00 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 116,770.00 | 117,125.00 116,475.00 | -665.00 -0.57% |

| BRENT CRUDE | 71.78 | 72.82 71.00 | -0.69 -0.95% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.38 | 69.46 69.22 | 0.12 0.17% |

| SUGAR #11 WORLD | 16.35 | 16.61 16.28 | -0.10 -0.61% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Consumer Confidence Survey

Consumer Confidence Survey