Central govt debt surges to Rs72tr in January

MG News | March 06, 2025 at 04:00 PM GMT+05:00

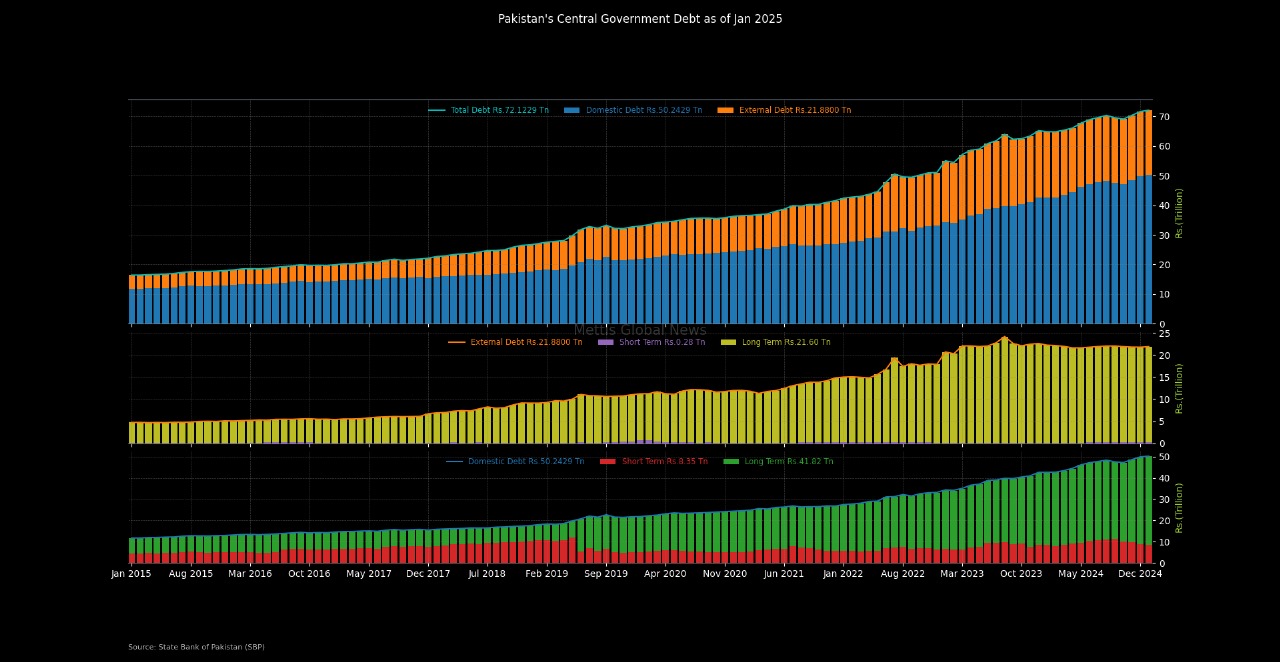

March 06, 2025 (MLN): The total debt of the central government went up by 11.23% YoY to Rs72.12 trillion in January 2024, compared to Rs64.84tr in January 2023, the data released by the State Bank of Pakistan (SBP) showed.

Moreover, on a sequential basis, the central government debt increased by 0.66% MoM compared to Rs71.65tr in December 2024.

The year-on-year increase in debt burden is primarily attributed to borrowing from domestic and foreign sources to cover the fiscal deficit.

As per details made available by SBP, the larger portion of the debt was domestic and stood at Rs50.24tr, comprising Rs41.82tr long-term debt, Rs8.35tr short-term debt and the remaining Rs65.86bn through Naya Pakistan Certificates.

The figures reported by the central bank for the domestic debt reflect an increase of 17.87% YoY and on a sequential basis an increase of 0.72%

By the end of January 2024, the government’s long-term debt rose by 22.49% YoY to Rs41.82tr as compared to Rs34.15tr recorded in the same period a year ago, while rising 1.75% MoM.

Conversely, the short-term debt decreased by -0.27% YoY to Rs8.35tr in the review month.

Within the long-term domestic debt, the Pakistan Investment Bonds (PIBs) accounted for the majority proportion and stood at Rs31.77tr, Up by 24.14% YoY and 1.79% MoM.

Meanwhile, in the short-term domestic debt, Market Treasury Bills (MTBs) were the dominant source of borrowing, amounting to Rs8.26tr, Down by 0.42% YoY and 3.99% MoM.

Borrowing through Naya Pakistan Certificates has declined by 36.43% YoY to stand at Rs65.86bn in January 2024.

Comparison on a monthly metric shows that in January, the government borrowed 18.65% less through these certificates compared to Rs80.96bn in the previous month.

A breakup of the central government's external debt shows that nearly Rs21.6tr came from long-term loans while Rs277.12bn came from short-term loans.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 171,571.68 69.75M | -0.35% -598.61 |

| ALLSHR | 102,850.27 146.09M | -0.61% -626.37 |

| KSE30 | 52,600.56 23.85M | -0.11% -58.23 |

| KMI30 | 240,058.40 20.35M | -0.19% -452.89 |

| KMIALLSHR | 65,698.49 75.21M | -0.44% -289.54 |

| BKTi | 50,840.72 9.62M | -0.34% -172.19 |

| OGTi | 33,888.73 3.96M | 0.96% 323.26 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,280.00 | 67,665.00 66,880.00 | 75.00 0.11% |

| BRENT CRUDE | 71.91 | 72.16 71.59 | 0.25 0.35% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.10 -3.13% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.75 -1.63% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.65 | 66.86 66.31 | 0.25 0.38% |

| SUGAR #11 WORLD | 13.72 | 13.85 13.62 | -0.04 -0.29% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account